One of the mysteries for the primary two months of the yr was the truth that the U.S. economic system was seemingly absorbing a wave of Federal Reserve interest-rate hike with no hiccup.

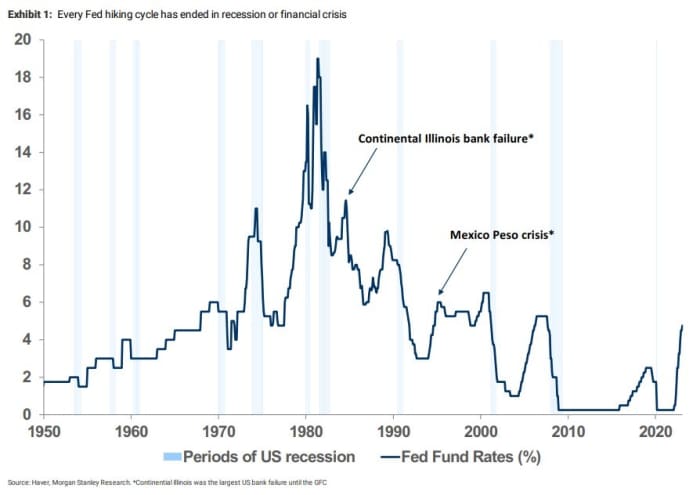

After the occasions of the final two weeks, that notion might be put to mattress. “Every rate hiking cycle of the last 70 years has ended in recession (c. 80% of the time) and/or a financial crisis (in 1984 and 1994),” says Graham Secker, chief European fairness strategist for Morgan Stanley in London.

“A week ago it was possible to argue that this observation was theoretical, now we know that it is not going to be different this time,” he added.

His feedback got here after three U.S. banks have collapsed, as federal authorities organized main banks to deposit $30 billion into First Republic Bank

FRC,

to stave off a fourth. Credit Suisse shares

CSGN,

in the meantime have slumped 22% this week on worries for its survival.

Secker did observe that monetary crises don’t at all times result in financial recessions, as evidenced in 1984, 1987, 1994 and 1998. “However, at this stage we think markets will run with the ‘guilty until proven innocent’approach given: 1) the prospect of a material tightening in credit availability and lending standards from banks after recent events;2) the deeply inverted yield curve going into recent events,” he stated.

European shares’ robust efficiency of the yr, earlier than final week, was pushed by financials and cyclicals. But now, he says, “we are confident that the economic outlook has deteriorated and that the window for ongoing good/improving macro data is beginning to close.” The agency upgraded the telecom sector to obese, because it additionally beneficial “re-engaging with quality and other long-duration ideas.”

Banks

SX7E,

shall be unstable, however the agency beneficial promoting into rallies whereas protecting an obese on the sector. “It is impossible to determine how much of European Banks underperformance is down to concerns around changes to the net interest margin outlook versus contagion risks versus lower bond yields and rate expectations,” stated Secker. “We think the latter factor has had a significant contribution and hence any rebound here could lead to some upward volatility in banks.”

A preferred European exchange-traded fund, the Vanguard FTSE Europe ETF

VGK,

has gained 5% this yr, barely outperforming the three% rise for the S&P 500

SPX,

Secker nonetheless says financial institution worries undermine the case for European shares over U.S. ones.

“While we still see merit in European equities versus global peers from a valuation and earnings standpoint, a rotation away from ‘cyclical value’ and back towards ‘defensive/quality growth’ would not be consistent with ongoing European outperformance,” he stated.

Source web site: www.marketwatch.com