Investment legend Charlie Munger will inform you. Our name of the day comes from the billionaire vice chairman of Berkshire Hathaway

BRK.A,

BRK.B,

who provided investing insights through a podcast from Acquired over dinner at his Los Angeles residence. The interview printed Oct. 29.

Warren Buffett’s proper hand man acknowledged the robust hunt for good investments, as he mentioned bets on Costco, Apple, Japanese buying and selling corporations and extra. “There was a lot of low hanging fruit in the early days to our operation, you don’t have any low hanging fruit that’s easy right now,” he mentioned.

He repeats that view in a while, saying the “low hanging fruit for the idiot is not gone, but it’s very small,” when requested how Berkshire chosen its largest holding, Apple

AAPL,

again in 2016.

“Everybody needs some significant participation in the 12 companies that do better than everybody else and you need two or three of them at least, and if you have that mindset, Apple is a logical candidate to be on the list,” he mentioned.

And how did they decide the iPhone maker out of the roster of Big Tech corporations? “We couldn’t find anything else. It got cheap — 10 times earnings.”

Munger was requested why he thought all of the Big Tech dominants — Apple, Microsoft

MSFT,

Tesla

TSLA,

Alphabet

GOOG,

and so forth. — have turn out to be so concentrated in markets, pensions and 401k plans. “It was natural…that’s what human nature and competition causes…eventually with this craziness in venture capital, when they’ve all gone stupid, that’s a natural outcome.”

And when requested to expose recommendation on discovering these good bets, he mentioned: “When you know you have an edge, you should bet heavily.”

Munger weighed in on Costco

COST,

which Berkshire bought off in 2020, although the billionaire nonetheless owns it and has mentioned he’d by no means promote any.

“Well they really did sell cheaper than anybody else in America and they did it in big efficient stores…the parking spaces were 10 feet wide instead of 8 feet or whatever they normally are…they kept out of their stores all these people who didn’t do big volumes. They gave special benefits to the people who did come to the stores in the way of reward points. It all worked,” he says.

He mentioned Walmart

WMT,

has made an enormous error over time versus Costco, mainly being “too wedded to the ideas they already had” and unable to simply accept new concepts. Walmart obtained caught right into a formulation of going into small cities the place actual property was not value a lot, and preserving their occupancy prices down.

“So it offended them to go against the rich suburbs and have to pay up for good locations, and Costco just specialized in the good locations where the rich people live. and Walmart just let them do it year after year and it was a terrible mistake,” he mentioned. Munger added that he likes Costco for the following 10 years, and shopping for now at present costs may match, however “it’s getting hard.”

He was additionally requested whether or not the auto business and electrical autos have been extra investible as a result of disruption. “Maybe for one or two electric cars [makers] that are really good at it, but certainly nobody else. It’s too tough,” he mentioned.

Munger praised China EV maker, BYD

002594,

which Berkshire owns as a “a miracle, but that guy works 70 hours a week and has a very high IQ. He can do things you can’t do, he can look at somebody else’s auto part and he can figure out how to make the…thing. You can’t do that.” While not naming names, one assumes he’s speaking about BYD’s rags-to-riches chairman Wang Chuanfu.

Munger additionally mentioned his aversion to so-called “style companies,” like Nike

NKE,

although he provided reward for luxurious makers like Hermès

RMS,

including that “I suppose if you offered me Hermès at a cheap enough price I’d buy it.” What makes these sorts of corporations enduring is “they’ve got a brand people trust so much,” he mentioned.

He additionally touched on Berkshire’s much-discussed investments in 5 Japanese buying and selling corporations, Mitsubishi

8058,

Mitsui

8031,

Itochu,

8001,

Marubeni

8002,

and Sumitomo

8053,

Those stakes have been boosted by Berkshire this summer time.

Munger known as the funding a “no-brainer. Something like that, if you’re as smart as Warren Buffett, maybe two, three times a century you get an idea like that. The interest rates in Japan were half a percent a year for 10 years and these trading companies were really entrenched old companies…so you could borrow for 10 years ahead all the money and you could buy the stock and the stock made 5% dividends so there is a huge flow of cash with no investment, no thought, no anything. How often do you do that?”

But he added that it was robust to construct stakes in these, and Berkshire needed to be “very patient and pick away little pieces at a time. It took forever to get 10 billion dollars in investment but it was like just like God opening a chest and pouring money into it. It was awfully easy money.”

Munger additionally weighed on his bitter style for enterprise capital, saying it’s akin to “gambling” nowadays, as among the offers “get so hot and you have to decide so quickly.” Also he mentioned numerous VCs nowadays generate income by “screwing” their traders.

He briefly mentioned China, the place he says the economic system has “better prospects over the next 20 years than almost any other big economy. Number one, the leading companies in China are stronger and better than practically any other” and cheaper, he added.

Among Asian corporations, although, TSMC

2330,

isn’t one he’d maintain as a result of it doesn’t actually have a “brand of its own” like Apple, mentioned the storied investor. Listen to the entire podcast right here.

Don’t miss: Stanley Druckenmiller slams Janet Yellen for ‘biggest blunder in Treasury history’: failing to lock in rock-bottom rates of interest

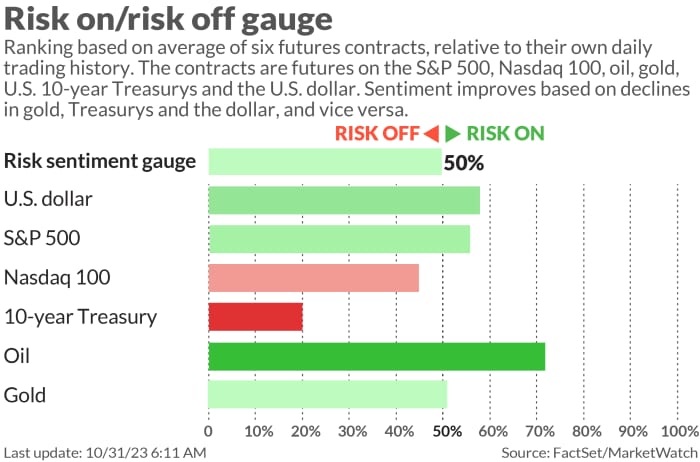

The markets

Stock futures

ES00,

are flat, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

falling and the greenback

DXY

decrease. The Bank of Japan mentioned it could persist with its 10-year JGB bund yield

BX:TMBMKJP-10Y

at 0%, however with plans to be extra versatile. Crude costs

CL.1,

BRN00,

are modestly up.

Read: Global central-bank gold purchases attain a file excessive for the primary 9 months of the 12 months

The buzz

Data revealed wages within the third quarter rose 1.2%, and S&P Case-Shiller information confirmed residence costs within the prime cities up a sixth straight month. Still to return is the Conference Board’s shopper confidence survey at 10 a.m.

Caterpillar

CAT,

inventory is climbing on a hefty revenue beat as value rises helped enhance gross sales. JetBlue

JBLU,

inventory is tumbling after the low-cost provider warned of an even bigger loss forward as its third quarter fell quick. Amgen

AMGN,

is up on an earnings beat, whereas Anheuser-Busch

BUD,

is up after a barely higher revenue and a brand new $1 billion inventory buyback plan. Results from First Solar

FSLR,

Paycom

PAYC,

and Caesars Entertainment

CZR,

after the shut.

Pinterest

PINS,

inventory is up 17% after the social-media firm blew previous estimates with a income and earnings surge.

Silicon-carbide group Wolfspeed

WOLF,

is up 14% after forecasting a narrower-than-expected loss. Lattice Semiconductor

LSCC,

slid 15% after a weak gross sales forecast. Watch for the following chip biggie, AMD

AMD,

to report after the market shut.

Ahead of earnings later this week, Apple

AAPL,

made its debut new processors and MacBook Pros.

Best of the net

Meet MarketWatch’s 50 most influential individuals proper now

Opinion: Hey, all you grownup celebration monsters: Stop spoiling Halloween for the children!

Ravaged Florida city turns into a magnet for risk-taking homebuyer.

How this 12 months’s hottest funding may find yourself costing you (subscription required)

Chart of the day

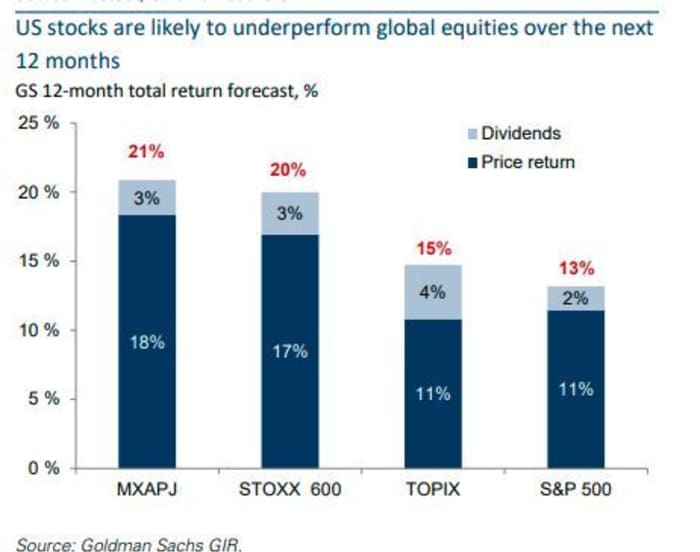

A ten-year outperformance by U.S. shares could have reached the tip of the highway, says a staff at Goldman Sachs. Peter Oppenheimer, chief international fairness strategist mentioned Wall Street equities have “underperformed for long stretches in the past,” and a lesser efficiency may very well be seen within the subsequent decade.

Oppenheimer acknowledges that “the U.S. remains at the cutting edge of technological innovation,” however the market is closely concentrated in a number of massive corporations and “increased competition from other asset classes in the current high-rate environment could dissuade U.S. households from adding to already high equity ownership,” the Goldman observe mentioned.

Here’s a chart that Goldman presents up:

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon.com |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

CAT, |

Caterpillar |

|

GME, |

RecreationStop |

|

MSFT, |

Microsoft |

|

NIO, |

Nio |

|

META, |

Meta Platforms |

Random reads

Europe’s largest Halloween celebration will shut with a parade for its 30,000 revelers on Tuesday

Goths and devils take over seaside city celebrating its Dracula connection

And welcome to Spirit Halloween, bringing retail area again from the lifeless.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com