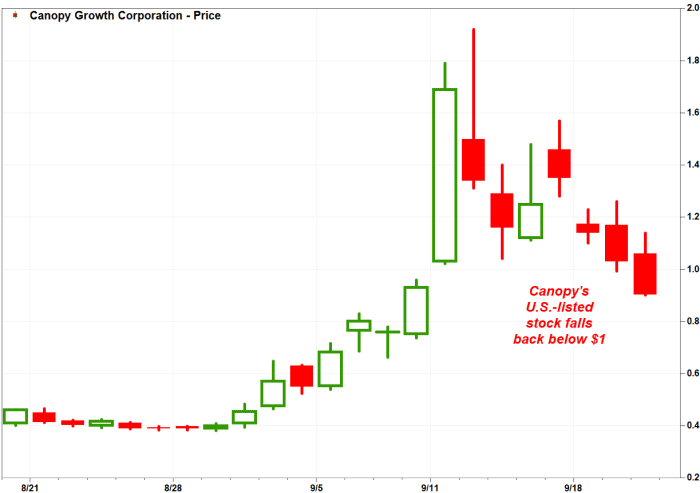

Shares of Canopy Growth Corp. had been reduce down Wednesday, again into penny-stock territory, after the Canada-based hashish firm registered roughly 46 million shares on the market to the general public.

The U.S.-listed inventory

CGC,

WEED,

tumbled 12.4% in morning buying and selling, placing it on monitor for the primary sub-$1 shut since Sept. 8.

In an S-1 submitting with the U.S. Securities and Exchange Commission, the corporate registered as much as 45.86 million frequent shares on the market, with all the shares held by promoting shareholders.

The shares registered embody 22.93 million frequent shares and 22.93 million shares underlying warrants to purchase frequent shares.

The submitting comes two days after the corporate introduced a personal placement with institutional buyers of as much as $50 million to spice up liquidity. The placement was for 22.9 million items, with every unit equal to at least one frequent share and one warrant to purchase a typical share.

The S-1 submitting registers all of the shares, if the institutional buyers train all of the warrants to purchase inventory, on the market.

With the non-public placement, Canopy Growth took benefit of an enormous rally in its inventory value, as buyers expressed optimism that hashish could be rescheduled within the U.S. as a safer drug and that favorable banking laws are on the horizon.

In the ten classes from Aug. 28 via Sept. 11, the inventory skyrocketed 333.3%. Since then, it has has tumbled 46.2%.

Canopy Growth’s inventory has retraced greater than half of its 333% rally over 10 days via Sept. 11.

FactSet, MarketWatch

Despite the selloff, Alliance Global Partners analyst Aaron Grey stated momentum for favorable banking laws might show a further upside catalyst for the hashish sector. He stated the Secure and Fair Enforcement (SAFE) Banking Act, which might make it simpler for banks to work with hashish firms, at present sits within the Senate Banking Committee and is scheduled for mark-up on Sept. 27.

“Overall, we look for the committee to advance the bill to the full Senate next Wednesday, with the question then being the ability to secure 60 votes in the full Senate and the timing of when Senate Majority Leader Chuck Schumer might put the bill up for a vote,” Grey wrote in a be aware to purchasers.

The AdvisorShares Pure US Cannabis exchange-traded fund

MSOS

rose 1.2% in morning buying and selling Wednesday.

Year thus far, Canopy Growth shares have tumbled 61%, whereas the hashish ETF has rallied 17.5% and the S&P 500

SPX

has superior 15.9%.

Source web site: www.marketwatch.com