Credit final yr’s hero Nvidia

NVDA,

for giving Wall Street its finest day up to now in a shaky begin to 2024. But gloom from Samsung is dampening the temper, with stock-market futures pointing to pullback.

In the bear camp, JPMorgan’s chief international strategist Marko Kolanovic, says shares stay overbought and traders complacent regardless of the partial early-year reversal. While danger belongings have began to “fully embrace” the concept central banks will ease as inflation falls, resilient progress and continued file profitability might find yourself as contradictory for traders.

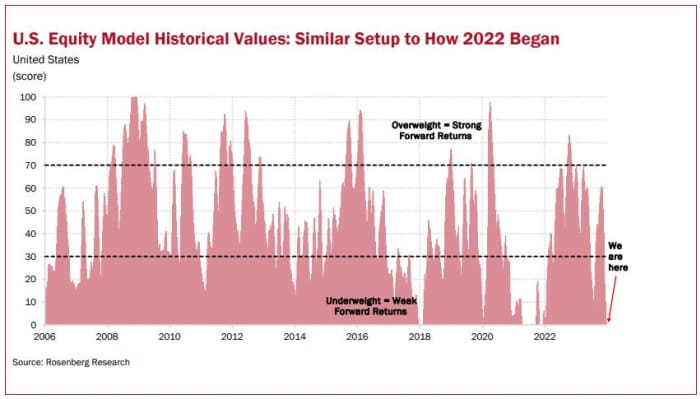

Also on that bearish facet is our name of the day from David Rosenberg, a veteran strategist who says his agency is now “maximum” bearish on U.S. shares, citing some troubling current historical past.

“The setup for 2024 is looking eerily similar to how we entered 2022, with positioning, sentiment, and technicals all at extreme readings – matching what we saw in December 2021 (and with worse fundamentals to

boot),” mentioned the president of Toronto-based Rosenberg Research and his group that features Marius Jongstra and Bhawana Chhabra, in a observe.

The S&P 500

SPX

completed 2022 with a 19% loss, its greatest since 2008.

Here’s Rosenberg’s chart:

Rosenberg’s bearish views final yr included an early 2023 name for shares to lose 30% and a persistent recession forecast. But he additionally predicted in September that the Nasdaq would see a peak in December-January, which may very well be heading in the right direction judging by the motion this yr up to now.

So the place to cover for now? The strategist sees financials — as a result of kick off earnings this week — because the clear prime decide for traders and among the many least expensive so far as valuations go. “Historical analysis shows this group to be a strong performer during both the Fed pause and disinflation periods,” he mentioned.

“While recession risks do loom over the sector, investors can look toward the larger banks (well-capitalized) and insurance companies (stable earnings growth; better valuations) beneath the surface,” mentioned Rosenberg.

And exterior of financials, the strategist says vitality, communication companies and utilities all are tied for second place.

He additionally weighs in on bonds, saying with markets pricing in about six Fed fee cuts, a piece of the pivot name is already “in the price.” Other headwinds embrace the ten% acquire seen for the 10-year Treasury since October. While not a promote advice, he says it could be time to “digest market moves.”

“With front-end T-bills still paying [approximately] 5.25%, investors can consider locking in these yields following the run-up we have experienced to date on the long end.”

Read: Former bond king Bill Gross says 10-year Treasury ‘overvalued’

Rosenberg additionally mentioned they turned constructive on commodities in December, with their mannequin rating reaching its highest since July 2022. However, vitality isn’t within the combine aside from pure fuel, as they like meals/agricultural, with wheat, cotton, corn and soybeans on the prime.

The strategist mentioned they rightly timed a bullish activate gold final fall, however are fading that, citing investor crowding and overbought technicals.

The markets

Stock futures

ES00,

COMP

are pushing decrease, as Treasury yields

BX:TMUBMUSD10Y

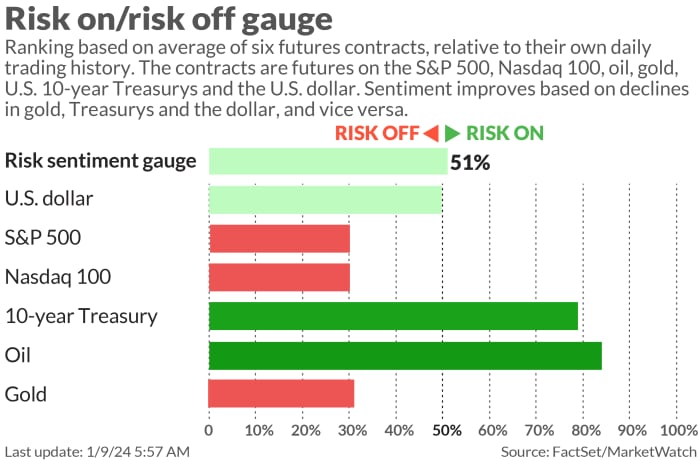

inch up . Elsewhere, oil

CL.1,

is up 2% and gold

GC00,

can be larger. The Nikkei 225 index

JP:NIK

hit a brand new 33-year excessive, in a combined day for Asia.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,763.54 | -0.13% | 3.05% | -0.13% | 22.39% |

| Nasdaq Composite | 14,843.77 | -1.12% | 2.85% | -1.12% | 39.57% |

| 10 yr Treasury | 4.045 | 10.86 | -15.89 | 16.37 | 42.39 |

| Gold | 2,037.90 | -1.64% | 2.02% | -1.64% | 8.61% |

| Oil | 71.23 | -0.14% | -0.24% | -0.14% | -4.86% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The buzz

Juniper Networks inventory

JNPR,

is up 22% after The Wall Street Journal reported late Monday that Hewlett Packard Enterprise

HPE,

is in superior talks to purchase the tech group for $13 billion.

Match Group

MTCH,

is rallying on a report activist investor Elliott Management desires adjustments.

Samsung Electronics

005930,

forecast plunging fourth-quarter revenue.

Urban Outfitters inventory

URBN,

is up 5% after the retailer reported a ten% rise in annual gross sales over the vacations.

Deutsche Bank upgraded JPMorgan Chase

JPM,

to purchase from maintain and reduce Wells Fargo

WFC,

to carry from purchase, forward of earnings from banks and others on Friday.

United Airlines

UAL,

discovered free bolts and “installation issues” upon inspecting some Boeing

BA,

737 Max 9 planes following final week’s midflight blowout. Boeing shares are off barely in premarket, after dropping 8% on Monday.

The commerce deficit is due at 8:30 a.m. and Fed Vice Chair for Supervision, Michael Barr will communicate at 12 midday. Fed governor Michelle Bowman mentioned she now thinks inflation might ease with out extra fee hikes.

Best of the online

National Association of Realtors president resigns after receiving ‘threat’ to reveal ‘personal’ matter

South Korea outlaws its canine meat trade in landmark laws

Lithuania’s first unicorn: The Vinted phenomenon

Top tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

BA, |

Boeing |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

AMZN, |

Amazon.com |

|

AMD, |

Advanced Micro Devices |

Random reads

Indonesia sends uncommon singing small apes again to the wild

Finally, the actual purpose urine is yellow.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com