HSBC grew to become the most recent home to challenge a bearish view of Dollar General, naming it least favourite amongst a gaggle of seven U.S. retailers it initiated protection of in a brand new report on Friday.

Analysts named Walmart Inc.

WMT,

their favourite and assigned it a purchase score, however slapped Dollar General

DG,

with a scale back score, equal to promote. It assigned Costco Corp., Home Depot, Kroger’s Inc., Lowe’s Inc. and Target Co. a maintain score.

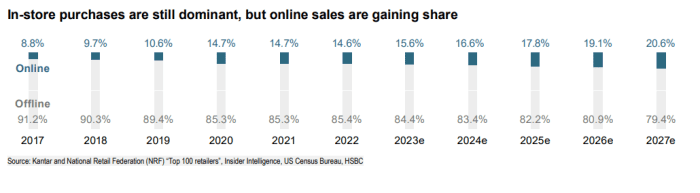

The pandemic drastically accelerated digital gross sales, which now account for about 15% of complete retail gross sales within the U.S., up from about 10% earlier than the pandemic broke out in 2020.

HSBC is anticipating that development to proceed with on-line purchases changing into the primary driver of retail gross sales and rising at a sooner tempo than bricks-and-mortar gross sales. At the identical time, offline gross sales will stay essentially the most related channel for many gamers, accounting for about 80% of gross sales by 2027.

“In our view, retailers with the best offline-to-online, or O2O, strategies will be the leaders in this environment,” mentioned analysts Daniela Bretthauer and Guilherme Domingues.

HSBC report

The analysts reviewed the seven firms towards the background of the postpandemic world, wherein shoppers look like valuing experiences over discretionary items purchases. That’s based mostly on the quantity of journey — and particularly worldwide journey — that was recorded this summer season, the primary wherein folks had been comfy flying lengthy distances once more.

“With mobility essentially back to normal post COVID-19 disruptions, spending on travel and experiences is gaining momentum at the expense of discretionary spending on physical goods, accounting for a higher share of total consumer expenditures, as reported in the U.S. Census Bureau for economic data,” the report mentioned.

Some discretionary items, similar to furnishings, constructing supplies and electronics, loved “pulled-forward” demand in 2020, and are actually experiencing volatility. The BEA has discovered the private financial savings charge is beneath prepandemic ranges, suggesting homeowners are counting on extra financial savings to assist consumption.

As excessive inflation squeezes family budgets, shoppers are spending extra rigorously, however in fact, groceries stay a precedence.

That makes Walmart a prime choose for the analysts, who praised its “superior O20 strategy, sheer size, and attractive growth story with operating profits growing at a faster pace than sales.”

“Size matters in retail,” they wrote. Walmart snaps up one in each 4 U.S. {dollars} spent on U.S. groceries, which is sort of as a lot as Kroger, Costco and Albertsons mixed.

Dollar General, in distinction, is behind on digitization and is hurting from a dearth of short-term drivers. The firm has a robust worth proposition as the largest low cost retailer by retailer rely within the U.S., however its publicity to weaker shopper spending on discretionary items name for a bearish view, mentioned the report.

Read additionally: Lower-income households ‘are acting recessionary today.’ JPMorgan provides Dollar General its worst score after firm presentation

Costco’s

COST,

e-commerce technique enhances its warehouse enterprise effectively and its pricing is aggressive.

“Shares appear fairly valued trading at a 2024e PE of 36x (10% premium to the historical average), and we see few near-term catalysts,” mentioned the report.

Home Depot

HD,

is a pacesetter within the fragmented however giant home-improvement market, which is estimated to be price about $1 trillion. It has a strong 020 technique and delivered $50 billion in income and $6 billion in earnings within the final three years.

See additionally: Dollar-store shares slide and UBS says Chinese low cost web sites could also be their subsequent problem

“While we acknowledge Home Depot’s distinct competitive advantages and operational excellence, we think shares present a balanced risk/reward return,” the analysts wrote.

Kroger

KR,

in the meantime, can be the third-largest U.S. meals retailer if its merger with Albertson’s

ACI,

goes by means of, however the timing and phrases of any deal stay unclear.

“Given that shares are trading in line with the historical sector average and

merger uncertainties, we believe the stock is fairly priced,” mentioned the report.

Lowe’s is the second-largest home-improvement retailer within the U.S. after Home Depot and it has returned $34 billion to shareholders within the final 4 years for a median return on invested capital of 37%. However, “shares appear fairly valued given that our target PE multiple is 6% below the average multiple the stock traded at during the pandemic years.”

Finally, Target

TGT,

is without doubt one of the most iconic retailers within the U.S. with an estimated 3% market share in 2022, the report mentioned, citing Euromonitor information.

Read additionally: Retailers compete to be first to carry vacation gross sales in a bid to spur flagging demand

But the analysts questioned whether or not its store-as-the-hub mannequin is one of the best and most worthwhile method to develop its 020 enterprise.

“Higher exposure to discretionary (c60% of sales) categories and execution risks keep us on the sidelines on Target shares,” they wrote.

The Consumer Staples Select Sector SPDR exchange-traded fund

XLP

has fallen 4.6% within the 12 months to this point, whereas the SPDR S&P Retail ETF

XRT

has gained 0.5%. The S&P 500

SPX

has gained 16%.

Source web site: www.marketwatch.com