Welcome again to Distributed Ledger. This is Frances Yue, crypto and markets reporter at MarketWatch.

Ether

ETHUSD,

has outperformed bitcoin to this point this yr. However, the second-largest cryptocurrency is additional off its all-time excessive than is bitcoin

BTCUSD,

Ether is greater than 40% decrease than its file excessive of $4,686, whereas bitcoin is roughly 26% decrease than its all-time excessive of $68,990, based on CoinDesk knowledge. Both cryptocurrencies’ costs peaked in November 2021.

Still, ether is prone to attain a brand new file excessive this yr, based on Jeff Owens, co-founder of layer1 blockchain Haven1.

Find me on X at @FrancesYue_ to share any ideas on crypto or the e-newsletter.

Ether to rally?

On March 13, the Ethereum community is ready to see a significant improve, referred to as Dencun, which may convey the largest modifications to the blockchain since final April, when the Shanghai improve was carried out.

The Dencun improve will make it cheaper to conduct transactions on networks constructed on high of Ethereum, by providing designated area to retailer knowledge.

That, coupled with optimism across the potential approval of exchange-traded funds investing immediately in ether, will present tailwinds for the cryptocurrency to probably surpass its file excessive this yr, Owens wrote in emailed feedback.

A variety of asset managers, equivalent to BlackRock

BLK,

Franklin Templeton, VanEck, Grayscale Investments, Ark Invest and 21Shares, have filed purposes for spot ether ETFs, that are pending approval from the U.S. Securities and Exchange Commission.

James Seyffart, ETF analysis analyst at Bloomberg Intelligence, stated he sees May 23 as crucial date to look at for the destiny of spot ether ETFs within the medium time period. That is the ultimate deadline for the SEC to resolve whether or not or to not approve VanEck’s ether ETF software.

Martin Leinweber, digital asset product strategist at MarketVector Indexes, stated he thinks it’s extra possible that the SEC will approve ether ETFs within the second half of this yr than in May.

The path for ether ETFs “is a little bit more unclear than that for bitcoin ETFs,” Leinweber stated in a cellphone interview.

SEC Chair Gary Gensler has repeatedly stated that bitcoin is the one cryptocurrency he’s prepared to publicly label as a commodity.

Ether’s value additionally faces headwinds as Ethereum faces competitors from different related blockchains, equivalent to Solana, with some supporters of the latter arguing that the community is far quicker and cheaper, Leinweber stated.

Smaller crypto to catch up?

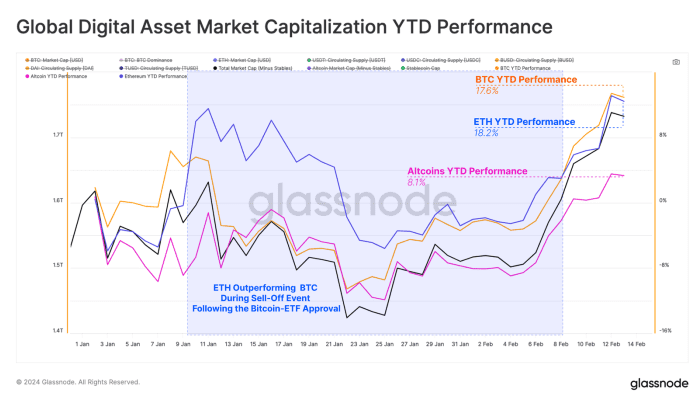

The costs of smaller cash have been lagging behind the biggest two cryptocurrencies by market cap to this point this yr, based on blockchain-data supplier Glassnode.

Glassnode

That is to be anticipated for crypto bull markets, throughout which bitcoin often leads the rally at first, whereas smaller cash outperform later, based on Leinweber.

“It will take a little more time until we get the shift [of the rally] from bitcoin to ether and then to the altcoins,” Leinweber stated.

Crypto in a snap

Bitcoin gained 1.6% over the previous seven days, and ether gained 8.8% throughout the identical interval, based on CoinDesk knowledge.

Must-reads

- Winklevoss twins donate $4.9M to crypto tremendous PAC Fairshake (Cointelegraph)

- Crypto Tycoon Do Kwon Should Be Extradited to U.S., Montenegro Court Rules (The Wall Street Journal)

Source web site: www.marketwatch.com