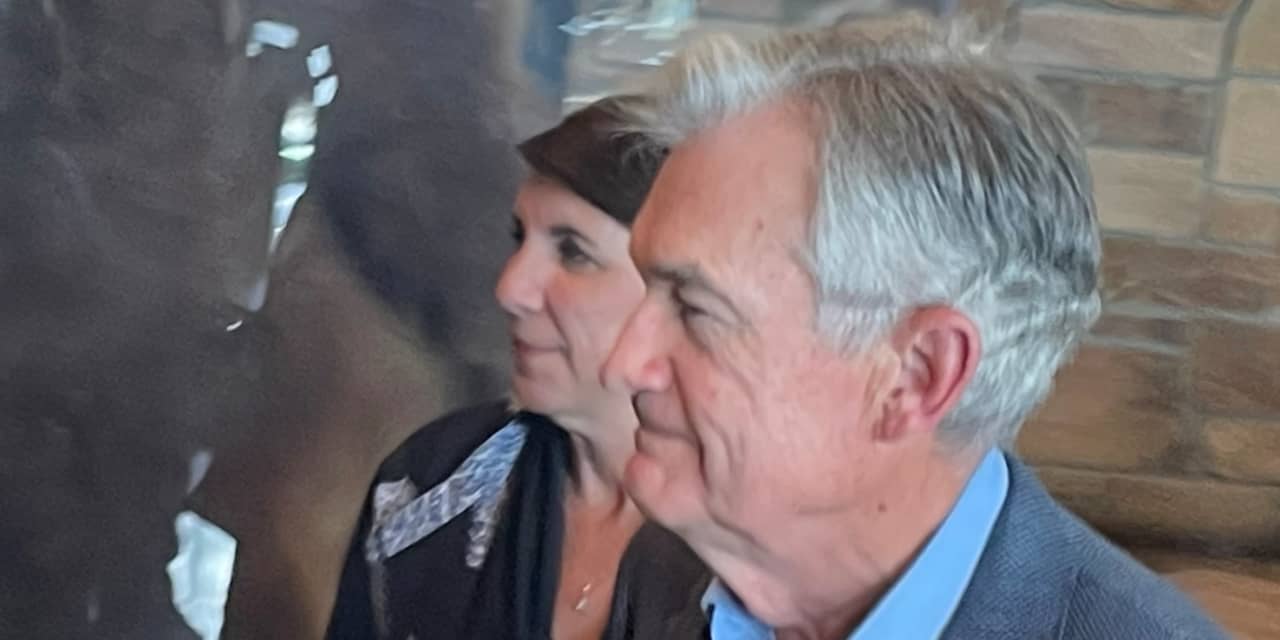

Federal Reserve Chair Jerome Powell on Friday mentioned the central financial institution stays uncertain of whether or not extra rate of interest hikes are wanted.

In a speech kicking off the Jackson Hole retreat, Powell promised that the central financial institution will transfer rigorously given “cloudy” financial outlook and mentioned the central financial institution would assess the incoming information.

“Based on this assessment, we will proceed carefully as we decide whether to

tighten further or, instead, to hold the policy rate constant and await further data,” Powell mentioned.

In his remarks, Powell repeated his agency intention to get inflation again to the two% goal. He rejected calls to boost the Fed’s 2% goal and took no victory lap for the current benign inflation readings, saying it was only the start of what was wanted.

Powell mentioned inflation remained “too high,” he mentioned. The Fed “will keep at it until the job is done.”

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” Powell mentioned firstly of his remarks.

Powell mentioned that, getting inflation again to 2%, “is expected to require a period of below-trend economic growth as well as some softening in labor market conditions.”

Many analysts assume that financial development may very well be reaccelerating within the third quarter and this might change the Fed’s view that it’s close to the height stage of rates of interest.

Powell mentioned the Fed was “attentive” to those indicators to indicators.

“Additional evidence of persistently above-trend growth could put further progress on inflation at risk and could warrant further tightening of monetary policy,” Powell mentioned,

In an analogous vein, Powell mentioned that the labor market was starting to melt however that price hikes is likely to be wanted if the labor market strengthened.

“Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response,” he mentioned.

But there have been components slowing development, he mentioned.

The current rise in long-term bond yields

BX:TMUBMUSD10Y,

together with extra stringent financial institution lending requirements, had contributed to tighter monetary situations.

“This tightening typically contributes to a slowing in the growth of economic activity, and there is evidence of that in this cycle as well,” Powell mentioned.

In one other nod to the doves, Powell mentioned that the economic system might not have felt the total impact but of the Fed’s fast financial tightening over the previous 12 months and a half.

“The wide range of estimates of these lags suggests that there may be significant further drag in the pipeline,” he mentioned.

Fed officers who need the Fed to boost charges extra this 12 months usually assume that the results from previous price hikes have already hit the economic system.

In June, Fed officers penciled in another price hike this 12 months. The Fed’s benchmark price is now in a variety of 5.25%-5.5%. There are three coverage conferences left in 2023.

Powell mentioned the Fed thinks that rates of interest are actually “restrictive,” or pushing down inflation, however it’s tougher to know if coverage is restrictive sufficient to return inflation to the two% goal, he mentioned.

The cloudy skies “complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little,” Powell mentioned.

In response to Powell’s speech, Adam Posen, president of the Peterson Institute, mentioned, “People should be taking it as more hawkish than they are.”

Powell was very clear he was sticking to the two% inflation goal and “it was very clear that we are going to be higher for longer,” he mentioned, in an interview on the sidelines of the convention.

Josh Shapiro, chief U.S. economist at MRF Inc. mentioned in a analysis observe that “the bottom line is that policy decisions remain seat of the pants relying largely on economic data that is either backward looking or questionable in terms of its true meaning.”

“We would caution against any smugness about the inflation fight being won with a minimum of collateral damage. These are early days in the process and there is still plenty that could go wrong,” he added.

Source web site: www.marketwatch.com