The residential real-estate asset class solely partially acquitted itself over the past two years.

I’m referring to what inventory market traders are on the lookout for when contemplating whether or not to diversify their portfolio into one other asset class: They are hoping that the brand new asset class can produce an honest long-term return whereas concurrently having a low correlation with the inventory market. To the extent it lives as much as these objectives, the online impact of including it to a inventory portfolio shall be to scale back threat by greater than return is forfeited—leading to a superior risk-adjusted return.

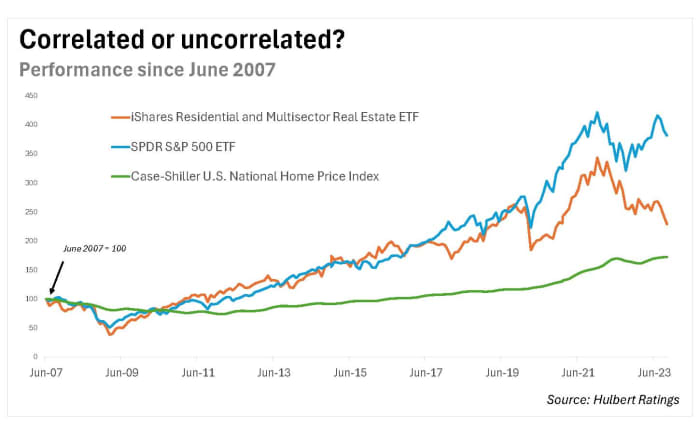

Historically residential actual property has greater than lived as much as these objectives, truly creating wealth in all however one of many inventory bear markets because the Fifties. Unfortunately, this was not the case through the 2022 bear market. And within the bull market because the October 2022 low, the asset class has continued to underperform.

I base these efficiency numbers on the ETF that seems to come back closest to providing particular person traders a handy funding automobile for gaining publicity to the residential real-estate market: The iShares Residential and Multisector Real Estate ETF

REZ.

Though the ETF isn’t a pure play on the residential real-estate asset class, I do know of no funding automobile that comes nearer that can be readily attainable to the person investor.

During the 2022 bear market, REZ produced a complete return lack of 29.2%, versus 24.5% for the S&P 500

SPX.

And since then, it has gained simply 8.3% versus 39.7% for the S&P 500.

Despite these disappointing returns, it’s nonetheless theoretically potential for the REZ to enhance a inventory portfolio’s risk-adjusted returns—if its returns have been sufficiently uncorrelated with these of the inventory market. But, as you’ll be able to see from the accompanying chart, it seems to be extremely correlated with the S&P 500. And on this case appearances usually are not deceiving: Since the REZ’s inception in 2007, the correlation coefficient between its month-to-month returns and people of the S&P 500 has been a fairly excessive 0.68.

Given this, you gained’t be shocked that allocating a small portion of an fairness portfolio to REZ doesn’t enhance risk-adjusted efficiency.

There’s nonetheless hope

Not all hope is misplaced, nonetheless. That’s as a result of the REZ is an imperfect illustration of the residential real-estate market. Its largest present holding, with a 12.5% weighting, is Welltower

WELL,

a healthcare infrastructure firm. Its second largest holding is Public Storage REIT

PSA,

which operates self-storage services. Pointing this out isn’t a criticism of REZ, because it doesn’t conceal its twin deal with each residential in addition to “multisector” actual property.

A fund could be far much less correlated with the inventory market if have been a pure illustration of the residential property market. We know that due to the Case-Shiller U.S. National Home Price Index. Over the identical interval wherein the REZ has a 0.68 correlation coefficient with the S&P 500, the Case-Shiller index’s coefficient is simply 0.15. (This index can be plotted within the accompanying chart.) You might enhance your risk-adjusted efficiency by allocating a portion of your fairness portfolio to the Case-Shiller index.

It’s unlucky that such a fund doesn’t exist. Until and until one is created, the asset class represents a tantalizing however unattainable diversifier for fairness portfolios.

This doesn’t imply you shouldn’t put money into residential actual property. But it does imply that your efficiency could, and possibly will, differ dramatically from that of the asset class itself, because of the myriad idiosyncratic elements that influence the value of a selected piece of actual property.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He could be reached at mark@hulbertratings.com.

Source web site: www.marketwatch.com