Hello! This is MarketWatch reporter Isabel Wang bringing you this week’s ETF Wrap. After a decade of seemingly endless fee-cutting wars, ETF issuers raised their charges in 2023 because the panorama developed past low cost index-tracking funds.

In this week’s version, we take a look at quite a lot of causes behind the industry-wide price hikes, and what it means for ETF buyers who proceed to favor cheaper choices.

Please ship suggestions or suggestions to isabel.wang@marketwatch.com or to christine.idzelis@marketwatch.com. You can even observe me on X at @Isabelxwang and discover Christine at @CIdzelis.

Sign up right here for our weekly ETF Wrap.

ETF issuers and fund managers are inflicting complications for buyers huge and small: They are charging larger charges for his or her merchandise — and should proceed to take action over the following few years, in accordance with ETF strategists.

Among greater than 2,000 ETFs that MorningStar tracked final 12 months, there have been 463 funds, or round 20%, that noticed price hikes in 2023. By distinction, solely 234 ETFs, or round 11%, noticed their charges lower over the identical interval, in accordance with Zachary Evens, supervisor analysis analyst at MorningStar Research Services.

It was the primary time since 2009 that extra ETFs raised their charges than minimize them, reversing a decade-long development that noticed ETF charges drop throughout asset courses as issuers competed for market share in an more and more saturated sector, Evens instructed MarketWatch.

A latest FactSet evaluation confirmed that by the top of 2015, U.S.-listed ETFs price a mean of 0.27% annually on an asset-weighted foundation. That quantity dropped to 0.17% in 2022 and fell once more in 2023 — however by simply 0.002%, or about one-fifth of the historic fee, mentioned Elisabeth Kashner, director of ETF analysis and analytics at FactSet.

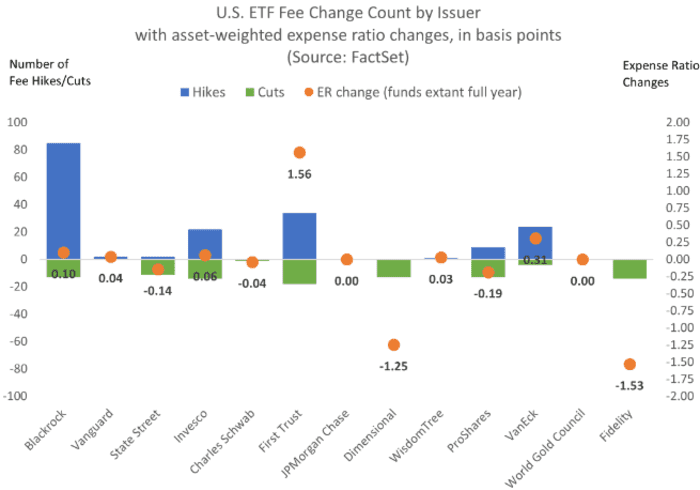

Among a number of the largest ETF issuers with $50 billion beneath administration on the finish of 2023, First Trust imposed the most important common price hikes of 0.016% final 12 months, whereas Fidelity and Dimensional made the most important cuts of 0.015% and 0.012%, respectively, in accordance with FactSet information (see chart beneath).

FactSet

The broad shift in favor of an energetic, as a substitute of passive, funding strategy has profoundly influenced ETF suppliers to go on the rising bills of managing funds to their purchasers, in accordance with ETF strategists.

See: Passive versus energetic investing: which one is best?

“A lot of what’s coming to market [over the past year] are mutual-fund conversions, actively-managed ETFs or factor-based and options-based ETFs that have an active component to them,” mentioned Paul Baiocchi, chief ETF strategist at SS&C ALPS Advisors.

In an interview with MarketWatch, Baiocchi mentioned energetic methods often add worth to an ETF both by an skilled or “star” fund supervisor or by a “methodology” designed to generate above-market efficiency for the portfolio, justifying the upper charges charged by issuers.

Meanwhile, the uptick in mutual-fund-to-ETF conversions over the previous few years can also be driving up ETF charges, as most mutual funds have a “fairly expensive distribution model” relative to ETFs, which forces fund managers to begin on the lookout for methods to compensate for his or her prices after the conversions, Baiocchi mentioned.

Investors have observed the rising charges

In 2023, the ETF flows hole, which measures the distinction between anticipated and precise flows, confirmed that buyers held again on sending capital to funds that raised their charges, whereas they accelerated investments in funds that minimize investor prices, in accordance with FactSet’s Kashner.

But whereas buyers do favor cheaper merchandise, the prices of switching funds may play an element, since a rise in charges typically nonetheless may not be value retail buyers promoting an ETF after which switching to a lower-cost possibility, mentioned Evens of MorningStar.

Meanwhile, when an ETF supplier “has a niche in a certain area of the market” with out a variety of competitors, that agency additionally has pricing energy and suppleness with the charges as buyers “can’t go anywhere else for it,” Evens famous.

Evens sees the development of surging ETF charges persevering with over the following couple of years. He says that forecast is pushed by “the [increased] adoption of actively-managed and alternative ETFs, which charge higher fees than more traditional passive products,” he mentioned.

As a outcome, the typical charges paid by buyers throughout all ETFs could tick up, he added.

As typical, right here’s your take a look at the top- and bottom-performing ETFs over the previous week by Wednesday, in accordance with FactSet information.

The good…

| Top Performers | %Performance |

|

VanEck Semiconductor ETF SMH |

4.8 |

|

Nuveen Growth Opportunities ETF NUGO |

4.7 |

|

T. Rowe Price Blue Chip Growth ETF TCHP |

4.3 |

|

iShares MSCI USA Momentum Factor ETF MTUM |

4.1 |

|

iShares Expanded Tech-Software Sector ETF IGM |

4.0 |

| Source: FactSet information by Wednesday, Feb. 7. Start date Feb. 1. Excludes ETNs and leveraged merchandise. Includes NYSE-, Nasdaq- and Cboe-traded ETFs of $500 million or larger | |

…and the dangerous

| Bottom Performers | %Performance |

|

iShares Mortgage Real Estate ETF REM |

-5.9 |

|

Amplify Junior Silver Miners ETF SILJ |

-5.7 |

|

PIMCO 25+ Year Zero Coupon US Treasury Index ETF ZROZ |

-5.6 |

|

VanEck Junior Gold Miners ETF GDXJ |

-5.4 |

|

VanEck Gold Miners ETF GDX |

-5.4 |

| Source: FactSet information | |

New ETFs

-

American Beacon Advisors Tuesday launched the American Beacon GLG Natural Resources ETF

MGNR,

which affords publicity to a portfolio of roughly 30 to 60 securities inside the natural-resources worth chain, together with power, supplies, agriculture and chemical substances, amongst others. -

Direxion on Wednesday rolled out the Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares

XXCH

to guess on positive factors within the MSCI Emerging Markets ex-China Index, which captures large-cap and midcap shares throughout 23 of the 24 rising markets, other than China.

Weekly ETF Reads

Source web site: www.marketwatch.com