Oil merchants braced Sunday for a possible “fear trade” that might push up crude oil costs, a minimum of within the quick time period, after a shock assault on Israel by Palestinian militants in Gaza threatened to place added scrutiny on rising Iranian oil exports.

The battle can also maintain penalties for talks aimed toward normalizing relations between Saudi Arabia and Israel.

“There is definitely going to be a fear trade put in place. While in the short term there is no impact directly on supply, it’s obvious how things play out over the next 24 to 48 hours could change that,” Phil Flynn, analyst at Price Futures Group in Chicago, instructed MarketWatch.

Movements in oil costs, in the meantime, may even function a gauge for broader market worries across the battle, analysts mentioned.

See: Israeli shares hunch in first day of commerce since Gaza assault

Hamas, the Iran-backed,Palestinian militant group that controls the Gaza Strip, staged a sweeping assault on southern Israel early Saturday. More than 600 Israelis have been confirmed useless, based on Israeli authorities, with greater than 2,400 injured. The Palestinian Health Ministry mentioned a minimum of 2,000 Palestinians have been killed and round 2,000 injured in Israeli counterstrikes.

Israeli troops on Sunday have been engaged in fierce preventing in an effort to retake territory in southern Israel as Hamas launched additional barrages of missiles. Israeli residents and troopers have been captured and are being held hostage in Gaza, based on the Israeli navy.

Read: Israel declares conflict, approves ‘significant’ steps to retaliate after shock assault by Hamas

“Iran remains a very big wild card and we will be watching how strongly [Israeli] Prime Minister Netanyahu blames Tehran for facilitating these attacks by providing Hamas with weapons and logistical support,” mentioned Helima Croft, head of worldwide commodity technique at RBC Capital Markets, in a Sunday morning observe.

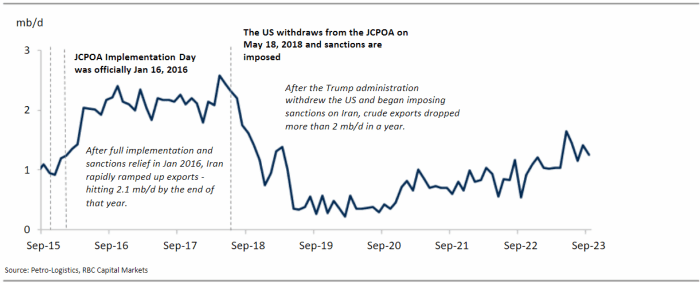

Iranian crude exports have risen in recent times, indicating the Biden administration has adopted a comfortable method to sanctions enforcement, Croft mentioned. Some analysts have put Iranian crude manufacturing at greater than 3 million barrels a day and exports above 2 million barrels a day — the best ranges because the Trump administration pulled the U.S. out of the Iranian nuclear accord in 2018, based on The Wall Street Journal. Sales fell to round 400,000 barrels a day in 2020 because the U.S. reimposed sanctions.

RBC Capital Markets

Hedge-fund supervisor Pierre Andurand, one of many world’s finest vitality merchants, mentioned in a social media put up that a big value spike for oil isn’t possible in coming days, however emphasised the market concentrate on Iran.

“Now, over the last 6 months we have seen a very large increase in Iranian supply due to weak enforcement of sanctions. As Iran is also behind Hamas’ attacks on Israel, there is a good probability that the US administration will start enforcing those sanctions on Iranian oil exports more tightly,” he wrote. “That would further tighten the oil market. Also the probability that this will lead to direct conflict with Iran is not zero.”

Rising Iranian manufacturing has helped to fill a world hole between demand and provide. If sanctions are forcefully reapplied, “prices will be substantially higher,” Flynn mentioned.

Meanwhile, The Wall Street Journal late Friday reported that Saudi Arabia had instructed the White House it could be keen to increase oil manufacturing subsequent 12 months if crude costs remained excessive, as a part of an effort aimed toward successful goodwill in Congress for a deal that will see the dominion acknowledge Israel and in return get a protection settlement with the U.S.

A Saudi manufacturing lower of 1 million barrels a day that was carried out in July and not too long ago prolonged by the tip of the 12 months has been given a lot of the credit score for a rally that took international benchmark Brent crude

BRN00,

inside a number of {dollars} of the $100-a-barrel threshold earlier than retreating this previous week. The U.S. benchmark

CL00,

CL.1,

final week briefly topped $95 a barrel for the primary time in 13 months.

In an announcement, Saudi Arabia’s international ministry known as on each side to halt the escalation and train restraint, but in addition recalled its “repeated warnings of the dangers of the explosion of the situation as a result of the continued occupation, the deprivation of the Palestinian people of their legitimate rights, and the repetition of systematic provocations against its sanctities.”

With the Israeli authorities vowing an unprecedented response, “it is hard to envision how Saudi normalization talks can run on a parallel track to a ferocious military counter offensive,” mentioned RBC’s Croft.

Beyond oil, a lot will depend upon the potential for the battle to widen.

Stocks have stumbled, retreating from 2023 highs set in late July, as yields on U.S. Treasurys have jumped. The yield on the 30-year Treasury bond

BX:TMUBMUSD30Y

rose 23.2 foundation factors final week to finish Friday at 4.941%, its highest since Sept. 20, 2007. The 10-year Treasury observe yield

BX:TMUBMUSD10Y

topped 4.80% on Oct. 3, its highest since Aug. 8, 2007, and ended the week at 4.783%. Yields and debt costs transfer reverse one another.

The U.S. bond market will probably be closed Monday for the Columbus Day and Indigenous People’s Day vacation, whereas U.S. inventory markets will probably be open.

The S&P 500 index

SPX

rose 0.5% final week, breaking a streak of 4 straight weekly declines, whereas the Dow Jones Industrial Average

DJIA

fell 0.3% and the Nasdaq Composite

COMP

gained 1.6%.

“I think there will be a negative reaction. However, I don’t see a meltdown,” Peter Cardillo, chief market economist at Spartan Capital Securities, instructed MarketWatch.

Traditional haven performs, together with gold

GC00,

the greenback

DXY

and U.S. Treasurys might even see a powerful transfer upward, with value features for Treasurys pulling yields down.

“Geopolitical crises in the Middle East have usually caused oil prices to rise and stock prices to fall,” mentioned economist Ed Yardeni, president of Yardeni Research Inc., in a observe. “More often than not, they’ve also tended to be buying opportunities in the stock market.”

The broader market response will depend upon whether or not the disaster seems to be a short-term flare-up or “something much bigger like a war between Israel and Iran,” he mentioned. The latter is unlikely, however tensions between the 2 are prone to escalate.

“The price of oil may be a good way to assess the likelihood of a broader conflict,” he mentioned.

Source web site: www.marketwatch.com