By now, greater than 60 million Medicare beneficiaries are within the thick of Medicare’s annual election interval, which runs from Oct. 15 by Dec. 7.

During this era, beneficiaries can modify their Medicare well being or drug protection for the approaching 12 months.

They can have acquired their annual discover of change and proof of protection paperwork, and may even have learn by Medicare & You 2024, the official U.S. authorities 130-page handbook, and used Medicare’s Plan Compare instrument to seek for a Medicare plan that meets their wants.

Read: Watch for this mail from Medicare. Missing out might price you cash and damage your healthcare protection.

But even when they’ve completed all that, choosing the right plan might be an awesome job. So for Medicare beneficiaries who need assistance throughout the annual election interval there are a minimum of six locations to show.

Read: What to Know concerning the Medicare Open Enrollment Period and Medicare Coverage Options.

- Medicare

During Medicare’s annual election interval, folks can name Medicare instantly 24 hours a day, seven days every week, at 1-800-633-4227 to obtain help in evaluating Medicare Advantage, Part D, and Medigap plans. The representatives at Medicare will help reply questions on protection, claims, funds, and extra, in each English and Spanish in addition to language assist in over 200 further languages.

Beneficiaries may use Medicare’s Plan Compare, which permits folks to match choices for well being and drug protection. Medicare’s Plan Compare instrument has been up to date with the 2024 Medicare well being and prescription drug plan data, in response to a CMS spokesperson.

Low-income seniors and adults with disabilities could qualify to obtain monetary help from the Medicare Savings Programs (MSPs). The MSPs are important to assist tens of millions of Americans entry high-quality healthcare at a diminished price, if folks meet the situations of eligibility. Enrolling in an MSP gives reduction from these Medicare prices, permitting folks to spend that cash on different requirements like meals, housing, or transportation. Individuals excited about studying extra can go to Medicare Savings Programs.

In addition, a CMS spokesperson mentioned the Low-Income Subsidy Program, additionally known as Extra Help, is a Medicare program that helps qualifying people pay Part D premiums, deductibles, coinsurance, and different prices. In 2024, this program is increasing due to the Inflation Reduction Act, permitting all eligible enrollees to learn from no deductible, no premium, and stuck decrease copayments for sure drugs. Enrollees can save practically $300 per 12 months, on common. Up to 3 million seniors and other people with disabilities may gain advantage from the Extra Help program now however aren’t at the moment enrolled. Individuals who enroll in MSPs robotically qualify for assist affording their prescribed drugs by the Extra Help program. To study extra concerning the Low-Income Subsidy Program, go to: Medicare.gov.

Additional assets: Centers for Medicare & Medicaid Services (CMS), Medicare.gov and Medicare & You Handbook.

Pros of calling Medicare throughout the annual election interval

Personalized interplay: According to Katy Votava, president of Goodcare.com, an unbiased consulting agency that gives recommendation on medical health insurance and Medicare protection choices and creator of “Making the Most of Medicare: A Guide for Baby Boomers,” one of many main advantages of calling Medicare throughout this era is the chance to talk with actual folks.

Medicare representatives can advise beneficiaries on what probably the most appropriate plan is that if “you’re willing to organize yourself and take the time to work with them,” Votava mentioned.

Beneficiaries nonetheless have to enroll within the plan, in response to Theresa Cangemi, president of Retirement Health Plans Made Simple, an unbiased Medicare insurance coverage agent.

Customized medicine plan search: Medicare representatives can conduct a tailor-made search for a medicine plan that most closely fits your wants, in response to Votava.

Assistance for caregivers: Caregivers may attain out to Medicare on behalf of beneficiaries. However, the beneficiary should be current to authorize the dialog, until prior authorizations are already in place with Medicare, mentioned Votava.

Preparation tip: To take advantage of your name, Votava recommends ensuring all related data is organized and available.

Cons of calling Medicare throughout the annual election interval

Potential wait instances: There may be a wait time on account of excessive name volumes. “Beneficiaries could find themselves on hold for extended periods,” mentioned Votava. To reduce wait instances, she recommends calling midweek. Mondays and Fridays are usually the busiest days, she mentioned.

Besides being tough to get by, you may get totally different solutions from totally different representatives, mentioned Scott Maibor, a Medicare relationship supervisor with Senior Benefits Boston, a agency that gives Medicare consultations and training.

Knowledge: Maibor additionally mentioned Medicare representatives must be a educated supply for all Medicare questions, however they don’t go into particulars a few provider’s choices past what the web site exhibits because the least costly medicine price.

Overwhelming: “Because the array of Medicare coverage options is completely overwhelming to the average consumer, attempting to ‘self-navigate’ by using Medicare.gov or calling 1-800-Medicare is not realistic for coverage comparisons,” mentioned Tom Wright, the president of The Turning 65 Workshop, a agency that gives coaching, seminars, and workshops centered on educating older staff and HR professionals on Social Security and Medicare. He did be aware, nonetheless, that Medicare.gov is beneficial for evaluating Part D prescription drug choices.

2. State Health Insurance Assistance Programs (SHIPs)

The State Health Insurance Assistance Programs (SHIPs), that are federally funded by the U.S. Administration for Community Living, present native and goal counseling and help to Medicare-eligible people, their households, and caregivers. In some states, resembling Massachusetts and Florida, the counseling service is known as the SHINE Program (Serving the Health Insurance Needs of Everyone).

During Medicare’s enrollment interval you possibly can contact your SHIP or SHINE for one-on-one help with reviewing well being or prescription drug plan choices. Among different issues, SHIP and SHINE counselors, who undergo in depth coaching, can clarify how Medicare works with supplemental insurance policies, retiree protection, Medicaid, and different insurers.

You can use the SHIP Locator to find a counselor close to you or name 1-877-839-2675.

Read: SHIP Overview Flyer.

Also learn this Medicare weblog about SHIPs and open enrollment

Read: Medicare handout with inquiries to ask when signing up for Medicare or Medicare Advantage

Pros of utilizing SHIPs

Well-trained and free: The SHIP and SHINE counselors are unbiased and properly educated. Plus, their providers are free and obtainable at most senior facilities. SHIP and SHINE counselors may present data and referral for different wanted providers.

SHIP and SHINE counselors assist beneficiaries with qualifying for presidency applications, Cangemi mentioned, and should assist with filling out purposes for further assist such because the Low-Income Subsidy program, Medicaid, and the Medicare Savings Program.

Cons of utilizing SHIPs

Limited availability: The large disadvantage is that volunteers have restricted availability, in response to Maibor. Often, volunteers are booked strong Monday by Friday from the second a senior heart opens until it closes. And provided that, Maibor mentioned it may be tough to ebook one other appointment in the event you want further data.

Not getting enrolled: Typically, a SHIP or SHINE counselor wouldn’t enroll a Medicare beneficiary right into a Medicare insurance coverage plan. “They might just suggest or give (the beneficiary) printouts to the different Medicare options,” Cangemi mentioned.

Competency may range: These applications serve an essential function; nonetheless, many depend on volunteers. “The caution I would offer is that this evaluation process is highly complex and that the level of a volunteer competency and experience varies greatly,” mentioned Wright.

Tip: Votava recommends signing up as early as attainable to schedule an appointment with a SHIP counselor.

3. Fee-for-service advisers

Fee-for-service Medicare advisers sometimes assessment the assorted Medicare choices for beneficiaries together with conventional Medicare, Medicare Advantage, Part D prescription plans, and Medigap supplemental plans and supply unbiased recommendation about the most effective plan to pick out.

Fee-for-service Medicare advisers are usually not affiliated with any particular insurance coverage firm or plan they usually sometimes cost a flat payment or hourly fee for his or her providers relatively than incomes commissions by enrolling beneficiaries into particular plans. Experts say the fee-based mannequin reduces conflicts of curiosity and incentives to steer beneficiaries in the direction of sure plans.

Pros of utilizing fee-for-service advisers

Independent: Such advisers are “truly independent,” mentioned Maibor. “They are able to act as a fiduciary with the best interest of the client at forefront,” he mentioned. “And they can be a year-round resource.”

Cons of utilizing fee-for-service advisers

Cost: The large disadvantage to utilizing a fee-for-service adviser is price, in response to Maibor.

Cangemi shares that opinion. “A fee adviser would not be allowed to enroll a Medicare beneficiary into a Medicare plan,” she mentioned. “After all that work, they could only show or discuss options. They advise only.”

According to Maibor, beneficiaries who do use a fee-for-service adviser will discover that pricing will range broadly. In his follow, as an example, he at the moment costs a flat payment of $395 for new-to-Medicare beneficiaries and $195 for a assessment with a assure. A colleague in Chicago, against this, costs $1,495 for a session and one other colleague costs $200 per hour.

Scarcity and high quality: Experts additionally be aware that it’s laborious to find out simply what number of certified and competent fee-for-service Medicare advisers there are within the U.S. There isn’t any official Medicare certification program particularly for fee-for-service Medicare advisers neither is there an official nationwide listing of fee-for-service Medicare advisers.

Plus, Maibor says the precise variety of fee-for-service mannequin Medicare advisers is an “extremely small number. “Finding one I think is somewhat tricky,” mentioned Maibor. “Google will mostly get you a list of brokers and it will be time consuming to distinguish between the two. The brokers typically highlight that their expertise is free to the beneficiary because the carrier is paying them.”

4. Independent brokers/dealer

Independent licensed Medicare insurance coverage brokers/brokers can characterize a number of insurance coverage carriers. Given that, unbiased brokers are sometimes in a position to supply shoppers a spread of Medicare plan choices. These brokers work on commissions paid by the insurers and can’t cost a payment. According to the Commonwealth Fund, the Centers for Medicare & Medicaid Services units most allowable commissions for Medicare Advantage and Part D plans that brokers can earn. However, precise compensation varies by insurer inside these limits.

Pros of working with unbiased brokers

No price: According to Maibor, there’s no price to the Medicare beneficiary when shopping for Medicare protection by an unbiased agent. Typically, the agent is paid by the medical health insurance firm nearly $600 to promote a Medicare Advantage plan and barely greater than $250 to promote a Medigap plan. Of be aware, the Centers for Medicare & Medicaid Services (CMS) units the utmost dealer commissions that may be paid for promoting Medicare Advantage plans annually. For 2023, as an example, the utmost preliminary fee an agent can obtain is $577 per Medicare Advantage plan offered. The most renewal fee is $288 per plan. There aren’t any federally regulated most commissions for Medigap plans, in response to the CMS. Insurers set their very own fee charges. Typical first 12 months commissions are round 20% of the plan’s annual premium. Renewal commissions are round 10%.

Wright mentioned brokers shouldn’t be reluctant to reveal their commissions.

Read: Agent Broker Compensation and Agent Commissions in Medicare and the Impact on Beneficiary Choice.

Wide choice: Independent brokers sometimes characterize a large variety of insurers/insurance policies in any given space, sometimes a minimum of a number of to dozens, Maibor mentioned.

Trust: A trusted insurance coverage skilled with Medicare experience is a precious native useful resource who will help you consider your choices. “The key is to make sure they are a “trusted insurance professional with Medicare expertise, said Wright. “That should ensure their recommendations are in your best interest and not theirs.”

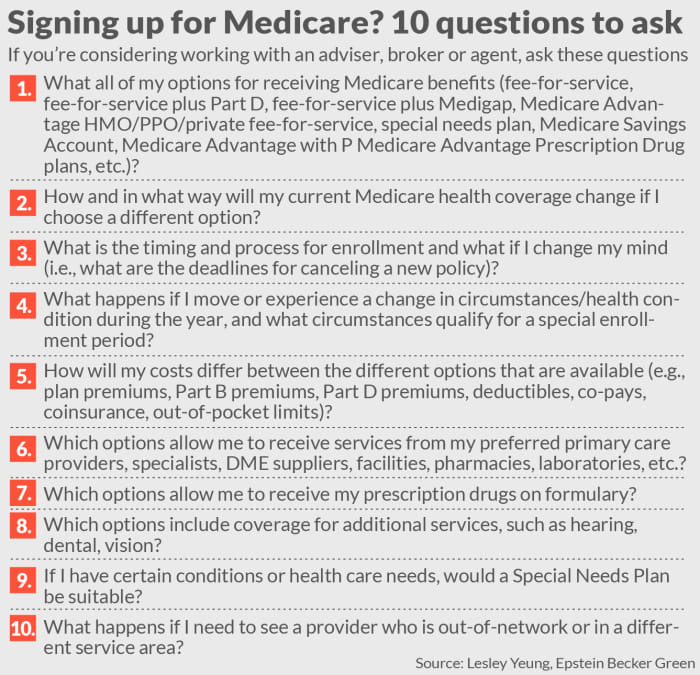

This is a tall order since brokers aren’t required, as, say, registered funding advisers are, to behave within the consumer’s finest curiosity, as fiduciaries. The finest solution to uncover whether or not you’re working with somebody who’s reliable is to ask them a sequence of questions aimed toward uncovering whether or not they’re appearing in your finest curiosity. (See graphic.)

Cons of working with unbiased brokers

Conflicts of curiosity: An unbiased agent doesn’t supply each plan in a given space “so (the agent) may choose a less appropriate plan to earn a commission,” mentioned Maibor. That can usually be the case provided that brokers earn extra money when promoting a Medicare Advantage plan versus a Medigap coverage.

It’s the provider that’s paying the fee, not the Medicare beneficiary. Independent brokers recommend the fee is finally modest. “Although commissioned, in reality the amount ‘per sale’ is very modest — unlike many life and annuity products,” Wright mentioned. “Agents are rewarded by building up a stable long-term ‘block of business,’ not by making a few huge commission sales.”

What’s extra, he famous that the market is carefully regulated by Centers for Medicaid & Medicare “with very serious penalties for market conduct violations.”

Expertise: Independent brokers, provided that they could characterize so many carriers, could not have complete experience on each particular person plan “because they represent so many,” mentioned Maibor.

5. Captive brokers

Captive brokers work for a single insurer and obtain a wage from the corporate in addition to a fee with a decrease fee than an unbiased agent’s fee. They have in-depth data of the merchandise provided by the corporate they characterize however are restricted to plans from that specific insurer when helping Medicare beneficiaries.

Pros of utilizing a captive agent

Well versed/no price: Captive brokers and firm representatives, not surprisingly, are properly versed in a given provider’s choices. Plus, there’s no price to the beneficiary when shopping for a plan from a captive or the corporate consultant.

Cons of utilizing a captive agent or firm consultant

Just one plan: A captive agent will solely be capable to supply plans from the provider they work for whether or not that’s the most suitable choice for the beneficiary.

Sales quota: Though regulated by the Centers for Medicare & Medicare, “there is genuine ‘pressure’ to make sales quotas for their company, which nullifies any genuine objectivity about which plan is best for the consumer,” mentioned Wright.

6. Calling insurers instantly

Beneficiaries may name any variety of insurers — UnitedHealthcare, Humana, Blue Cross Blue Shield, Aetna, Cigna, and Anthem to call however a number of — and converse with a customer support rep.

Pros of calling insurers instantly

No price: A Medicare beneficiary pays no price to buy a plan instantly from an insurer, mentioned Maibor. Plus, there’s no agent to take care of.

Cons of calling insurers instantly

Just one plan: The large draw back to calling insurers instantly is that they solely supply their plan, which can or is probably not the most suitable choice for the beneficiary.

Calling insurers instantly is usually a helpful train when attempting to type by particulars of accessible protection choices for that particular well being plan. “However, it does not offer a way to directly compare the pros and cons of competing plans,” mentioned Wright. “The consumer would still have to make that evaluation for themselves after consulting multiple health plans directly.”

Other choices

Pharmacies could also be providing no-fee consultations relating to Medicare Part D plans.

The benefits are that it’s handy. “It saves time because they already have your medication list,” she famous. The large drawback, Votava mentioned, “is that it’s possible that they are incentivized to suggest plans that they have preferred status with.”

Check whether or not you’re getting the most effective worth at a specific pharmacy. And if in case you have a Medicare Advantage plan, you have to to confirm your healthcare suppliers’ plan participation individually, Votava mentioned.

Bottom line

“I tell clients that this is an important decision and not an area where the cheapest source of advice is the best source,” mentioned Maibor.

If they’re already on Medicare, the beneficiary ought to ask the dealer/adviser why they’re suggesting that they modify. “There may be absolutely valid reasons to make a switch but in many cases it is so the commission gets moved from where it is now to that broker,” mentioned Maibor. “And that’s not a valid reason.”

One different be aware: Understanding the twin possibility alternative of conventional Medicare vs Medicare Advantage is the important thing to understanding Medicare and its protection selections, mentioned Wright. “Unfortunately, 90% of advertising comes from Medicare Advantage plans because the Centers for Medicare & Medicaid Services do not ‘advertise’ traditional Medicare although agents sometimes will because they can sell the Medigap policies,” he mentioned. “This results in a very lopsided public perception in favor of Medicare Advantage plans and contributes greatly to the confusion.”

Source web site: www.marketwatch.com