Fund managers are now not forecasting a U.S. recession for the primary time in a yr and half, in keeping with a intently adopted survey.

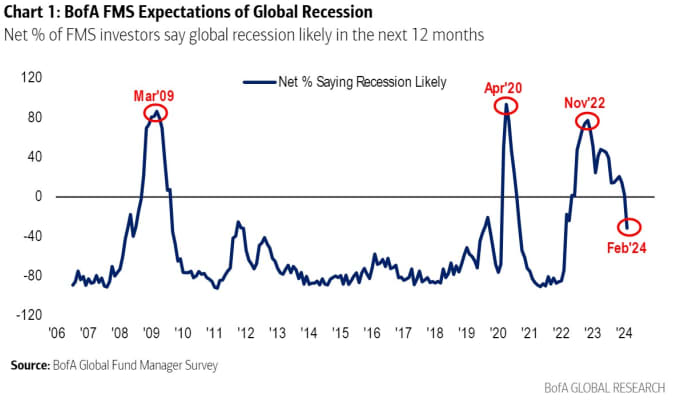

Bank of America’s month-to-month world fund supervisor survey finds the share anticipating a worldwide recession within the subsequent 12 months has turned adverse for the primary time since April 2022.

The survey, which for February counted 249 panelists with $656 billion in property underneath administration, usually is used not simply as a illustration of market views however as a supply for contrarian concepts.

The p.c anticipating a stronger financial system over the subsequent 12 months continues to be adverse, however at -25% is probably the most optimistic since Feb. 2022. Just 11% count on a tough touchdown, whereas about two-thirds nonetheless say a mushy touchdown is the more than likely case for the worldwide financial system.

With this financial optimism, fund managers taken their money ranges right down to 4.2% in February from 4.8% in January, close to the Bank of America contrarian promote sign when money is at or beneath 4%.

The fund managers choose the “long Magnificent Seven” commerce to be probably the most crowded one, which at 61% is probably the most crowded since 64% in Oct. 2022 stated lengthy the U.S. greenback was probably the most crowded commerce.

Related: The Magnificent Seven are so large, they’re value as a lot as all of the shares in Japan, France and the U.Okay. put collectively

The second most crowded commerce is brief Chinese equities, at 25%.

U.S. business actual property took the number-one spot for the more than likely supply of a systemic credit score even after the latest warnings from New York Community Bancorp

NYCB,

Aozora Bank

8304,

AOZOY,

and Deutsche Pfandbriefbank

PBB,

The largest change in allocations was a rotation into telecom, shares extra broadly, tech and the U.S., and out of rising markets, actual property funding trusts, staples and money.

Overall, traders are bullish tech, healthcare, shares, U.S. and telecom and bearish U.Okay., REITs, utilities, vitality and banks.

The S&P 500

SPX

ended Monday simply shy of one other report excessive and has superior 21% during the last 52 weeks.

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

has climbed 31 foundation factors this yr on rising optimism over the U.S. financial system.

Source web site: www.marketwatch.com