Bets on dangerous bullish choices tied to members of the “Magnificent Seven” and different market-leading expertise shares are nearing their most crowded ranges prior to now yr, in response to information from market-data agency Spotgamma.

This is prompting some derivatives-market specialists to warn that the broader equities market could possibly be prone to a pullback as Big Tech shares, which have led the market larger over the previous yr, might falter following Friday’s choices expiration.

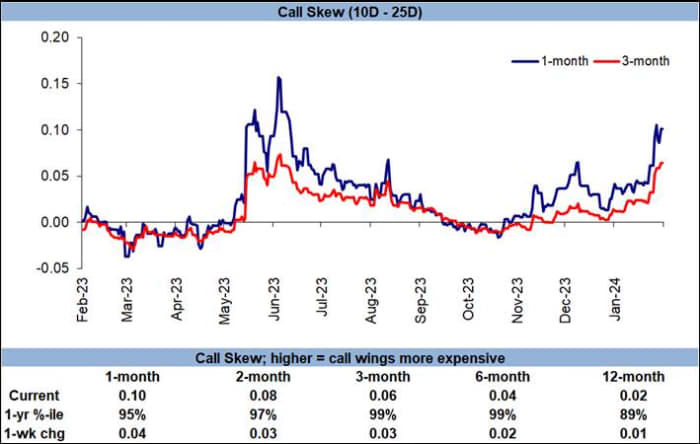

According to information from Amy Wu Silverman, head of derivatives technique at RBC Capital Markets, the one-month and three-month name skew for Nvidia Corp.

NVDA,

has reached the very best degree since a minimum of June.

Call skew measures demand for riskier out-of-the-money calls relative to at-the-money bullish bets. When skew rises, it means demand for riskier choices is climbing relative to demand for choices that might repay if the inventory have been to see a smaller advance earlier than expiration.

RBC CAPITAL MARKETS

According to Silverman, nonetheless, the straightforward incontrovertible fact that relative demand for out-of-the-money calls has reached excessive ranges in contrast with current historical past doesn’t essentially portend a direct reversal within the underlying inventory.

While it means that Nvidia is buying and selling nearly totally on momentum, “momentum tends to beget momentum,” Silverman stated in a analysis notice shared with MarketWatch.

Nvidia is the best-performing inventory within the S&P 500 to date in 2024, having gained 46.7% this yr on prime of its 238% advance in 2023. Its shares have been buying and selling at $726 round noon Tuesday because the broader market sank following the discharge of January inflation information that got here in barely hotter than economists had anticipated.

Others stated that excessive demand for bullish choices might create issues not just for members of the Magnificent Seven, but additionally different semiconductor shares like Arm Holdings Plc

ARM,

which has seen its shares rocket larger by greater than 60% year-to-date — and maybe for the broader market.

Skew for calls tied to Arm shares on Monday touched its 98th percentile over the previous yr, in response to information offered by Spotgamma. Skew for calls tied to Amazon.com Inc.

AMZN,

was even larger, having reached the 99th percentile over the previous yr, whereas Meta Platforms Inc.’s

META,

name skew was additionally in its 98th percentile.

The Magnificent Seven consists of shares of Nvidia, Amazon and Meta, in addition to Microsoft Corp.

MSFT,

Alphabet Inc.

GOOGL,

GOOG,

Tesla Inc.

TSLA,

and Apple Inc.

AAPL,

Charlie McElligott, a derivatives-market strategist at Nomura, has been saying for months now that rising demand for out-of-the-money name choices represents traders’ “fear of missing out” on additional upside.

In impact, traders are paying a premium to make sure their portfolios will profit from any additional good points for particular person megacap expertise shares, in addition to indexes just like the S&P 500 and Nasdaq Composite.

The largest disadvantage to the sort of upside hedging is it creates an atmosphere the place exercise within the choices market might affect buying and selling in underlying shares, doubtlessly making a harmful suggestions loop.

Brent Kochuba, founding father of Spotgamma, stated in a notice to purchasers dated Monday that this Friday’s expiration of month-to-month choices tied to single-stock names, indexes and exchange-traded funds might precipitate a correction in shares — with the S&P 500 doubtlessly retreating to the 4,900 degree or beneath.

“The bullish tech trade is very crowded,” Kochuba stated within the notice.

Heavy demand for bullish choices forces choices sellers, who’re promoting calls to merchants, to hedge their positions by shopping for shares, pushing the market larger. This is the place the suggestions loop comes into play, as larger shares draw extra long-call demand, which attracts extra hedge-buying from sellers.

Wednesday’s expiration of choices linked to futures of the Cboe Volatility Index

VIX,

higher often called the Vix or the market’s “fear gauge,” might additionally turn out to be a possible catalyst for the subsequent transfer decrease within the markets, McElligott and Kochuba stated.

In choices parlance, being “in the money” means an choice may be exercised or bought for a revenue. “At the money” describes an choice with a strike worth near or at the place the underlying asset is at the moment buying and selling. “Out of the money” means an choice with a strike worth that’s larger, if it’s a name, or decrease, if it’s a put, than the place the underlying inventory is buying and selling.

The Vix was at 14.90 in current buying and selling Tuesday, on observe for its highest shut of the yr.

Kochuba additionally famous that the heavy name skew for Nvidia might make it harder for the corporate’s shares to rally after it experiences earnings on Feb. 21, even when it surpasses Wall Street’s expectations.

He famous that the final two cases the place Nvidia’s name skew was at or close to present ranges occurred in November 2021 and June 2023, as traders awaited earnings from the chip maker. In each circumstances, the height in skew for Nvidia coincided with market tops, together with the Nasdaq Composite’s document closing excessive from November 2021.

U.S. shares bought off on Tuesday following the January inflation report, with the S&P 500

SPX

down 1.3% to 4,955 in current buying and selling, whereas the tech-heavy Nasdaq Composite

COMP

fell 1.7% to fifteen,679.

The Dow Jones Industrial Average

DJIA,

in the meantime, was off by 508 factors, or 1.3%, to 38,286.

Source web site: www.marketwatch.com