Eligible taxpayers in 13 states could have the chance to check out the Internal Revenue Service’s foray into free tax preparation within the upcoming tax season, the company introduced Tuesday.

Taxpayers who wish to check out the pilot program might want to have comparatively easy tax returns. They’ll additionally want an invite from the tax company so as to take part, the IRS stated.

In May, the IRS introduced it will check a program that can let folks file their taxes without cost immediately with the company, as a substitute of utilizing paid choices like tax software program or an accountant.

The objective of the pilot program is to see if the federal tax collector can feasibly get entangled in tax-return preparation. The prospect of the IRS providing free tax prep has been panned by Republican members of Congress and by tax-prep firms that stand to lose clients, together with H&R Block

HRB,

and Intuit

INTU,

the corporate that owns TurboTax.

This previous tax season, people and companies spent a median of $250 and 13 hours getting ready their taxes, in line with IRS estimates.

Now the IRS is sharing some particulars about how the carefully watched pilot program goes to work.

The program can be open to sure taxpayers in 9 states that don’t have any state-level earnings tax: Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Wyoming and Washington. It may even be out there to sure taxpayers in 4 states with their very own earnings taxes: Arizona, California, Massachusetts and New York.

At this level, the IRS tax-prep platform is barely geared up to deal with quite simple returns for taxpayers with earnings from W-2 wages, Social Security or jobless advantages and curiosity earnings below $1,500.

It may deal with claims for credit just like the Earned Income Tax Credit and the Child Tax Credit, in addition to deductions such because the extensively used customary deduction, the student-loan-interest deduction and the educator-expense deduction.

“We still have much more work in front of us,” IRS Commissioner Danny Werfel advised reporters Tuesday at a briefing about this system.

The IRS nonetheless wants to find out what number of tax returns this system can deal with and the way the company will invite taxpayers to make use of it, he stated. The company plans to slowly roll out the pilot to find out what works and what doesn’t, he added.

The IRS anticipates that not less than a number of hundred thousand taxpayers will select to take part within the free program, which the Treasury Department directed the IRS to create.

The web-based program can be out there in English and Spanish on computer systems and smartphones and could have customer-service representatives skilled to troubleshoot person issues.

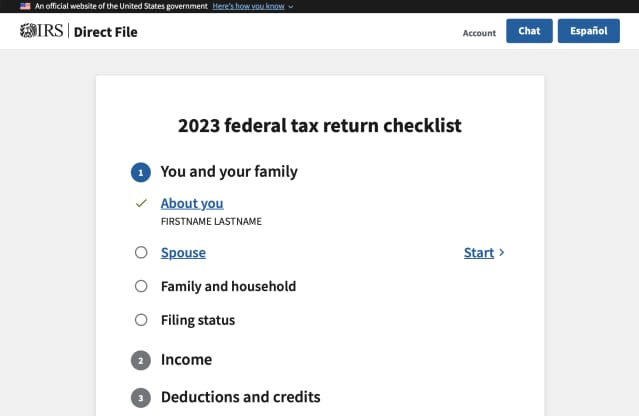

A sneak peek on the IRS’s pilot program for submitting federal income-tax returns.

Courtesy Treasury Department/IRS

“I can’t stress enough, if direct file is pursued further after the pilot, it would be just another choice taxpayers have to help them prepare their income-tax returns,” Werfel stated. “It would be an addition to existing options, such as the use of a tax professional, commercial tax software, Free File or another option.”

The Free File program is an current IRS partnership with sure tax-software firms that lets folks below a sure earnings threshold file their taxes without cost, however few eligible taxpayers use this system.

While some shopper advocates staunchly help the thought of a free IRS-run tax-prep possibility, skeptics keep that it wouldn’t assist taxpayers.

TurboTax maker Intuit has been an outspoken critic of this system and has questioned whether or not the IRS can each pretty accumulate taxes and supply taxpayers with a refund that’s as large as potential. H&R Block and Intuit didn’t instantly reply to a request for remark.

When the IRS introduced the plans in May to press forward with a check program, Intuit stated the estimates on the price of this system had been “laughable.”

When Congress handed the Inflation Reduction Act final summer season, it put aside $15 million to review whether or not a direct-file program was possible. More than $11 million of the $15 million has been earmarked to be used by means of early July, in line with a report this month from the Treasury Inspector General for Tax Administration.

The watchdog report stated the IRS could have overstated the quantity of shopper curiosity in having the company put together income-tax returns.

After the Treasury watchdog’s report got here out, U.S. Rep. Jason Smith, a Republican from Missouri who chairs the House Ways and Means Committee, stated it underscored the “trust gap” between the IRS and the general public.

“The Biden administration’s so-called ‘study’ into establishing a direct e-file system was a foregone conclusion designed to further their goal of inserting the IRS into every aspect of Americans’ lives,” he stated.

Source web site: www.marketwatch.com