Yields on 3-month

BX:TMUBMUSD03M

and 6-month

BX:TMUBMUSD06M

Treasury payments have been seeing yields north of 5% since March when Silicon Valley Bank’s collapse ignited fears of a broader instability within the U.S. banking sector from rapid-fire Fed fee hikes.

Six months later, the Fed, in its remaining assembly of the yr, opted to maintain its coverage fee unchanged at 5.25% to five.5%, a 22-year excessive, however Powell additionally lastly signaled that sufficient was possible sufficient, and {that a} coverage pivot to rate of interest cuts was possible subsequent yr.

Importantly, the central financial institution chair additionally mentioned he doesn’t wish to make the error of conserving borrowing prices too excessive for too lengthy. Powell’s feedback helped elevate the Dow Jones Industrial Average

DJIA

above 37,000 for the primary time ever on Wednesday, whereas the blue-chip index on Friday scored a 3rd document shut in a row.

“People were really shocked by Powell’s comments,” mentioned Robert Tipp, chief funding strategist, at PGIM Fixed Income. Rather than dampen rate-cut exuberance constructing in markets, Powell as a substitute opened the door to fee cuts by midyear, he mentioned.

New York Fed President John Williams on Friday tried to mood hypothesis about fee cuts, however as Tipp argued, Williams additionally affirmed the central financial institution’s new “dot plot” reflecting a path to decrease charges.

“Eventually, you end up with a lower fed-funds rate,” Tipp mentioned in an interview. The danger is that cuts come out of the blue, and might erase 5% yields on T-bills, money-market funds and different “cash-like” investments within the blink of a watch.

Swift tempo of Fed cuts

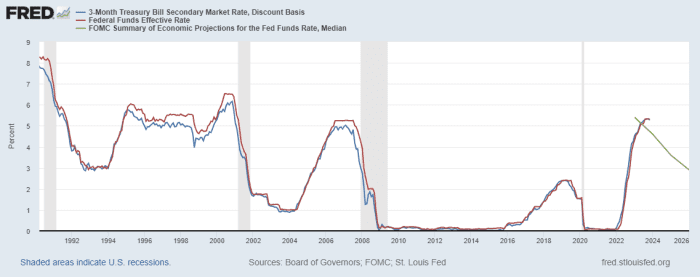

When the Fed minimize charges previously 30 years it has been swift about it, usually bringing them down shortly.

Fed rate-cutting cycles for the reason that ’90s hint the sharp pullback additionally seen in 3-month T-bill charges, as proven under. They fell to about 1% from 6.5% after the early 2000 dot-com inventory bust. They additionally dropped to virtually zero from 5% within the tooth of the worldwide monetary disaster in 2008, and raced again all the way down to a backside throughout the COVID disaster in 2020.

Rates on 3-month Treasury payments dropped out of the blue in previous Fed rate-cutting cycles

FRED knowledge

“I don’t think we are moving, in any way, back to a zero interest-rate world,” mentioned Tim Horan, chief funding officer mounted revenue at Chilton Trust. “We are going to still be in a world where real interest rates matter.”

Burt Horan additionally mentioned the market has reacted to Powell’s pivot sign by “partying on,” pointing to shares that had been again to document territory and benchmark 10-year Treasury yield’s

BX:TMUBMUSD10Y

that has dropped from a 5% peak in October to three.927% Friday, the bottom yield in about 5 months.

“The question now, in my mind,” Horan mentioned, is how does the Fed orchestrate a pivot to fee cuts if monetary situations proceed to loosen in the meantime.

“When they begin, the are going to continue with rate cuts,” mentioned Horan, a former Fed staffer. With that, he expects the Fed to stay very cautious earlier than pulling the set off on the primary minimize of the cycle.

“What we are witnessing,” he mentioned, “is a repositioning for that.”

Pivoting on the pivot

The most up-to-date knowledge for money-market funds exhibits a shift, even when non permanent, out of “cash-like” property.

The rush into money-market funds, which continued to draw document ranges of property this yr after the failure of Silicon Valley Bank, fell previously week by about $11.6 billion to roughly $5.9 trillion by Dec. 13, in response to the Investment Company Institute.

Investors additionally pulled about $2.6 billion out of quick and intermediate authorities and Treasury mounted revenue exchange-traded funds previously week, in response to the most recent LSEG Lipper knowledge.

Tipp at PGIM Fixed Income mentioned he expects to see one other “ping pong” yr in long-term yields, akin to the volatility of 2023, with the 10-year yield prone to hinge on financial knowledge, and what it means for the Fed as it really works on the final leg of getting inflation all the way down to its 2% annual goal.

“The big driver in bonds is going to be the yield,” Tipp mentioned. “If you are extending duration in bonds, you have a lot more assurance of earning an income stream over people who stay in cash.”

Molly McGown, U.S. charges strategist at TD Securities, mentioned that financial knowledge will proceed to be a driving power in signaling if the Fed’s first fee minimize of this cycle occurs in the end.

With that backdrop, she expects subsequent Friday’s studying of the personal-consumption expenditures worth index, or PCE, for November to catch the attention of markets, particularly with Wall Street prone to be extra sparsely staffed within the remaining week earlier than the Christmas vacation.

The PCE is the Fed’s most popular inflation gauge, and it eased to a 3% annual fee in October from 3.4% a month earlier than, however nonetheless sits above the Fed’s 2% annual goal.

“Our view is that the Fed will hold rates at these levels in first half of 2024, before starting cutting rates in second half and 2025,” mentioned Sid Vaidya, U.S. Wealth Chief Investment Strategist at TD Wealth.

U.S. housing knowledge due on Monday, Tuesday and Wednesday of subsequent week additionally will catch the attention of buyers, significantly with 30-year mounted mortgage fee falling under 7% for the primary time since August.

The main U.S. inventory indexes logged a seventh straight week of beneficial properties. The Dow superior 2.9% for the week, whereas the S&P 500

SPX

gained 2.5%, ending 1.6% away from its Jan. 3, 2022 document shut, in response to Dow Jones Market Data.

The Nasdaq Composite Index

COMP

superior 2.9% for the week and the small-cap Russell 2000 index

RUT

outperformed, gaining 5.6% for the week.

Read: Russell 2000 on tempo for greatest month versus S&P 500 in practically 3 years

Year Ahead: The VIX says shares are ‘reliably in a bull market’ heading into 2024. Here’s easy methods to learn it.

Source web site: www.marketwatch.com