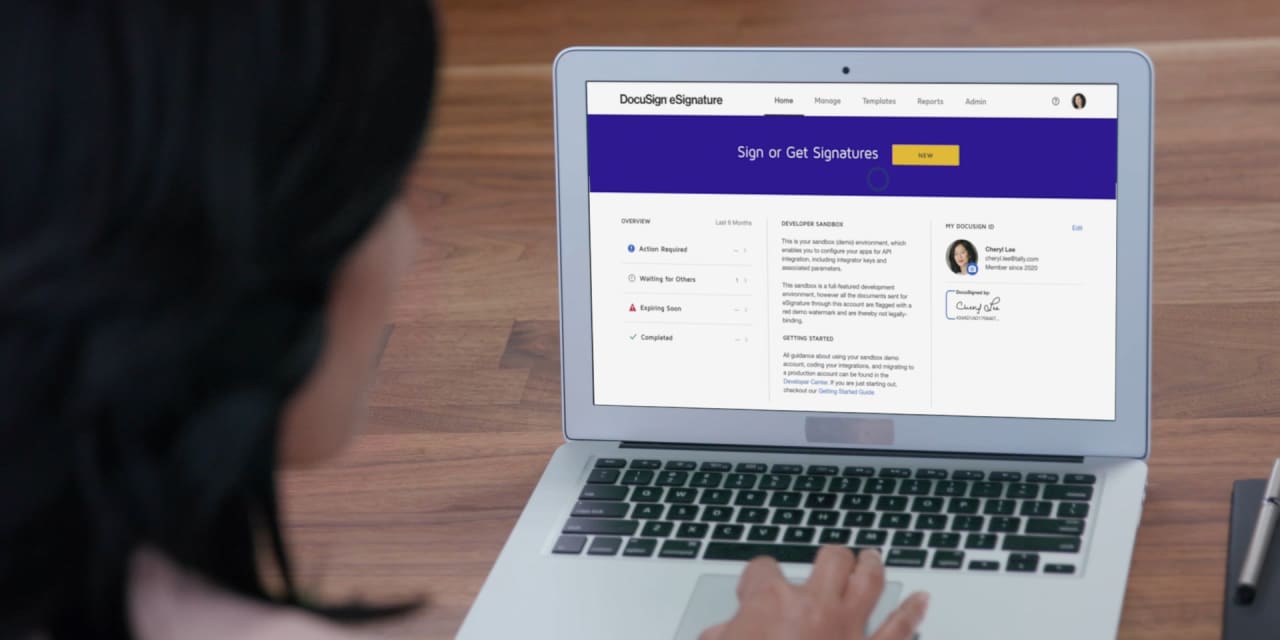

One-time pandemic darling DocuSign Inc. could also be seeking to signal a deal of its personal.

The e-signature firm is working with advisers because it considers a sale, the Wall Street Journal reported Friday afternoon. A deal for DocuSign

DOCU,

valued at upwards of $11 billion, may lead to one of many largest current leveraged buyouts, the report stated, noting that private-equity corporations and expertise firms had been among the many potential suitors.

DocuSign shares had been up greater than 11% in afternoon buying and selling Friday following the report.

A DocuSign spokesperson stated the corporate doesn’t touch upon rumors or hypothesis.

The firm was a pandemic-era poster little one as companies regarded for methods to get signatures on contracts, mortgages and different paperwork in a digital world. But DocuSign has struggled to match its earlier progress charges as workplaces have resumed in-person exercise, and administration acknowledged a troublesome macroeconomic surroundings when DocuSign final posted earnings.

DocuSign shares traded above $310 at their highest level in September 2021, however they closed Thursday close to $56. The inventory was altering palms simply south of $64 Friday amid the intraday rally.

Source web site: www.marketwatch.com