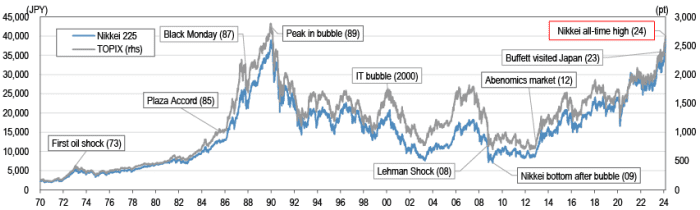

The present bull market that has seen the tip of Japan’s misplaced three a long time ought to be referred to as the “end of deflation” market, says JPMorgan’s high Japan strategist.

The word from JPMorgan’s Rie Nishihara got here as inflation knowledge out of Japan as soon as once more got here in on the recent facet, with core CPI sliding to 2% from 2.3% however topping estimates of 1.8%.

The yield on the 2-year Japanese authorities bond

BX:TMBMKJP-02Y

rose as excessive as 0.176%, the best degree since 2011.

The Nikkei 225

JP:NIK

completed nearly unchanged at 39,239. It’s up 43% during the last 52 weeks. The Japanese yen rose 0.3% to 150.22 per U.S. greenback.

Nishihara stated the tip of deflation grew to become the theme after core CPI reached 2% for the primary time, in April 2022. Share costs bottomed in Jan. 2023 after the Bank of Japan’s shock revision of its yield curve management coverage, which occurred the earlier month.

JPMorgan

She stated there’s a roadmap to a sustainable degree of 40,000 on the Nikkei 225, as the main target is now on the Topix

JP:180460,

the market cap-weighted index which had a bubble excessive of two,884.80 in Dec. 1989. Share worth features have to unfold past semiconductor shares for the Topix to take out that prime, Nishihara stated.

The Topix completed at 2,678.46, up 0.2% on the day.

Source web site: www.marketwatch.com