One longtime Wall Street strategist believes the S&P 500 nonetheless has some fuel left within the tank, which may propel the index as a lot as 5% increased within the coming months.

Following the S&P 500’s first file shut in two years, Sam Stovall, chief funding officer at CFRA, crunched the numbers and located that after the S&P 500 has erased all of its bear-market losses, the index sometimes tacks on an extra “post-high five” — that’s, a post-high rally of 5%, or barely extra.

“If history is any guide, for it’s never gospel, investors should prepare for a ‘post-high five,’ or a possible advance of 5% before pausing to digest recent gains,” Stovall mentioned.

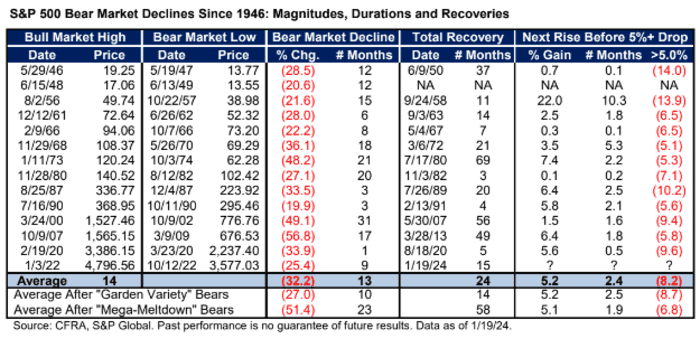

Stovall primarily based his evaluation on how markets have behaved following the 14 bear markets which have occurred, by his depend, for the reason that finish of World War II. Of these, 11 had been “garden-variety bear markets,” whereas three had been “mega meltdowns,” Stovall mentioned.

The bear market that resulted in October 2022 took 9 months to go from the market’s January 2022 peak to its nadir. This is near the typical period for garden-variety bear markets, which is 10 months, in accordance with Stovall’s numbers. But it’s nicely wanting the 23 months, on common, it has taken the market to recuperate from larger meltdowns like the good monetary disaster, when the S&P 500 fell 38.5% throughout 2008, in accordance with FactSet knowledge.

This time round, the market took 15 months to recoup all of its bear-market losses, which is barely longer than the typical bear market.

CFRA

Once U.S. shares have lastly clawed their manner again, they reliably rise one other 5% on common, in accordance with the information in Stovall’s desk. After a bear market just like the one which, presumably, has simply ended, shares proceed to climb on common 5.2% over the following two and a half months, Stovall mentioned, earlier than experiencing a decline of 5% or higher, which Stovall outlined as a interval of consolidation.

After that, the S&P 500 sometimes enters a short interval of decline, with the index seeing a pullback, typically as shallow as 5.1% however typically as massive as 14%, in accordance with Stovall’s knowledge.

Past efficiency, in fact, isn’t any assure of future returns.

The S&P 500

SPX

completed increased once more on Monday, notching a second straight file closing excessive. The index gained 0.2% to 4,850.43, whereas the Nasdaq Composite

COMP

gained 0.3% to fifteen,360.29.

The Dow Jones Industrial Average

DJIA,

in the meantime, tacked on one other 138.01 factors, or 0.4%, to shut north of 38,000 for the primary time ever on Monday. The blue-chip gauge closed at 38,001.81, in accordance with FactSet knowledge.

Also learn: After S&P 500’s file excessive, AI optimism may proceed to strengthen shares by means of the top of the last decade, UBS says

Source web site: www.marketwatch.com