The Federal Reserve can most likely finish its inflation battle now that labor market is cooling after it gained a historic 26 million jobs in roughly the previous three years, in accordance with BlackRock’s Rick Rieder.

“In truth, 26 million jobs is like including an financial system the dimensions of Australia or Taiwan (together with each man, girl, and little one), stated Rieder, BlackRock’s chief funding officer of worldwide fastened earnings, in emailed commentary following Friday’s month-to-month jobs report for August.

The report confirmed the U.S. including 187,000 new jobs, barely greater than forecasts, but in addition pointing to an uptick within the low unemployment fee to three.8% from 3.5%.

“Remarkably, 22 million people were hired between May 2020 and April 2022, and 11 million were added to the workforce from June 2021 to May 2023, as the economy has opened up massive amounts of roles for fulfillment,” stated Rieder.

He expects wage pressures to ease and thinks the “economy may now have fulfilled many of its needs,” which ought to make the Fed really feel extra assured in “the permanence of lower levels of inflation,” in order that it will possibly gradual or cease its rate of interest rises by year-end.

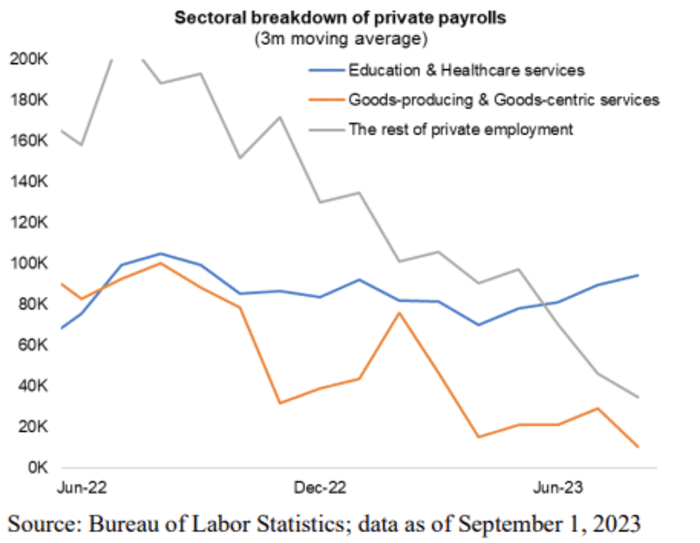

Hiring within the U.S. has slowed, apart from in training and healthcare companies, when taking a look at non-public payrolls primarily based on a three-month shifting common.

Payrolls are slowing in lots of sectors, count on training and healthcare

Bureau of Labor Statistics, BlackRock

The Fed has already raised rates of interest to a 22-year excessive in July to a 5.25%-5.5% vary, with merchants in fed-funds futures on Friday pricing in solely a few 7% likelihood of one other Fed fee hike in September and favoring no hike once more on the central financial institution’s November coverage assembly.

Rieder at BlackRock, one of many world’s largest asset supervisor with $2.7 trillion in belongings beneath administration, thinks a Fed pause or finish of fee hikes may calm markets, even when the Fed, as BlackRock expects, retains charges excessive for a time.

U.S. shares have been uneven Friday forward of the lengthy vacation weekend for Labor Day, with the Dow Jones Industrial Average

DJIA

up 0.1%, the S&P 500 index

SPX

roughly flat and the Nasdaq Composite Index

COMP

was 0.2% decrease, in accordance with FactSet.

The 10-year Treasury yield

BX:TMUBMUSD10Y

was round 4.18%, after hitting its highest since 2007 in late August, including to volatility that has worn out earlier yearly positive factors within the roughly $25 trillion Treasury market.

See: This hadn’t occurred on the U.S. Treasury market in 250 years. Now it has.

Source web site: www.marketwatch.com