It will take years — a long time even — for China’s inventory market to really feel the affect of the nation’s newest demographic information. China lately reported that 2023 was the seventh yr in a row through which the variety of births in has fallen. Netted towards deaths, the decline within the nation’s whole inhabitants is accelerating.

While an accelerating decline in inhabitants shouldn’t be good, the China bears are improper to assert that the most recent information means the Chinese inventory market is about to plunge. It’s attainable that Chinese equities will fall in coming months, after all. But in the event that they do it received’t be due to what number of (or few) infants have been born final yr within the nation.

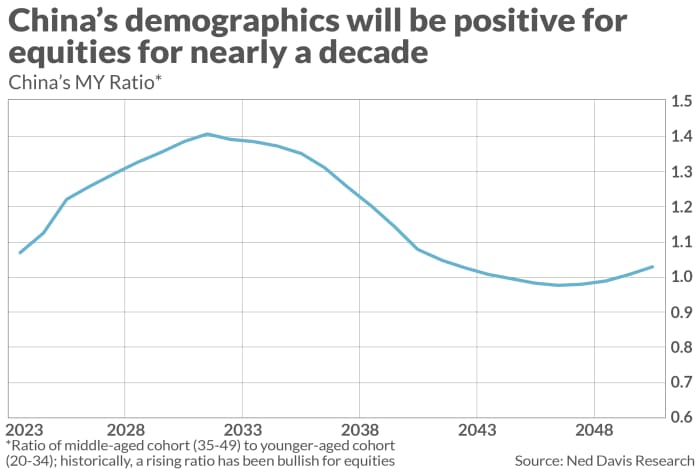

Consider the indicator that has maybe the perfect correlation with the inventory market, in accordance with quite a few research: The so-called “MY Ratio,” which stands for “Middle-Young Ratio.” It is calculated by dividing the scale of a rustic’s middle-aged inhabitants (35-49) to the scale of the young-adult cohort (20-34). Researchers have discovered {that a} nation’s inventory market performs higher, on common, when its MY Ratio is rising than when it’s declining.

There are two noteworthy implications of this analysis:

- Last yr’s births received’t have an effect on China’s MY Ratio, and by extension the inventory market, for 20 years.

- It can be even additional into the long run when final yr’s decrease start charge will begin having a detrimental affect on equities. Between 20 and 34 years from now, the scale of China’s young-adult cohort would be the denominator of the MY Ratio, and a smaller denominator interprets to a bigger ratio. In different phrases, final yr’s decrease births shouldn’t negatively affect Chinese equities for one more 35 years — in 2059.

What does the MY Ratio say about Chinese shares at present? As you’ll be able to see from the chart above, China’s MY Ratio can be in an uptrend for the subsequent a number of years. Because of that uptrend, Alejandra Grindal, Ned Davis Research’s chief economist, stated in an e-mail that “China’s equities should continue to have positive tailwinds until 2031, when the MY ratio peaks.”

Of course, demographics aren’t the one issue that may affect the Chinese inventory market over the long run. But because it does play a significant position, it’s necessary that we all know the course it’s going. And for the subsequent a number of years, no less than, China’s demographics will assist propel its inventory market ahead — not gradual it down as many are claiming.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He will be reached at mark@hulbertratings.com

More: China-focused ETFs battle amid fears of one other regulatory ‘crackdown’

Also learn: U.S. recession nonetheless a risk; China progress stalls, and different 2024 investing dangers

Source web site: www.marketwatch.com