The odds stay stacked in opposition to GameStop, even with the sudden revenue the corporate reported earlier this week.

That’s as a result of GameStop

GME,

at its now much-higher inventory worth, is simply as overvalued because it was earlier than, if no more so. Its share worth has been pushed larger in no small half by speculators who’re interested in the inventory’s lottery-type buying and selling traits. Stocks with related traits are likely to underperform the market, on common.

In labeling GameStop a lottery-type inventory, I’m referring to its previous returns. The inventory has what statisticians name an extended right-hand tail — representing the small probability of profitable large, like a lottery. To illustrate, contemplate GameStop’s day by day returns over the month main as much as its newest earnings report. Its common day by day share change over that interval was a lack of 0.7%, with no day by day return better than 5.1%. But within the buying and selling session following the earnings report, the inventory jumped 35.2%.

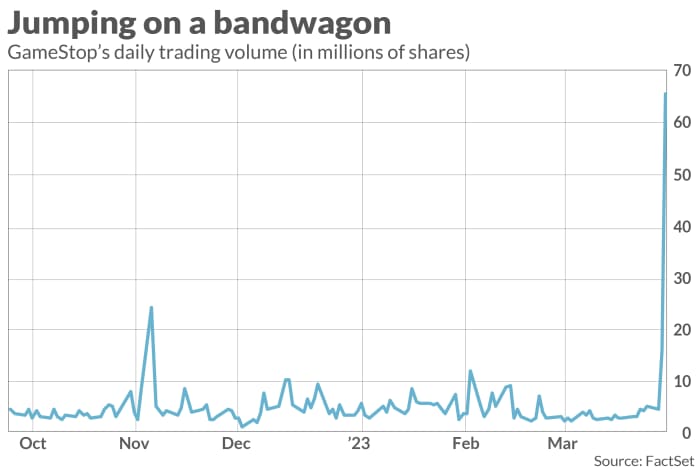

Speculators piled into the inventory in an enormous means, as you possibly can see from the accompanying chart. In distinction to a median day by day buying and selling quantity over the prior six months of 4.6 million shares, quantity jumped to greater than 65 million on the day after the earnings report.

Many of the speculators who propelled GameStop’s inventory larger have no real interest in the corporate’s long-term turnaround prospects. They as an alternative piled into the inventory in hopes of profitable large on a short-term commerce. To that extent, the inventory’s worth will probably be larger than is justified by the corporate’s fundamentals, and due to this fact overvalued. This is one motive, in accordance with a latest examine circulated by the National Bureau of Economic Research, lottery-type shares proceed to underperform the market, on common.

This tendency could have already begun with GameStop. In after-hours buying and selling the identical day by which its buying and selling quantity skyrocketed, the inventory was buying and selling for five% lower than its volume-weighted common worth through the day session.

“ A stock acquires lottery-like characteristics because of a feedback loop involving volatility, investor attention, and social media. . ”

The NBER examine, entitled “Attention, Social Interaction, and Investor Attraction to Lottery Stocks,” was performed by Turan Bali of Georgetown University; David Hirshleifer of the University of Southern California; Lin Peng of Baruch College; and Yi Tang of Fordham University. The researchers discovered {that a} inventory acquires lottery-like traits due to a suggestions loop involving its volatility, investor consideration, and social interactions through channels corresponding to social media.

What occurs is a inventory with comparatively boring day-to-day buying and selling will abruptly come to life. Its large one-day acquire will appeal to the eye of speculative merchants on the lookout for extra, pushing the inventory even larger —at the very least quickly. Social media then catches on, inflicting the inventory to turn out to be much more unstable and attracting much more consideration. Notice that this suggestions loop has nothing to do with a inventory’s underlying web price.

Further proof of this suggestions loop is supplied by the jumps in different meme shares within the speedy wake of GameStop’s sudden revenue. AMC Entertainment

AMC,

and Bed Bath & Beyond

BBBY,

soared in live performance, for instance. Yet GameStop’s surprisingly good earnings don’t have anything to do with the prospects for both of those different two firms. Apparently, the one motive their shares rallied together with GameStop is as a result of they too are lottery-type shares and speculators are fascinated about a fast revenue.

Investors — versus gamblers — needs to be on their guard.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He might be reached at mark@hulbertratings.com

Plus: GameStop surges on shock earnings beat, lifting meme shares AMC and Bed Bath & Beyond

More: The financial institution panic of 2023 might be simply what the inventory market must become profitable for traders once more

Source web site: www.marketwatch.com