Shares of General Electric Co.

GE,

pulled again sharply Tuesday, after the aerospace, energy and renewable-energy firm’s disappointing revenue outlook for the present overshadowed a fourth-quarter earnings beat that was fueled by power within the GE Vernova companies.

For the primary quarter via March, GE expects adjusted earnings per share of 60 cents to 65 cents, which is beneath the present FactSet consensus of 70 cents.

Meanwhile, income development is predicted to develop within the “high-single-digit” share vary, whereas the FactSet income consensus of $15.15 billion implies a 4.6% improve.

The inventory

GE,

dropped 6.2% in premarket buying and selling, which put it on monitor for the most important one-day drop because it sank 6.7% on May 9, 2022. The selloff comes after the inventory had closed Monday on the highest worth since October 2017.

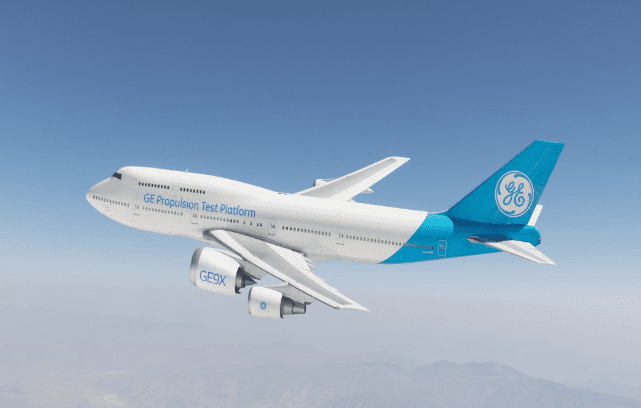

GE’s earnings report could be the final one the corporate releases earlier than the ultimate breakup, which is predicted to happen in early April. The energy and renewable-energy companies will then be spun off as GE Vernova and the remaining enterprise shall be relaunched as GE Aerospace.

For the fourth quarter, web earnings fell to $1.59 billion, or $1.45 a share, from $2.10 billion, or $1.90 a share, in the identical interval a yr in the past.

Excluding nonrecurring objects, adjusted earnings per share elevated to $1.03 from 66 cents, to beat the FactSet consensus of 90 cents.

Total income grew 15.4% to $19.42 billion, nicely above the FactSet consensus of $17.27 billion.

Among GE’s enterprise segments, Aerospace income grew 11.9% to $8.52 billion to high the FactSet consensus of $8.50 billion.

For GE Vernova’s companies, energy income rose 15% to $5.79 billion, nicely above the FactSet consensus of $4.89 billion, and renewable-energy income jumped 23.4% to $4.21 billion, beating expectations of $3.71 billion.

Free money circulate of $3.0 billion was above the common estimate of two analysts surveyed by FactSet of $2.77 billion.

GE’s inventory has run up 23% over the previous three months via Monday, whereas the S&P 500

SPX,

has climbed 15%.

Source web site: www.marketwatch.com