The rally lifting U.S. shares to recent 2023 highs within the 12 months’s house stretch may very well be in danger if the Federal Reserve subsequent week crushes expectations for rate of interest cuts in 2024.

U.S. central bankers and buyers haven’t precisely been seeing eye-to-eye about when the Fed will begin easing its financial coverage, in accordance with Melissa Brown, senior principal of Applied Research at Axioma.

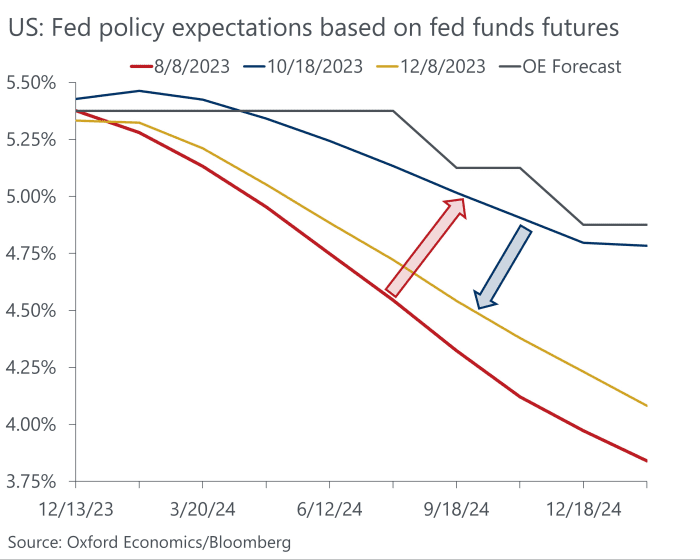

Traders even have been flip-flopping on their forecasts for fee cuts over the previous few months, based mostly on Fed funds futures knowledge.

Oxford Economics/Bloomberg

Given the whipsaw of current volatility, it isn’t arduous to think about a jittery market backdrop as buyers wait to listen to from Fed Chairman Jerome Powell subsequent Wednesday, despite the fact that the central financial institution isn’t anticipated to alter its vary for short-term rates of interest. Since July, the Fed funds fee fee has been unchanged at a 22-year excessive in a 5.25% to five.5% vary.

U.S. shares superior this 12 months after a bruising 2022, including large beneficial properties in November, as benchmark 10-year Treasury yields

BX:TMUBMUSD10Y

tumbled from a 16-year excessive of 5%. The Dow Jones Industrial Average

DJIA

closed on Friday just one.5% away from its report shut almost two years in the past. The S&P 500 index

SPX

booked its highest end since March 2022, in accordance with Dow Jones Market Data.

Year Ahead: The VIX says shares are ‘reliably in a bull market’ heading into 2024. Here’s tips on how to learn it.

“I don’t see any report on the horizon that would really make them [the Fed] change their stance on where we are on monetary policy,” stated Alex McGrath, chief funding officer at NorthEnd Private Wealth. It is usually the expectation of Fed fee cuts subsequent 12 months which have supported inventory and bond markets rallies not too long ago, he stated.

The Dow Jones closed 9.4% larger on the 12 months by way of Friday, the S&P 500 was up 19.9% and the Nasdaq Composite superior 37.6% for a similar interval, in accordance with FactSet knowledge.

“We have been a little skeptical of the market’s excitement over rate cuts early next year,” stated Ed Clissold, chief U.S. strategist at Ned Davis Research.

It takes a gradual course of for the Fed to maneuver away from its financial coverage tightening, Clissold instructed MarketWatch. The Fed is more likely to pivot its tone from being very hawkish to impartial, take away the tightening bias, after which speak about fee cuts, famous Clissold.

The bond market on Friday already was once more flashing indicators of a possible rethink by buyers in regards to the path of rates of interest in 2024.

Junk bonds

JNK

HYG,

typically a canary within the coal mine for markets, hit pause on a rally that began in late October as benchmark borrowing prices fell, despite the fact that the sector has benefited from large inflows of funds in current weeks.

Treasury yields for 10-year and 30-year

BX:TMUBMUSD30Y

bonds additionally shot larger Friday, echoing volatility that took maintain in mid-October.

Read: Investors have fought a 2-year battle with the bond market. Here’s what’s subsequent.

Mike Sanders, head of mounted earnings at Madison Investments, has been equally cautious. “I think the market is a little too aggressive in terms of thinking that cuts are going to occur in March,” Sanders stated. It is extra probably that the Fed will begin slicing charges within the second half of subsequent 12 months, he stated.

“I think the biggest thing is that the continued strength in the labor market continues to make the services inflation stickier,” Sanders stated. “Right now we just don’t see the weakness that we need to get that down.”

Friday’s U.S. employment report provides to his issues. About 199,000 new jobs have been created in November, the federal government stated Friday. Economists polled by the Wall Street Journal had forecast 190,000 jobs. The report additionally confirmed rising wages and a retreating unemployment fee to a four-month low of three.7% from 3.9%.

The U.S. central financial institution subsequent week will probably “try their best to push back on the narrative of cuts coming very soon,” Sanders stated. That may very well be achieved in its up to date “dot plot” rate of interest forecast, additionally due Wednesday, which is able to present the Fed’s newest considering on the probably path of financial coverage. The Fed’s replace in September shocked some available in the market because it bolstered the central financial institution’s stance of upper charges for longer.

There’s nonetheless an opportunity that inflation will reaccelerate, Sanders stated. “The Fed is worried about the inflation side more than anything else. For them to take the foot off the brake sooner, it just doesn’t do them any good.”

Ahead of the Fed resolution, an inflation replace is due Tuesday within the November consumer-price index, whereas the producer-price index is due Wednesday.

Still, seasonality elements may support the inventory market in December. The Dow Jones Industrial Average in December rises about 70% of the time, no matter whether or not it’s in a bull or bear market, in accordance with historic knowledge.

See: Stock market barrels into year-end with momentum. What meaning for December and past.

“The overall market outlook remains constructive,” stated Ned Davis’s Clissold. “A soft landing scenario could support the bull market continuing.”

Last week the Dow eked out a acquire of lower than 0.1%, the S&P 500 edged up 0.2% and the Nasdaq rose 0.7%. All three main indexes went up for a sixth straight week, with the Dow logging its longest weekly profitable streak since February 2019, in accordance with Dow Jones Market Data.

Source web site: www.marketwatch.com