Shares of Fisker Inc. prolonged their losses under $1 after the electric-vehicle maker misplaced its most bullish analyst, who cited the corporate’s continued accumulation of “unanticipated growing pains” for his lack of religion.

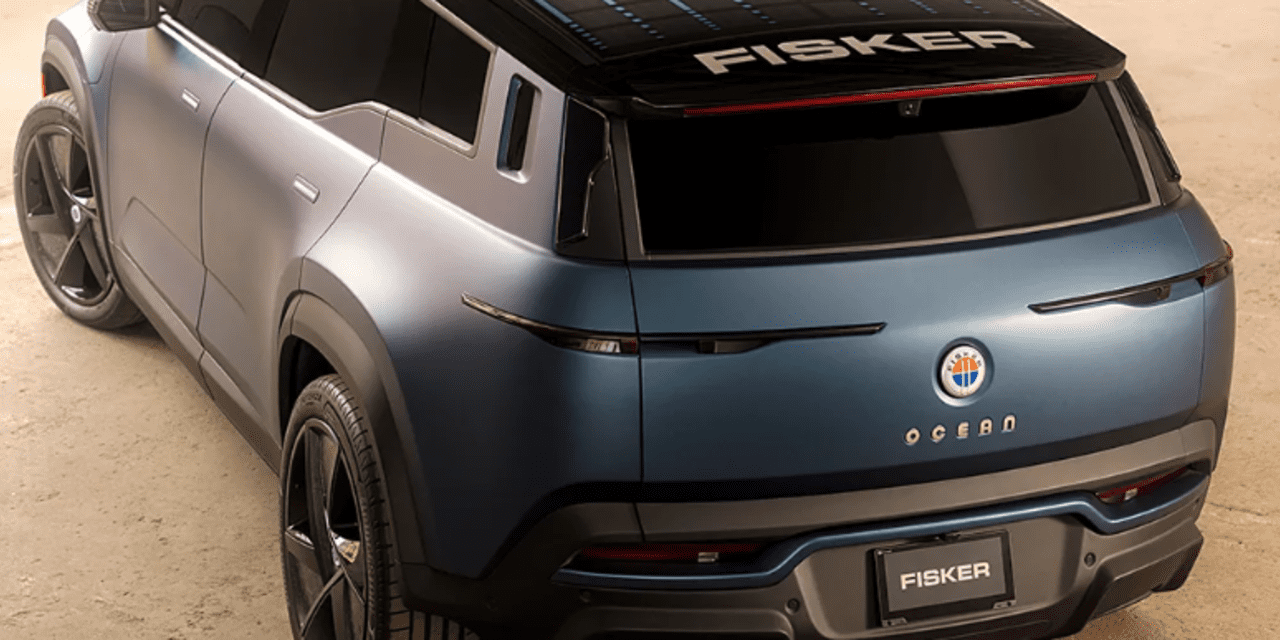

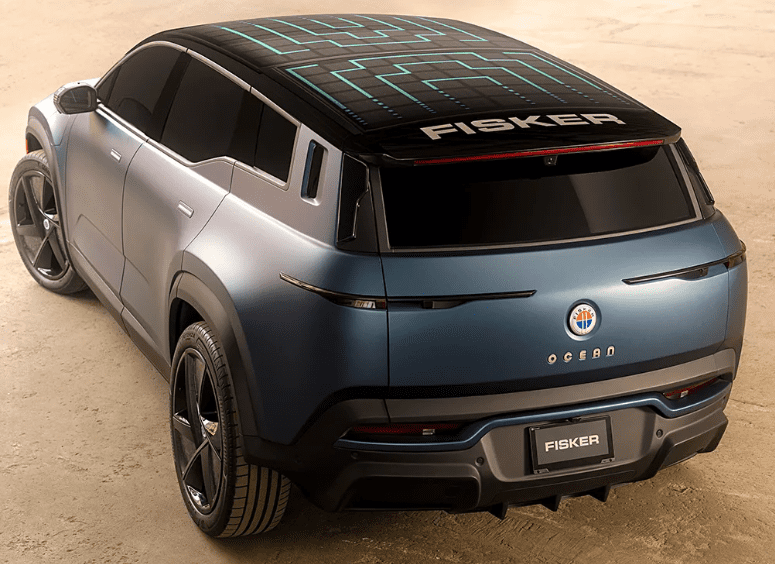

“While we still believe Fisker has the potential to be a player in the EV market, the inconsistency of delivery cadence, shift in distribution strategy and now an investigation into the Ocean’s braking performance, give us pause in recommending the stock,” TD Cowen analyst Jeffrey Osborne wrote in a observe to shoppers Wednesday.

Osborne minimize his ranking on the inventory to market carry out, after it had been at outperform for at the least the previous three years. His value goal swung to $1, which is now the bottom of the 13 analysts surveyed by FactSet who cowl Fisker, from $11 beforehand, which had been the best.

Fisker shares

FSR,

tumbled 7.4% towards a report low in afternoon buying and selling. It had closed under $1 for the primary time on Tuesday, amid experiences that the National Highway Traffic Safety Administration was trying into the Fisker Ocean for questions of safety associated to braking efficiency.

“[W]e admit we missed the mark on the timing of Fisker reaching its potential and tried to maintain our faith, in what we still see as a promising product, for too long,” Osborne wrote.

The California-based firm stated it had no remark presently on the experiences of the NHTSA’s probe.

Osborne stated that whereas regulatory probes are “relatively common” for auto producers and often have little monetary affect, the NHTSA’s probe might “thicken the scar tissue on investor sentiment” by leading to “material delays” for a corporation with a “sporadic” delivery-to-production ratio.

The shift in distribution technique Osborne talked about refers back to the firm’s announcement earlier this month that it was abandoning the direct-sales mannequin, in favor of a brand new dealer-partnership enterprise mannequin.

Osborne believes this shift won’t solely put strain on margins, however may also require “incremental state regulatory approvals.” And coupled with “mixed” automobile opinions and an NHTSA probe, he believes the supply delays the corporate has skilled will likely be exacerbated over the following 12 months.

Fisker stated in an electronic mail to MarketWatch that it was already in superior talks with unnamed, “big-name” seller teams concerning partnerships, and that the National Automobile Dealers Association “has expressed excitement” at its shift in technique.

The inventory has now plummeted 85.4% over the previous three months, whereas the Global X Autonomous & Electric Vehicles ETF

DRIV

has slipped 3.4% and the S&P 500 index

SPX

has gained 8% in that point.

Source web site: www.marketwatch.com