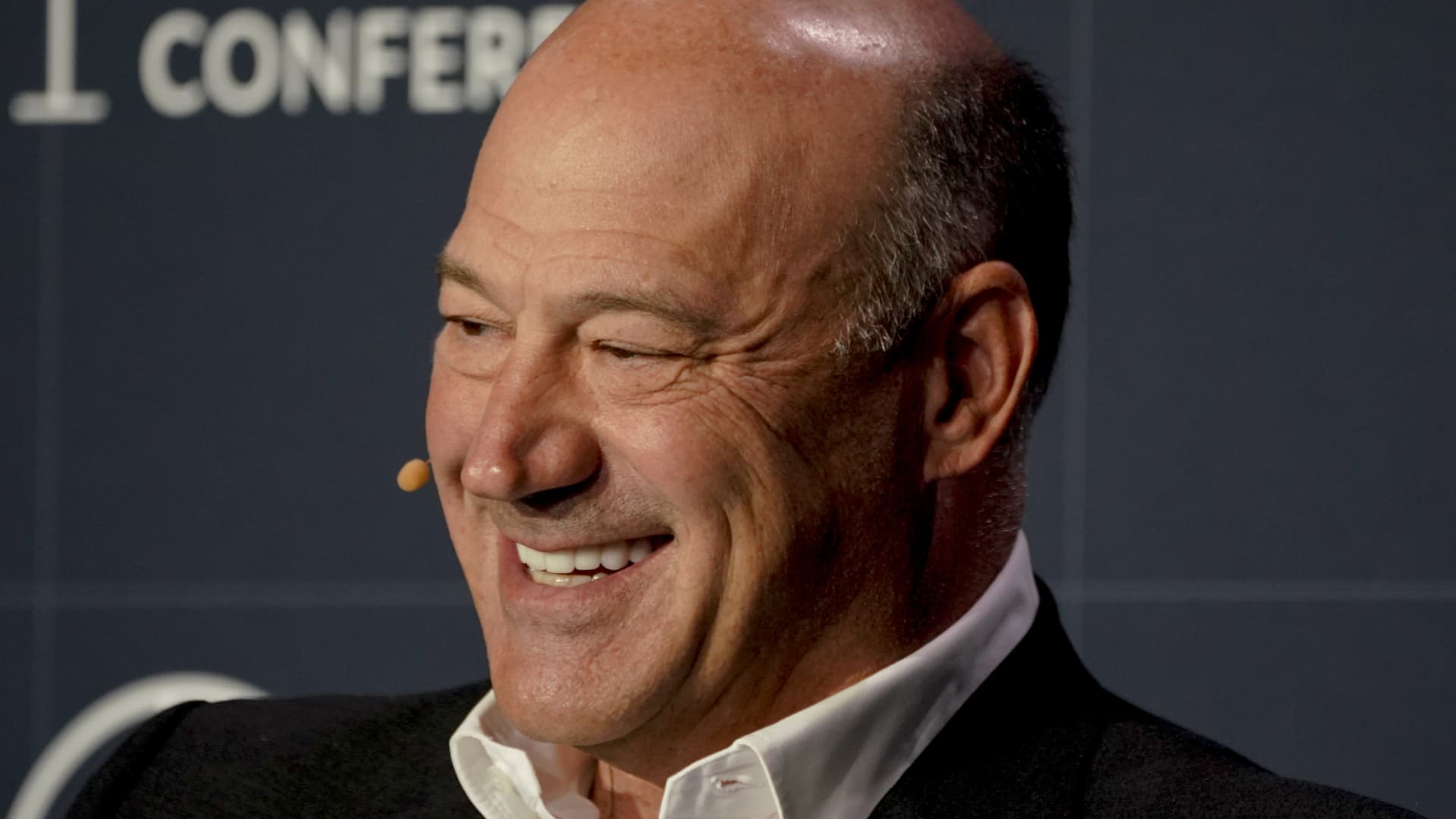

Gary Cohn, vice chairman of International Business Machines Corp. (IBM), throughout the Milken Institute Global Conference in Beverly Hills, California, U.S., on Tuesday, Oct. 19, 2021.

Kyle Grillot | Bloomberg | Getty Images

The U.S. financial system is “back to normal” for the primary time in twenty years, however the market is getting forward of the possible tempo of rate of interest cuts, in keeping with IBM Vice Chairman Gary Cohn.

The market is narrowly pricing a primary fee discount from the Federal Reserve in May 2024, in keeping with CME Group’s FedWatch instrument, with round 100 foundation factors of cuts anticipated throughout the yr.

The central financial institution in September paused its traditionally aggressive financial tightening cycle with the Fed funds fee goal vary at 5.25-5.5%, up from simply 0.25-0.5% in March 2022.

Cohn — who was chief financial advisor to former U.S. President Donald Trump from 2017 to 2018 and is a former director of the National Economic Council — doesn’t see the Fed beginning to unwind its place till not less than the second half of subsequent yr, after comparable strikes from different main central banks that started mountain climbing sooner.

“You don’t want to be early to leave when you’re the last one to come to the party. You have to be the last one to leave the party, so the Fed is going to be the last one to leave this party,” Cohn instructed CNBC’s Dan Murphy on stage on the Abu Dhabi Finance Week convention on Wednesday.

“The economy will clearly turn down before the Fed had starts to cut interest rates, so I strongly believe that for the first half of ’24, we will see no rate activity in the Fed. Maybe [in the third quarter], we’ll start hearing rumblings of some forward guidance of lower rates.”

The U.S. shopper value index elevated 3.2% in October from a yr in the past, unchanged from the earlier month however down significantly from a pandemic-era peak of 9.1% in June 2022.

Despite the sharp rise in rates of interest, the U.S. financial system has thus far remained resilient and averted a broadly predicted recession, fueling bets that the Fed can engineer a fabled “soft landing” by bringing inflation right down to its 2% goal over the medium time period with out triggering an financial downturn.

Cohn highlighted that U.S. shopper debt has soared to report highs of over $1 trillion, and that shopper spending is persisting regardless of tightening monetary circumstances. He mentioned the buyer and the broader financial system is “back to a normal, but we all forgot what normal is.”

“We haven’t seen normal for over two decades. We went through a decade plus of zero interest rates, we went through a decade of quantitative easing, zero interest rates and the Fed trying to see if they could create inflation,” he mentioned.

“We’ve gone from the Fed not being able to create inflation — we now know the answer, the Fed can’t create inflation, but the market can — to us trying to unwind a shorter term inflationary shock. We’re back into a normal world.”

He famous that the 100-year common for 10-year U.S. Treasury yields is round 4.5%, and that the 10-year yield has moderated from the 16-year excessive of 5% logged in October to round 4.3% as of Wednesday morning. Meanwhile, inflation is “running back towards the mean” of between 2% and a pair of.5%.

“So every piece of economic data, if you look, is sort of heading back towards its very long term average. If you look at these over 100-year generational cycles, we seem to be running into that phase right now,” Cohn added.

Source web site: www.cnbc.com