Welcome again to Distributed Ledger. This is Frances Yue, reporter at MarketWatch.

Bitcoin

BTCUSD,

had one other leg up this week, as Thursday marked the beginning of an eight-day window for the Securities and Exchange Commission to “theoretically issue approval orders” for pending spot bitcoin ETF functions.

Ether

ETHUSD,

additionally rose, as BlackRock appeared to have taken the primary steps towards an ether ETF, with the web site for Delaware’s Division of Corporations exhibiting that an iShares Ethereum Trust was registered Thursday.

I caught up with just a few trade individuals to see what it means.

Find me on Twitter at @FrancesYue_ to share any ideas on crypto or this article.

The ETF hope

Crypto trade individuals predict a spot bitcoin ETF to be accredited quickly, and an ether ETF to probably observe.

Once greenlighted, an ether ETF might additional improve the institutional adoption of digital belongings, famous Diogo Mónica, co-founder and president of Anchorage Digital.

“A spot Ethereum ETF would have a similar impact as a Bitcoin counterpart, providing a regulated and accessible wrapper for institutions and consumers to participate in the ETH ecosystem,” Mónica mentioned in emailed feedback.

“But Ethereum adds an extra layer of intrigue as a proof-of-stake asset, which means underlying ETH could also be staked for additional rewards,” he added. “If approved, a spot Ethereum ETF would drive institutional demand for safe, secure, and regulated staking.”

Meanwhile, as bitcoin and ether costs rise, some smaller coinsalso noticed their costs elevated, pointing to a possible crypto spring, in line with Leo Mizuhara, founder and chief govt at Hashnote.

“I think one of the usual patterns we see in these markets is that oftentimes a rally will begin with bitcoin and ether being more of the blue chip tokens, and then we’ll see a lot of the alt coins rally after it,” mentioned Mizuhara.

XRP

XRPUSD,

rose 8% over the previous seven days, and Solana

SOLUSD,

added about 11% over the identical interval, in line with CoinDesk knowledge.

Bitcoin’s tight provide

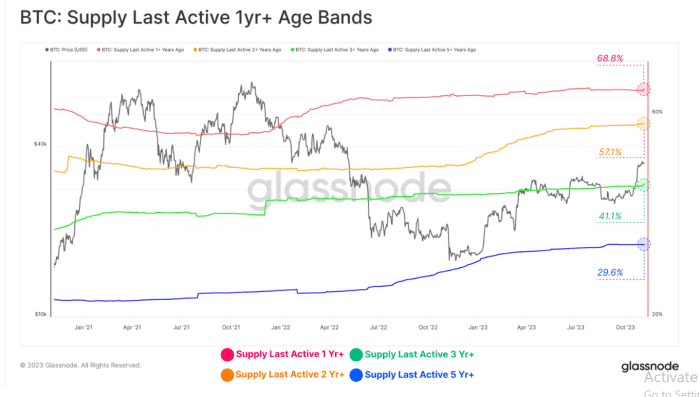

Bitcoin provide is at the moment tight in contrast with historic ranges, a bullish signal for the cryptocurrency, in line with analysts at Glassnode.

Many provide metrics concerning “coin inactivity” have been reaching multiyear, and even file highs, the analysts famous.

For instance, the proportion of circulating bitcoin provide that’s held for longer than one yr, is hovering at its file excessive, the analysts famous.

Glassnode

Meanwhile, roughly 70% of bitcoin’s provide has remained untouched in over three months, in line with a word from analysts at Reflexivity Research.

Bitcoin has risen over 120% up to now this yr, nevertheless it nonetheless is down over 45% from its peak in November 2021, in line with CoinDesk knowledge.

While greater bitcoin costs normally encourage gross sales of the coin, “for the time being it doesn’t appear current price levels are enticing enough for the majority of Bitcoin’s holder base,” the analysts famous.

Crypto in a snap

Bitcoin gained 4.6% up to now seven days and was buying and selling at round $36,495 on Thursday, in line with CoinDesk knowledge. Ether rose 7.5% throughout the identical interval at round $2,058.

Must-read

- Grayscale CEO: Bitcoin positive aspects present a ‘flight to quality’ amid financial uncertainty (MarketWatch)

- Wild Bitcoin, Ether Price Swings Spur $400M of Crypto Liquidations, the Most Since August (CoinDesk)

Source web site: www.marketwatch.com