The Federal Reserve has no plans to increase an emergency mortgage program it launched final 12 months to bolster the capability of the banking system within the wake of the collapse of Silicon Valley Bank.

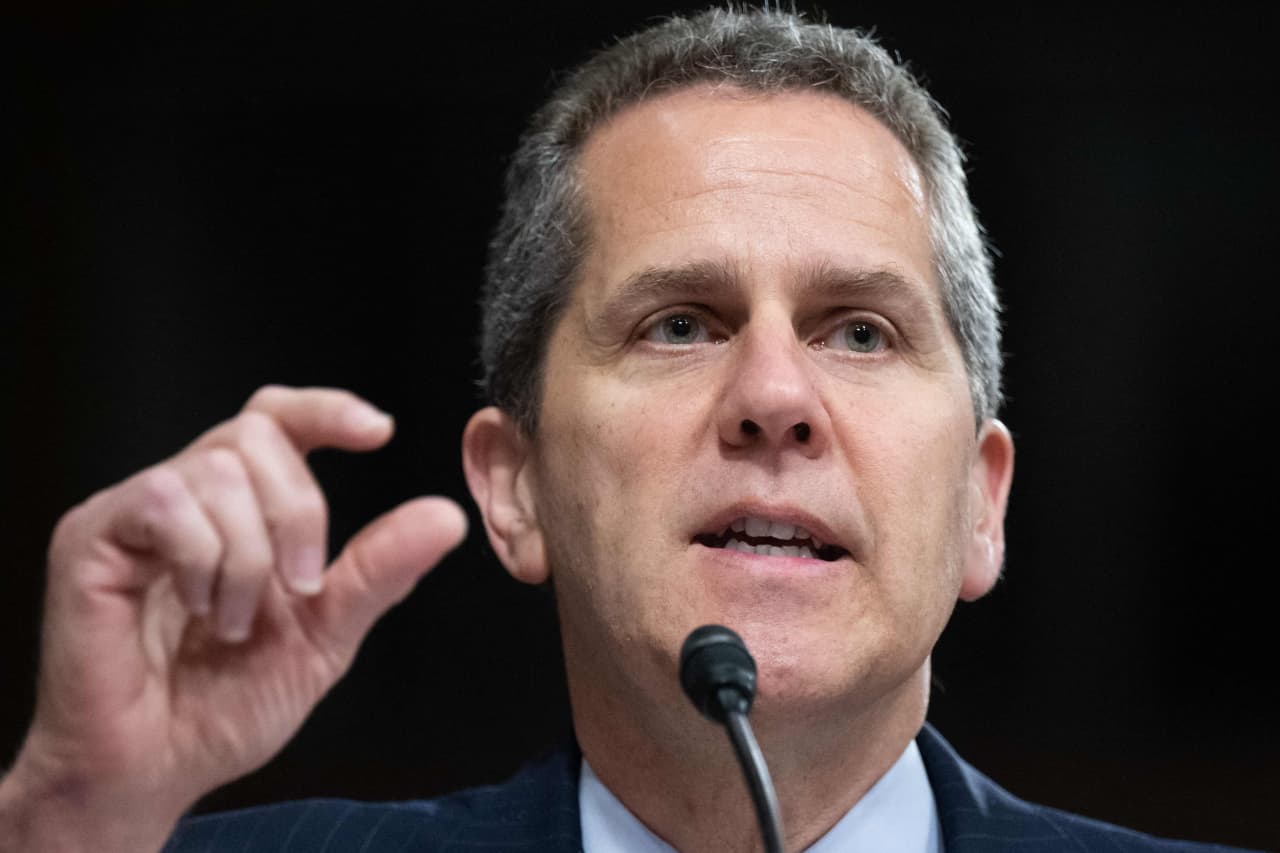

The Bank Term Funding Program will expire on March 11 because it reaches its unique one-year time restrict, Fed Vice Chair for Supervision Michael Barr mentioned at a panel look on Tuesday.

“The program worked as intended,” Barr mentioned. “It dramatically reduced stress in the system very quickly. … It was highly effective.”

At the second, banks have $141.2 billion in loans excellent from the financial institution program, in accordance with the most recent Fed knowledge.

Banks could proceed to borrow underneath this system till March 11 and refinance loans till 2025, Barr mentioned.

The authorities put aside $25 billion final 12 months as a backstop for the emergency program, which was established to stem a rush of deposit outflows from banks following the collapse of Silicon Valley Bank in March 2023.

On different regulatory matters, Barr mentioned the prolonged remark interval for the proposed Basel III capital necessities ends on Jan. 16, however he didn’t present any particulars on what the ultimate proposal will appear to be.

“We’ve been receiving a lot of comments,” he mentioned. “It’ll help us to get the balance right.”

Barr pushed again in opposition to fees by the banking business that larger capital necessities will elevate the worth of mortgages and different loans to customers.

A typical mortgage-loan price underneath the proposed regime would rise to about 5.03% from 5%, he mentioned, including that the proposed guidelines would have a “pretty modest” impression on the price of credit score.

Barr mentioned financial institution officers “talk all the time” about potential dangers to the banking system posed by non-public credit score and different various lenders and about methods to regulate these dangers.

Although non-public lenders function exterior the regulated banking system, banks nonetheless act as counterparties and supply loans to them, he mentioned.

“There’s no easy answer” for methods to regulate your entire system, Barr mentioned. If rules are too onerous, it’ll be like “squeezing a balloon,” and the dangers could merely come out someplace else, he mentioned.

At the identical time, the banking system wants rules to guarantee that the monetary universe “has a strong core,” Barr mentioned.

Barr’s feedback got here throughout a moderated discuss in Washington, D.C., with Women in Housing and Finance, a member group for ladies within the fields of housing, finance and improvement.

Also learn: Fed community-bank advocate Michelle Bowman says proposed financial institution reforms transcend what the legislation intends

Also learn: Fed cop Michael Barr defends larger capital necessities as bankers bristle

Source web site: www.marketwatch.com