If you’re looking for a home or automotive this spring, you’ll in all probability pay a a lot steeper rate of interest than for those who had purchased the identical factor in March 2022. Likewise, for those who’re carrying a credit-card steadiness, the annual share charge that now applies is nearly actually larger than it was in early 2022.

It’s been a 12 months because the Federal Reserve began ratcheting up its benchmark rate of interest from practically zero in a bid to tame inflation. Wednesday’s 25-basis-point improve was the central financial institution’s ninth straight hike of its federal-funds charge.

And whereas the inflation charge ebbs from four-decade highs, curiosity on debt is beginning to pile up. “It’s kind of insidious,” mentioned Kelly LaVigne, Allianz Life’s vp of client insights. “It makes everything so much more expensive without you realizing it.”

For people who find themselves conscious about their money owed, larger charges intensify the woes, mentioned Ashley Agnew of Centerpoint Advisors in Needham, Mass. “It feels more like a punishment than an interest rate,” she mentioned.

The Fed’s charge selections have big implications for the economic system and the inventory market — particularly with questions now being raised concerning the well being of the banking sector. And whereas the banking system is “sound and resilient,” the Fed mentioned in its assertion on Wednesday that “recent developments are likely to result in tighter credit conditions for households and businesses.”

On Wednesday afternoon, the Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

have been all buying and selling decrease after Powell spoke with reporters.

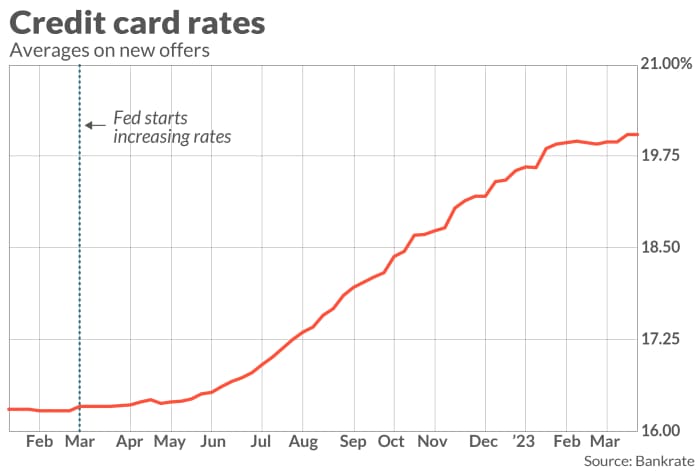

Credit playing cards are a key instance of the sneaky lagging results of rates of interest when prices are excessive, mentioned Ted Rossman, a senior trade analyst at Bankrate.com. “It made a bad situation worse,” he mentioned. “The cumulative effect is really significant.”

The central financial institution’s fed-funds charge immediately impacts the prime charge that credit-card issuers use to find out annual share charges, or APRs. It can take one or two billing cycles for a Fed charge hike to have an effect on the APR on an current account, however it may possibly improve the speed for brand spanking new presents inside days, consultants mentioned.

Americans had a complete of $968 billion in credit-card debt on the finish of 2022, in accordance with the New York Fed. Credit-card accounts carrying a steadiness averaged an APR of 20.4%, up from 16.4% within the fourth quarter of 2021, in accordance with Fed knowledge.

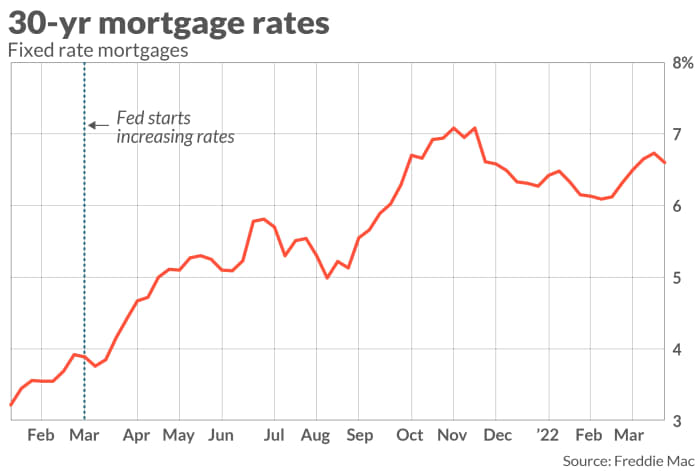

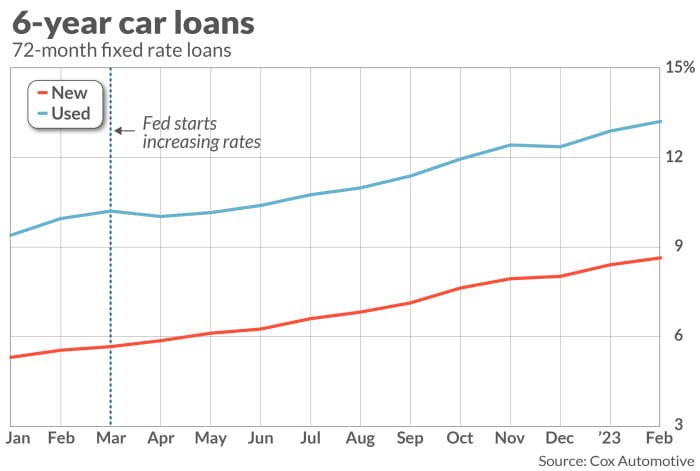

The Fed’s charge additionally not directly influences the charges that lenders use for automotive loans and mortgages and the charges banks use to find out annual share yields on financial savings accounts.

Would-be house consumers can simply see the consequences of a change in mortgage charges on their month-to-month funds. Mortgage demand elevated final week after charges declined for a second week.

“Home buyers in 2023 have shown themselves to be quite sensitive to any changes in mortgage rates,” mentioned Mike Fratantoni, senior vp and chief economist on the Mortgage Bankers Association. “With this move from the Federal Reserve, MBA is holding to its forecast that mortgage rates are likely to trend down over the course of this year, which should provide support for the purchase market.”

Higher charges may also make shopping for a automotive much more unaffordable at a time when the common month-to-month cost on a brand new automotive is above $700.

But after years of comparatively low charges, the will increase are placing a brand new gloss on financial savings accounts.

For instance, a high-yield on-line financial savings account now averages 3.5%, up from 0.49% in March 2022, in accordance with knowledge from DepositAccounts.com. At the identical time, inflation is sapping shoppers’ potential to save lots of money, mentioned Ken Tumin, the positioning’s founder and editor.

“The hope is once inflation goes down, we’ll have a period — at least some period — where we’ll have some real positive yields on savings and CDs, where the savings-account rate is above the inflation rate,” Tumin mentioned.

Agnew has a consumer at Centerpoint Advisors who’s in her 20s, at first of her profession and monetary life. It took the fast rise in rates of interest for her to appreciate that cash might develop in a financial savings account and that it wasn’t a advertising and marketing gimmick. “Oh, I thought banks just did that to be nice,” Agnew recalled her consumer saying.

And as rates of interest have elevated, so has the principal debtors owe. Americans had $16.9 trillion in mortgage and client debt on the finish of 2022, in accordance with the New York Fed.

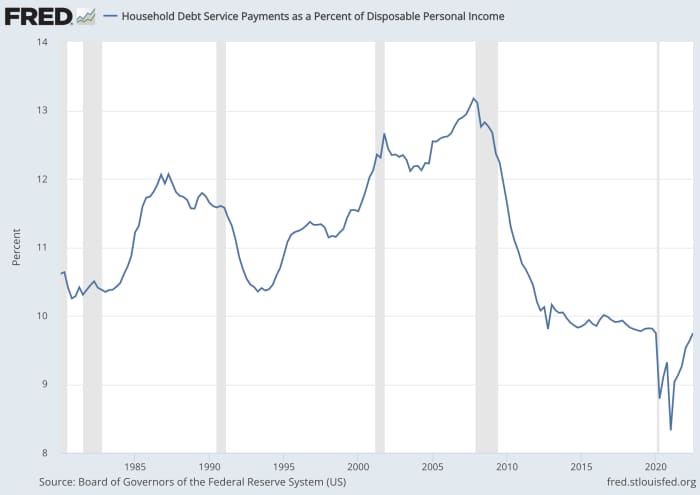

It’s robust to say what portion of these money owed is curiosity. But there are different peeks into the methods larger rates of interest are affecting shoppers.

The curiosity paid on client money owed, together with bank cards, now eats up the identical quantity of disposable revenue it did at first of the pandemic. Consumer debt-service funds account for five.75% of disposable private revenue, in accordance with the Federal Reserve’s most up-to-date report, from the third quarter of 2022.

Add in mortgage curiosity, and 9.7% of a family’s disposable revenue was going towards the borrowing prices for housing and client debt through the third quarter of final 12 months. That’s again to the extent within the first quarter of 2020, though it’s nonetheless low if you have a look at the massive image.

The actual query is what’s subsequent, mentioned Allianz Life’s LaVigne. The knowledge doesn’t seize how a lot curiosity folks have been paying on the finish of final 12 months and the way a lot they’re paying now.

“It doesn’t look horrible, but it could be a shot across the bow [signaling] that we ought to curb spending a little bit more,” he mentioned.

Aarthi Swaminathan contributed to this report.

Source web site: www.marketwatch.com