The inventory market, as measured by the S&P 500 Index

SPX,

has tried to rally since March 12th, when the closely oversold market started to bounce. This rally has generated a number of purchase alerts, however the truth stays that the chart of SPX continues to be unfavourable — decrease highs and decrease lows.

It appears that each time the bulls assume they’ll have fun, the Fed or the Treasury throws chilly water on the occasion by stating one thing unfavourable about charges or about not saving each financial institution within the nation if it goes underneath.

So, at this level, there may be resistance on the SPX chart at 4040 (Wednesday’s highs), however there may be stronger resistance in your complete space between 4080 and 4200 — the buying and selling vary from the primary half of February. As for assist, the overall space between 3760 and 3850 stays in place. The current March 12th lows had been in that vary.

The current rally is, thus far, merely an oversold rally. Such rallies usually attain the declining 20-day Moving Average of SPX — or maybe exceed it by a small quantity — after which fall again once more. That situation is in place concerning the present rally.

A brand new McMillan Volatility Band (MVB) purchase sign was confirmed on March 16th. That sign has a goal of the +4σ “modified Bollinger Band” (mBB), which is at 4140, however would start to rise if SPX had been to strategy that value. The MVB purchase sign can be stopped out if SPX closes under the -4σ Band, which is at the moment at 3800 however declining.

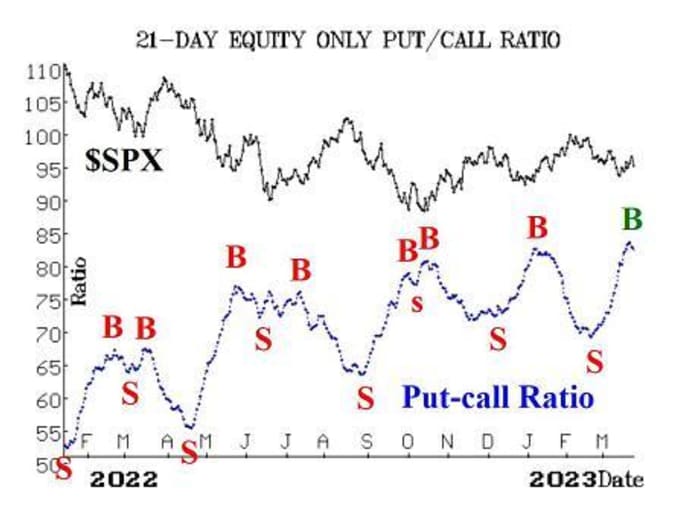

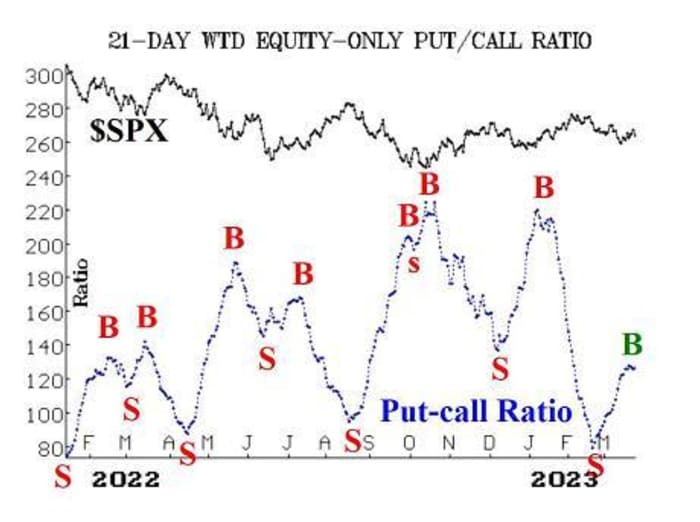

Equity-only put-call ratios had been rising fairly quickly, regardless of the current rally in shares. However, as of only a day or two in the past, there have been new purchase alerts from each the usual and weighted equity-only put-call ratios. These alerts are confirmed by the pc packages that we use to research these charts. Both alerts are marked with inexperienced “B’s” on the accompanying put-call ratio charts. These new purchase alerts can be canceled out if the ratios moved above the highs of this week.

The complete put-call ratio has additionally reached oversold territory and is making an attempt to roll over and type a peak, which might be a purchase sign. So far, this ratio has not been in a position to generate a confirmed purchase sign.

Market breadth has closely unfavourable since early February. As a consequence, each breadth oscillators have been on promote alerts for a while. They, too, reached extraordinarily oversold territory per week or so in the past. This week, with the robust rallies on Monday and Tuesday, breadth improved. But it was nonetheless not sufficient to generate purchase alerts, and now the unfavourable breadth following the FOMC assembly on Wednesday has pushed the oscillators decrease — protecting them on promote alerts nonetheless.

New 52-week Lows on the NYSE have continued to dominate New 52-week Highs. Thus, this indicator stays on the promote sign that was generated per week or so in the past. This is the one current new promote sign.

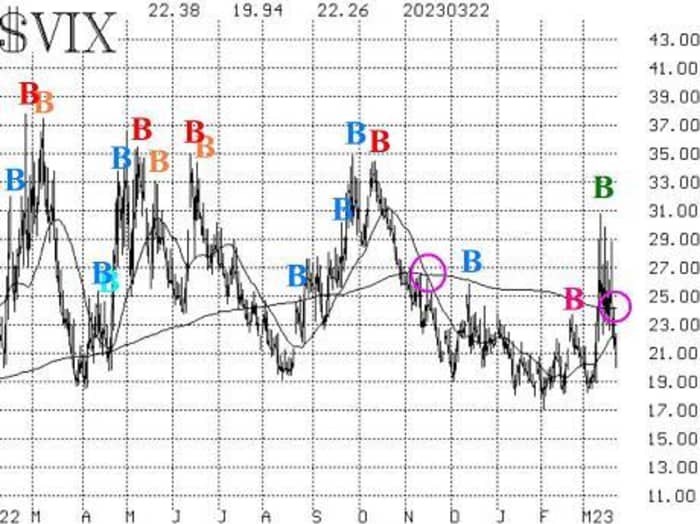

VIX

VIX,

has produced some purchase alerts as effectively. First, the “spike peak” purchase sign of simply over per week in the past stays in place. Second, with VIX closing under its 200-day Moving Average, a brand new pattern of VIX purchase sign has been generated as effectively. It is marked with a circle on the accompanying VIX chart; the earlier one from final November is marked as effectively. This pattern of VIX purchase sign is mostly an intermediate-term sign. It will stays in place till both VIX or its 20-day Moving Average crosses again above the 200-day MA.

There was some fear in the course of the mini-financial disaster that the time period construction of the volatility derivatives may invert. That can be a giant unfavourable for shares, nevertheless it didn’t happen. The time period buildings are sloping modestly upward now. The April VIX futures are actually the entrance month, so we’re evaluating their value that of the May VIX futures. If April rises above May, that could be a unfavourable for shares.

In abstract, we’re sustaining our “core” bearish place due to the unfavourable chart for SPX. We have now seen a lot of purchase alerts happen: MVB, equity-only put-call ratios, VIX “spike peak”, and the pattern of VIX. Breadth and “New Highs vs. New Lows” stay on promote alerts. Thus, the image is combined. In the previous, there have been many occasions when the symptoms appeared to show bullish after large oversold circumstances had been labored off, however the chart of SPX was not in settlement. This is one other a kind of, and the chart of SPX wins each time – by definition. So, we’ll proceed to commerce this different alerts round our “core” bearish place.

New Recommendation: MVB purchase sign

We wish to take a place according to the current MVB purchase sign:

Buy 1 SPY

SPY,

Apr (28th) at-the-money name

And Sell 1 SPY Apr (28th) name with a putting value 15 factors greater.

This place can be stopped out if SPX had been to shut under the -4σ Band. We will maintain you updated on that info weekly.

New Recommendation: Equity-only put-call ratio purchase sign

As famous available in the market commentary part above, there have been new purchase alerts by the put-call ratios, so we wish to add place based mostly on that.

Buy 1 SPY May (19th) at-the-money name

And Sell 1 May (19th) name with a putting 20 factors greater.

This purchase sign can be stopped out if the ratios moved above their current peaks. Again, that’s one thing that we’ll replace weekly.

Follow-Up Action:

We are utilizing a “standard” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the quick strike, then roll your complete unfold. That can be roll up within the case of a name bull unfold, or roll down within the case of a bear put unfold. Stay in the identical expiration, and maintain the gap between the strikes the identical except in any other case instructed.

Long 2 GRMN April (21st) 95 places: These had been purchased on February 21st, when GRMN

GRMN,

closed under 95. We will stay on this place so long as the GRMN weighted put-call ratio stays on a promote sign.

Long 2 SPY April (21st) 390 and quick 2 SPY April (21st) 360 places: that is our “core” bearish place. Close out this place if SPX closes above 4080.

Long 10 LLAP Apr (21st) 2 calls: Stop out if LLAP

LLAP,

closes under 1.90.

Long 2 OMC Apr (21st) 85 places: Hold these places so long as the weighted put-call ratio for OMC

OMC,

stays on a promote sign.

Long 1 SPY May (19th) 391 put and Short 1 SPY May (19th) 351 put: This unfold was purchased according to the promote alerts from the “New Highs vs. New Lows” indicator. This promote sign can be stopped out if New Highs on the NYSE outnumber New Lows for 2 consecutive days.

Long 1 SPY Apr (21st) 391 name and Short 1 SPY Apr (21st) 411 name: This name bull-spread was purchased according to the VIX “spike peak” purchase sign. We are going to tighten the cease: cease your self out if VIX returns to “spiking” mode – that’s, if it rises by no less than 3.00 factors over any 1-, 2-, or 3-day interval. Currently, that will make the closing cease at 24.38, based mostly on the VIX shut of 21.38 on March 21st.

All stops are psychological closing stops except in any other case famous.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities beneficial on this report, each personally and in consumer accounts. He is an skilled dealer and cash supervisor and is the writer of the best-selling e-book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The info on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness should not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals could have positions within the securities beneficial within the advisory.

Source web site: www.marketwatch.com