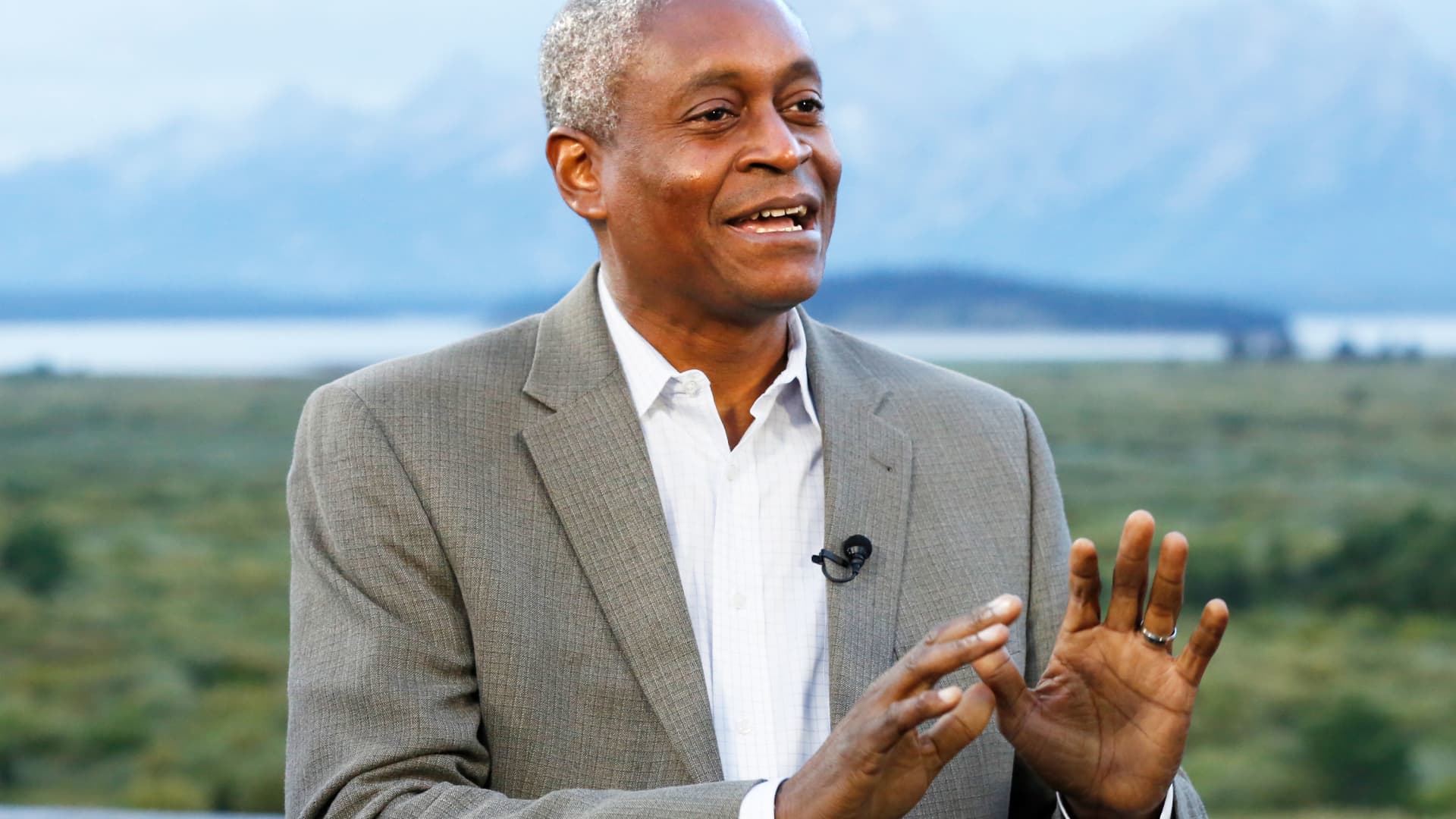

Raphael Bostic at Jackson Hole, Wyoming

David A. Grogan | CNBC

Atlanta Federal Reserve President Raphael Bostic expects policymakers to begin reducing charges within the third quarter of this 12 months, saying Thursday that inflation is properly on its method again to the central financial institution’s aim.

Bostic, a voting member this 12 months on the rate-setting Federal Open Market Committee, asserted that the aim forward is to calibrate coverage to be not so restrictive as to choke off development whereas nonetheless appearing as a bulwark in opposition to persistently elevated costs.

However, he mentioned a “golden path” state of affairs of tamping down inflation whereas selling stable development and wholesome employment is getting nearer than many Fed officers had anticipated.

“Because I’m data dependent, I have incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter,” Bostic mentioned in ready remarks for a speech to enterprise leaders in Atlanta.

While the remarks assist illuminate a timeline for price cuts, additionally they function a reminder that Fed officers and market members have totally different expectations about coverage easing.

Current pricing within the fed funds futures market factors to the primary reduce coming as quickly as March, based on the CME Group’s FedWatch measure. The implied chance for 1 / 4 proportion level discount has decreased in current days however nonetheless stood round 57% Thursday morning. Pricing additional signifies a complete of six cuts this 12 months, or one at each FOMC assembly however one from March ahead.

Bostic mentioned he is not useless set in opposition to reducing sooner than the third quarter, implying a transfer in July on the earliest, however mentioned the bar will probably be excessive.

“If we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate normalization sooner than the third quarter,” he mentioned. “But the evidence would need to be convincing.”

Numerous elements might change the calculus, akin to geopolitical conflicts, the continuing funds battle in Washington and looming presidential election, to call just a few that Bostic cited.

Consequently, he advocated warning and mentioned his method will probably be “grateful and vigilant.”

“In such an unpredictable environment, it would be unwise to lock in an emphatic approach to monetary policy,” Bostic mentioned. “That is why I believe we should allow events to continue to unfold before beginning the process of normalizing policy.”

Some of the information factors he mentioned he will probably be watching embrace general financial development, inflation readings such because the Commerce Department’s private consumption expenditures value index and knowledge on job development and losses.

The Labor Department reported Thursday that preliminary jobless claims hit their lowest degree since September 2022, an indication that the labor market stays tight.

Source web site: www.cnbc.com