The U.S. inventory market, as measured by the S&P 500 Index

SPX,

stumbled into the top of January. On the optimistic facet, since January registered a acquire, that could be a longer-term optimistic beneath the “January Barometer” philosophy (as goes January, so goes the yr). On the opposite hand, this market is in want of a relaxation, and February has been a down month in a few years — generally very harshly (see the Market Insight part). So, we’re on the look ahead to promote indicators from our indicators.

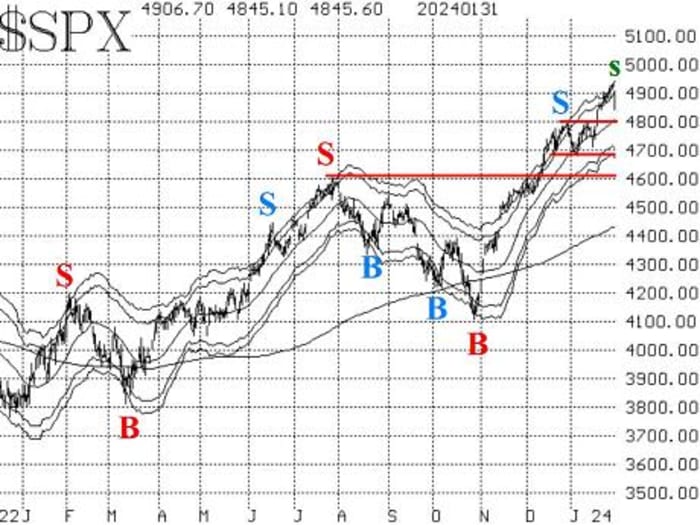

The S&P 500 chart remains to be optimistic, as Wednesday’s sharp pullback didn’t attain the rising 20-day shifting common. There remains to be help within the 4,680-4,800 space, with help at 4,600 under that (see the accompanying chart). Until a few of these help areas are damaged, that is nonetheless a bullish chart — worthy of sustaining a “core” bullish place.

Meanwhile, SPX has fallen again under its +3σ “modified Bollinger Band” (mBB). That generated a “classic” mBB promote sign. We don’t commerce these as a result of they’re topic to frequent whipsaws. However, if there’s additional draw back affirmation, that can generate a McMillan Volatility Band (MVB) promote sign, and we do commerce these. That will happen if SPX trades at 4,824 or decrease.

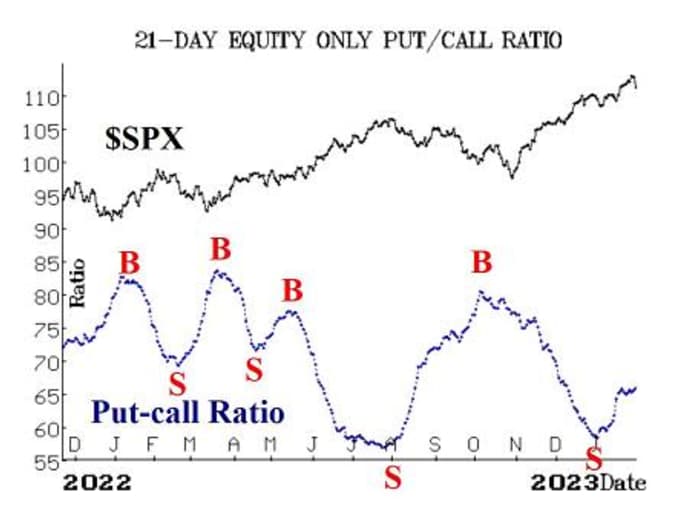

Equity-only put-call ratios stay on promote indicators, a minimum of based on the pc applications that we use to research these charts. The normal ratio remains to be shifting slowly greater. However, the weighted ratio is shifting kind of sideways. These could be extra assured promote indicators in the event that they have been steadily rising. Currently they’re bearish for shares, however not overly so.

Breadth has weakened previously few days, and now the breadth oscillators are on promote indicators. This is our shortest-term indicator and as such might be topic to whipsaws. So, we require a two-day affirmation for any new sign. If breadth is damaging as we speak, and even solely modestly optimistic, that can be sufficient to substantiate breadth-oscillator promote indicators.

New highs on the NYSE have been robust, simply outnumbering new lows and in addition registering greater than 100 new highs for the previous six days in a row — and eight of the previous 9. Yes, I understand that lots of these 100 shares are the identical from day after day, however that’s the method it really works. So, this indicator stays on a purchase sign and can proceed to do till new lows outnumber new highs for 2 consecutive days on the NYSE.

VIX

VIX

VX00,

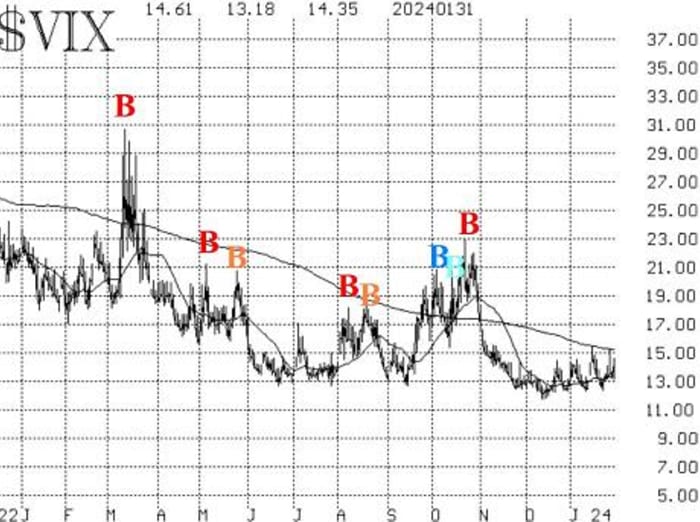

stays in a bullish mode for shares. VIX barely reacted to the S&P 500 promoting off near 80 factors on Jan. 31. As a consequence, the pattern of VIX purchase sign stays in place. That could be stopped out if VIX have been to shut above its declining 200-day shifting common, which is at present at 15.25. A low VIX shouldn’t be a promote sign by itself; VIX should start to rise as a way to create a bearish sign for shares.

The assemble of volatility derivatives additionally stays in a bullish mode for shares. The time period buildings slope simply upward, and the VIX futures are buying and selling with a wholesome premium over VIX. The first signal of fear right here could be if the front-month February VIX futures have been to rise in worth above the March futures, however that has not been even remotely the case.

The January seasonal sample ends with as we speak’s buying and selling. The FOMC assembly positively messed with the sample this yr. I can’t recall that taking place earlier than, however as of late the market is extra delicate to FOMC statements than in previous occasions. Now, February looms (see the Market Insight part under).

Overall, we’re sustaining a “core” bullish place due to the optimistic nature of the SPX chart. However, we are going to act on promote indicators if they’re confirmed.

New advice: Potential MVB promote sign

As famous above, a “classic” modified Bollinger Band (mBB) promote sign has occurred. We don’t commerce these, however we are going to commerce a McMillan Volatility Band (MVB) promote sign if that’s confirmed. Specifically, that may be confirmed if the S&P 500 have been to commerce at 4,824 or decrease. That worth is mounted, so it stays there within the following days in addition to as we speak.

IF SPX trades at 4,824 or decrease, then purchase 1 SPY Mar (15th) at-the-money put and promote 1 SPY Mar (15th) put with a hanging worth 25 factors decrease.

If this commerce is established, it could have a goal of the decrease -4σ Band, and it could be stopped out if SPX have been to shut above the +4σ Band.

| Year | S&P 500 level transfer in February |

| 2002 | -23.5 |

| 2003 | -14.6 |

| 2004 | 13.8 |

| 2005 | 22.4 |

| 2006 | 0.6 |

| 2007 | -31.4 |

| 2008 | -47.9 |

| 2009 | -90.8 |

| 2010 | 30.6 |

| 2011 | 41.1 |

| 2012 | 53.2 |

| 2013 | 16.5 |

| 2014 | 76.9 |

| 2015 | 109.6 |

| 2016 | -8 |

| 2017 | 84.8 |

| 2018 | -110 |

| 2019 | 80.3 |

| 2020 | -271.3 |

| 2021 | 96.9 |

| 2022 | -141.6 |

| 2023 | -106.5 |

| Gains | 12 |

| Losses | 10 |

| Total SPX factors | -218.9 |

There have been positive factors in 12 of the years and losses in 10, however the whole S&P 500 level fluctuation was a lack of 218.9, and the previous six years have proven 4 massive losses. So, a certain quantity of warning is warranted from these statistics. With this background, one ought to be notably cautious to not keep away from promote indicators that will come up.

We will base this commerce on a mixture of things — equity-only put-call ratio promote sign, breadth promote sign, and an increase in VIX. If the rise in VIX happens, the others will definitely be in place.

IF $VIX closes above 15.40, then purchase 1 SPY Mar (15th) at-the-money put and Sell 1 SPY Mar (15th) put with a hanging worth 25 factors decrease.

If this commerce is established, we are going to set a cease for it subsequent week.

Follow-up motion:

All stops are psychological closing stops until in any other case famous.

We are utilizing a “standard” rolling process for our SPY spreads. In any vertical bull or bear unfold, if the underlying hits the quick strike, then roll all the unfold. That could be roll up within the case of a name bull unfold or roll down within the case of a bear put unfold. Stay in the identical expiration and preserve the space between the strikes the identical until in any other case instructed.

Long 4 XLP

XLP

Feb. (16th) 72 calls: Raise the cease to 71.70.

Long 1 SPY

SPY

Feb. (16th) 485 name: This place was initially a protracted straddle. It was rolled up, and the places have been bought. The calls have been rolled up a number of extra occasions, together with most not too long ago on Jan. 22, when SPY traded at 485. This is, in essence, our “core” bullish place. Roll the calls up each time they turn out to be a minimum of eight factors in-the-money.

Long 4 UNM

UNM,

March (15) 45 calls: roll as much as the March (15) 50 calls. The put-call ratio is now not on a purchase sign, however the inventory is trending greater. Set a closing cease at 47.80 after the roll.

Long 0 SPY Feb. (16) 469 put and quick 0 SPY Feb. 16) 449 put: Bought in step with the McMillan Volatility Band promote sign. Last week, we mentioned that the place could be stopped out if SPX closed above 4,894 on Jan. 25. It was stopped out by 10 cents. So, now we’re ready for the subsequent potential promote sign (see the advice within the e-newsletter above).

Long 1 SPY Feb. (16) 484 name: This was initially a protracted straddle. The name was rolled up, and the put was bought. Roll up each time the decision is eight factors in-the-money. Meanwhile, set a closing cease at 480 to promote the decision.

Long 3 TLT

TLT

May (19) 95 put: We will maintain so long as the put-call ratio promote sign is in place for Treasury bonds.

Long 1 SPY Feb. (16) 486 name: This name was purchased in step with the brand new highs vs. new lows purchase sign. Stop out if NYSE new lows exceed new highs for 2 consecutive days. Roll up each time the decision is eight factors in-the-money.

Long 2 SPY Feb (9) 487 calls: Bought in step with the January bullish seasonal sample. Roll the calls up in the event that they turn out to be six factors in-the-money. Sell the entire calls on the closing of buying and selling on Thursday, Feb. 1. The FOMC assembly positively interfered with this seasonal sample this yr.

All stops are psychological closing stops until in any other case famous.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan might maintain positions in securities beneficial on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the creator of the best-selling e book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The data on this e-newsletter has been rigorously compiled from sources believed to be dependable, however accuracy and completeness are usually not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals might have positions within the securities beneficial within the advisory.

Source web site: www.marketwatch.com