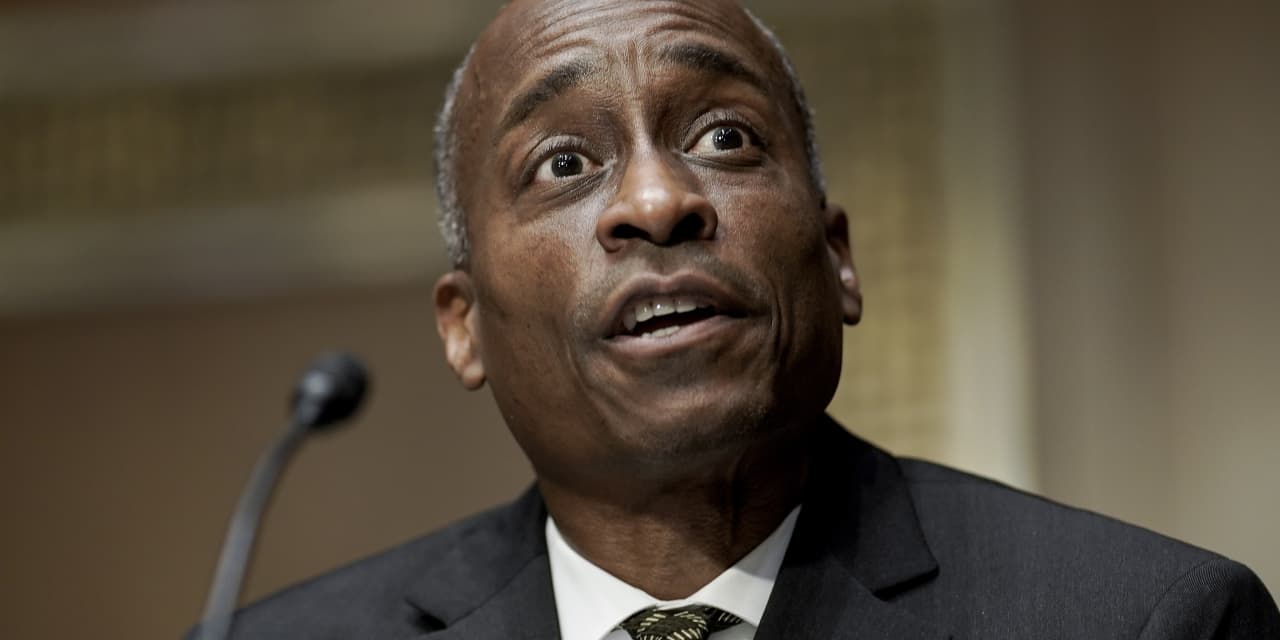

The robust job market might make it arduous for the U.S. central financial institution to deliver down inflation, Federal Reserve Gov. Philip Jefferson mentioned on Friday.

“The ongoing imbalance between the supply and demand for labor, combined with

the large share of labor costs in the services sector, suggests that high inflation may come down only slowly,” Jefferson mentioned in a speech at a University of Chicago Booth School of Business convention in New York.

Jefferson mentioned that current information exhibits that wage development has began to decelerate considerably over the previous yr however famous that it’s nonetheless working too excessive to return inflation to the Fed’s 2% goal “in a timely and sustainable fashion.”

He mentioned that the inflationary forces impinging on the U.S. economic system “represent a complex mixture of temporary and more long-lasting elements that defy simple, parsimonious explanation.”

Jefferson was commenting on a brand new paper by a number of outstanding Wall Street economists who concluded that further interest-rate hikes are crucial in an effort to deliver inflation all the way down to the Fed’s 2% goal by 2025. The authors mentioned this tightening is prone to result in a gentle recession.

Stocks

DJIA,

SPX,

had been decrease on Friday after a scorching private consumption expenditures, or PCE, inflation studying for January. The yield on the 10-year Treasury word

TMUBMUSD10Y,

rose to three.94%.

Source web site: www.marketwatch.com