Are buyers getting ready to dropping a hard-fought restoration for the inventory market this 12 months? September is about to ship the S&P 500’s

SPX

worst month-to-month efficiency of 2023 — a 5.1% drop (December 2022 noticed a 5.8% tumble.) Thanks for nothing, bond yields and King Dollar.

If the index can grasp onto the 11% return earned to date this 12 months, that’s higher than 2022, however perhaps not the rebound many hoped for. And rising concern amongst buyers may make the following three months robust, particularly as unhealthy news is now unhealthy news.

Over to our name of the day, the place a workforce at HSBC led by chief multi-asset strategist Max Kettner, says issues are so gloomy, an upside shock shouldn’t be dominated out.

“Our recent conversations have not been short of pushbacks on potential downside

catalysts — from a post-Taylor Swift/Beyoncé consumer spending hangover and numerous others,” say Kettner and the workforce, who draw upon Swift’s work to headline the notice, “Shake it off.”

And whereas the catalyst for the most recent pullback in danger property is mirroring these of 2022 — greater yields and higher-for-longer restrictive financial coverage, they see one massive distinction.

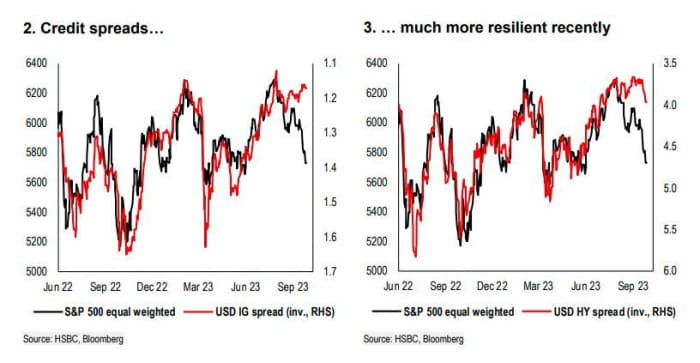

“The key difference to last year’s rates-driven selloffs is that it hasn’t happened in anticipation of a significant slowdown in growth, but instead due to growth still being too resilient, in particular in the U.S,” mentioned the HSBC strategists in a notice to shoppers. “As a result, credit spreads have also remained much more stable compared with equities.”

Credit spreads provide a trying glass into the well being of companies and their entry to capital. Here’s the HSBC chart that lays out what’s been occurring:

HSBC

How to play this? HSBC is sticking to an obese on U.S. equities, and has lifted their publicity to power resulting from “attractive carry” (potential revenue to be earned from simply proudly owning an asset), with a nudge towards the U.Ok. resulting from its publicity to that sector.

Apart from religion in U.S. shares, they broadly favor U.S. over European danger property headed into the fourth quarter. “The reason is simple: near-term consensus growth expectations for the U.S. are still very low – similar to the last couple of quarters. So the bar for positive surprises remains pretty low.”

For instance, Kettner and Co. say it’s actually arduous to see any destructive surprises within the subsequent three to 6 months, and their very own economists predict greater fourth-quarter and first-quarter U.S. development and in addition fewer charge cuts in 2024 and 2025 than consensus. Inflation will head greater within the fourth quarter.

The massive modifications to sentiment that has put the S&P 500 on a slippery slope have been U.S. charges pricing, a greenback comeback and better power costs. Here, HSBC pushes again on a couple of extra considerations amongst buyers:

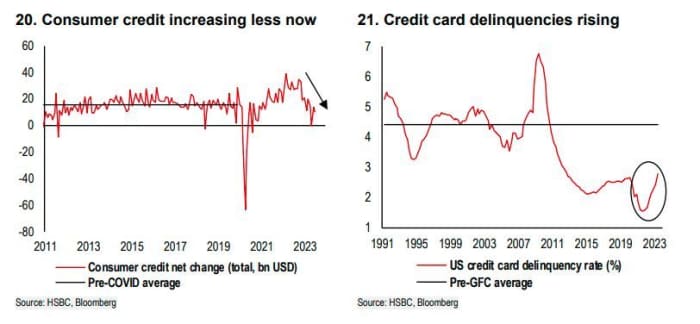

HSBC says markets are worrying an excessive amount of about shopper credit score and delinquencies.

- Excess financial savings working low amongst U.S. customers. HSBC argues that actual wage development has been constructive for a while, and low-income customers haven’t been neglected of that. Also, rising danger property have like led to a “positive wealth effect for U.S. households.”

- Rising shopper credit score. They level out that shopper credit score is rising at a slower tempo than 2021 and 2022. “In any case, it’s often a variable that is used as a bearish argument, regardless of the direction.”

- Increased bank card delinquencies. While delinquencies have been rising since late 2022, the extent is “barely” the place it was earlier than COVID-19 and “nowhere near the pre-GFC [Global Financial Crisis] average yet.”

- Student mortgage debt moratorium expiration. As HSBC explains, these repayments have quickly spiked greater since early July, however have since reverted down, and a few concern this may restrain spending. “We wouldn’t be that negative though: the fact that debtors repaid student debt ahead of the expiration of the moratorium shows that indeed consumers still have money left to spend.”

- Wobbly job market. The strategists level out {that a} 12 months in the past, overwhelming consensus was for a first-half recession, Fed pivot and second-half restoration. Nonfarm payrolls, they notice, grew 190,000 in August, preliminary jobless claims are lower than 20,000 away from a document low seen a 12 months in the past and job openings stay about 1.5 million above their pre-COVID 19 peak. “This hardly qualifies as weaker.”

Also learn: Investors ought to shun shares and bonds as U.S. financial system reveals shades of 2008, high JPMorgan strategist warns

The markets

Stock futures

ES00,

NQ00,

are flat as crude

CL.1,

briefly tapped $95 a barrel — the primary time in a 12 months. The 10-year Treasury yield

BX:TMUBMUSD10Y

is up, to round 4.63%. The Hang Seng

HK:HSI

fell 1.3% with shares of deep-in-debt property group Evergrande

3333,

halted amid experiences its chairman is in police custody.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Fed Chairman Jerome Powell will converse at a city corridor with lecturers at 4 p.m. Weekly jobless claims and a revision to second-quarter GDP are due at 8:30 a.m., and pending dwelling gross sales at 10 a.m. Federal Reserve Gov. Lisa Cook will converse at 1 p.m.

Meme-stock favourite GameStop

GME,

is up 9% in premarket buying and selling after the buyer electronics retailer named Ryan Cohen president and CEO.

Accenture

ACN,

and AutomobileMax

KMX,

outcomes are forward, with just lately downgraded Nike

NKE,

coming after the shut.

Peloton Interactive

PTON,

is up 13% after the train bike maker and yoga-wear big Lululemon Athletica

LULU,

introduced a five-year partnership.

Micron Technology

MU,

is off 4% after the memory-chip maker forecast extra destructive margins. Its CEO sees “several hundreds of millions of dollars” in AI-fueled 2024 information middle gross sales, however not for some time.

Best of the net

How Cathie Wood’s ARK plans to crack Europe

One investor’s battle to flip rewilding right into a multibillion-dollar business

The iPhone 15 is overheating for some customers, and the repair is probably not splendid.

The chart

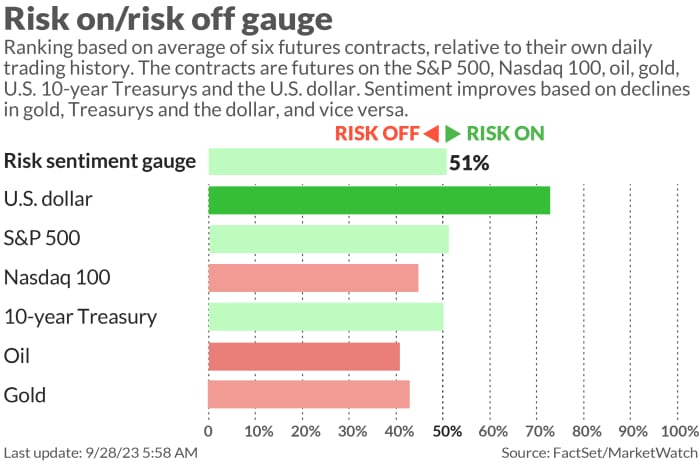

This chart sees a line within the sand for markets proper now, from a dealer and chartist often known as Heisenberg on X:

@Mr_Dervatives

The tickers

These had been the highest searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

NKLA, |

Nikola |

|

PLTR, |

Palantir Technologies |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

Random reads

China is mad, and recalling its pandas.

When a bear involves your celebration, let him eat tacos.

Meet Grimpoteuthis, the lovely dumbo Octopus.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com