The remaining session of Wall Street’s holiday-shortened buying and selling week will see the S&P 500 open just about smack in the course of the three,800 to 4,200 vary it’s inhabited for greater than three months. Dips hold getting purchased and rips bought.

The good news for bulls is that the benchmark fairness index

SPX

stays up 4.5% for the yr and has gained 12.2% from the October trough.

However that rebound is predicated on a story of incompatible outcomes, which in the end could also be unhealthy news for danger property, warns Blackrock.

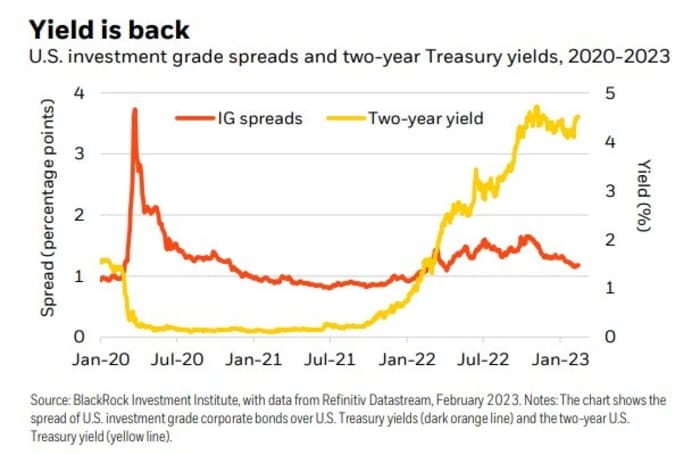

But first, why the rally? The group at BlackRock Investment Institute Risk led by Jean Boivin, notes that property jumped initially of 2023 due to falling inflation, decrease power costs in Europe, China’s speedy re-opening as COVID restrictions have been lifted, and what it phrases technical elements – i.e. many traders have been overly bearishly positioned.

“Yet we think the rally also reflects hopes that the sharpest central bank policy tightening in decades can avoid economic damage: growth will be sustained even if rates stay higher, and inflation will drop to 2% targets. Central banks then wouldn’t need to further tighten policy and create recessions to lower inflation,” says BlackRock.

The inventory market seems, largely, to nonetheless imagine this. Yet 2-year Treasury yields

BX:TMUBMUSD02Y,

that are significantly delicate to Federal Reserve financial coverage, sit close to their highest since 2007, having jumped almost 50 foundation factors to this point in February.

“Now bond markets are waking up to the risk the Fed hikes rates higher and holds them there for longer,” says BlackRock.

With current information displaying financial exercise is holding up nicely — see the strong labor market –and core inflation is proving stickier than anticipated, BlackRock doesn’t suppose inflation is on monitor again to the Fed’s 2% goal and not using a recession.

“That means solid activity data should be viewed through its implications for inflation. In other words: Good news on growth now implies that

more policy tightening and weaker growth later is needed to cool inflation. That’s bad news for risk assets, in our view,” says BlackRock.

Because the asset supervisor reckons this isn’t a typical financial cycle, it thinks “a new investment playbook is needed.”

It suggests going obese short-duration Treasuries, which provide 3 times greater than the 1.5% they have been offering only a yr in the past. “We also like their ability to preserve capital at higher yields in this more volatile macro and market regime.”

Source: BlackRock

Exposure to funding grade credit score ought to be decreased as a result of the current danger asset rally has prompted credit score spreads to tighten an excessive amount of, suggesting traders are too sanguine.

In equities, BlackRock favors rising markets

EEM

over developed: “We prefer EM as their risks are better priced: EM central banks are near the peak of their rate hikes, the U.S. dollar is broadly weaker in recent months and China’s restart is playing out.”

“That is in contrast to major economies that have yet to feel the full impact of central bank rate hikes – and yet still have a too-rosy earnings outlook, in our view. Plus, the risk is growing that DM central banks press ahead with more rate hikes.”

Markets

Stock-index futures point out a comfortable opening, with the S&P 500 contract

ES00

off 0.4% and the Nasdaq 100

NQ00

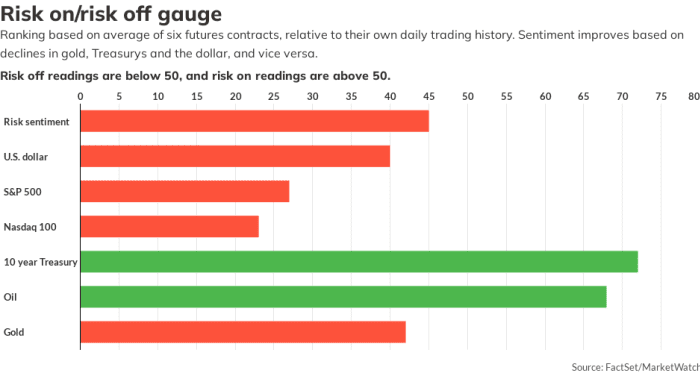

easing 0.8%. The U.S. 10-year Treasury yield

BX:TMUBMUSD10Y

is up 2.3 foundation factors to three.905%, near a 3 month excessive. The greenback index

DXY

is including 0.1% to 104.67.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

On the primary anniversary of Russia’s invasion of Ukraine the Chinese authorities referred to as for a ceasefire and proposed a peace plan. Beijing this week refused to again a UN vote condemning Moscow’s invasion. China’s chief Xi Jinping has not referred to as Ukraine’s president Volodymyr Zelenskyy since Russia’s invasion however has spoken with Vladimir Putin on a number of events.

There’s numerous financial information and Fedspeak for merchants to think about on Friday. Arguably of most significance is the private consumption expenditure value index for January, due at 8:30 a.m. The PCE index is a popular inflation gauge of the Federal Reserve.

Consumer spending and private revenue information for January will even be revealed at 8:30 a.m. adopted at 10 a.m. by January new residence gross sales and the ultimate studying on shopper sentiment for February.

Fed Governor Phillip Jefferson is because of converse at 10:15 a.m., the identical time as Cleveland Fed President Loretta Mester. At 11:30 a.m. St. Louis Fed President James Bullard will make some remarks, adopted at 1:30 p.m. by Boston Fed President Susan Collins and Fed Governor Christopher Waller.

Two badly crushed down former inventory darlings are having a greater time in premarket buying and selling. Shares in Beyond Meat

BYND,

which have been nicely above $200 in 2019, are leaping 14% to flirt with $20 after delivering higher than anticipated outcomes.

Meanwhile, Block

SQ

is up greater than 7% to close $80 after the fee know-how group’s earnings have been nicely acquired. Block’s inventory was above $275 in August 2021.

Adobe shares

ADBE

are off 3% following a report the DOJ was seeking to block the corporate’s $20 billion buy of Figma .

Best of the online

Eight methods the Russia-Ukraine struggle modified the world.

Timing the market is a loser’s sport.

We should hold preventing Russia with banks in addition to tanks, says Browder.

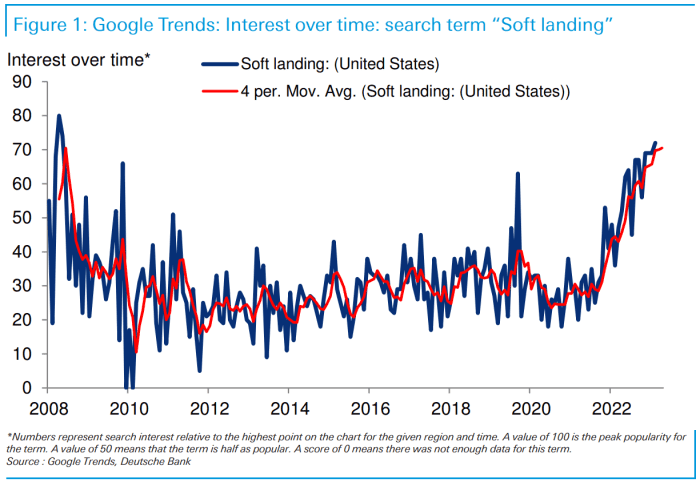

The chart

As alluded to above, one of many causes that shares had a superb begin to the yr was that traders started to suppose the U.S. economic system may escape the Fed’s tightening cycle with a “soft landing.” As the chart under from Deutsche Bank exhibits, U.S.-based searches on Google for the phrase reached a 15-year excessive this month. And everyone knows what tends to open when an concept in markets turns into overly widespread.

Source: Deutsche Bank

Top tickers

Here have been probably the most energetic stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

| TSLA | Tesla |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| NVDA | Nvidia |

| GME | SportStop |

| LUNR | Intuitive Machines |

| NIO | NIO |

| AAPL | Apple |

| APE | AMC Entertainment most well-liked |

| MULN | Mullen Automotive |

Random reads

California man claims successful $2.04 billion Powerball ticket was stolen from him.

80-year janitor can now re-retire after college students increase $200,000.

Ryan Reynolds to take the sphere for Wrexham FC.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source web site: www.marketwatch.com