A 12 months after Russia invaded Ukraine and set off the bloodiest battle in Europe since World War II, world monetary markets appear to now not stick with it the lasting shocks each day, however the full penalties and implications are but to return, mentioned a strategist at Deutsche Bank.

U.S. shares tumbled on Feb. 24, 2022, with the Dow Jones Industrial Average

DJIA,

opening down greater than 700 factors, or 2.2%, whereas the large-cap index S&P 500

SPX,

slumped 1.8%, hours after Russian President Vladimir Putin introduced the navy motion. Meanwhile, oil costs rallied with the U.S. benchmark West Texas Intermediate crude

CL00,

CL.1,

CLJ23,

rising to $100 a barrel on the New York Mercantile Exchange for the primary time since 2014.

See: What Russia’s invasion of Ukraine means for markets a 12 months later

As of Friday, the Dow industrials have been barely decrease from a 12 months in the past after tumbling for many of 2022 and bouncing off October lows in early 2023. The S&P 500 slumped 7.4% up to now 12 months, whereas the Nasdaq dropped 15.5%, in response to Dow Jones Market Data.

Meanwhile, bonds wrapped up their worst 12 months on report in 2022. Instead of holding up as shares tumble, nearly each sort of bond — from the U.S. and European authorities bonds to top-rated company bonds — posted double-digit losses up to now 12 months.

A steep U.S. Treasury selloff despatched yields hovering, with the yield on the 2-year notice

TMUBMUSD02Y,

rising 3.67 proportion factors for the 12 months, whereas the 10-year yield

TMUBMUSD10Y,

jumped 2.33 proportion factors, the most important on report based mostly on information going again to 1977, in response to Dow Jones Market Data. Bond costs and yields transfer in reverse instructions.

The carnage, significantly in U.S. markets, got here because the Federal Reserve aggressively ratcheted up rates of interest in its effort to calm hovering inflation that had accompanied the restoration from the preliminary COVID shock. A sequence of hikes started in March of final 12 months.

“With regards to the last year since the Ukraine invasion, most of the negative bond returns of the last three years have occurred in this period,” wrote Jim Reid, a strategist at Deutsche Bank, in a notice to purchasers on Friday.

“The war in Ukraine started only a few weeks before the U.S. led the DM [developed market] global hiking cycle. So although the backdrop for the bond selloff was already in place with the extreme covid stimulus, it wasn’t until the central banks started hiking that the bond dam broke.”

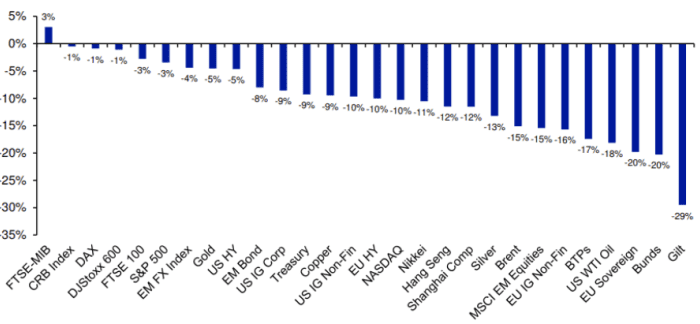

In the chart under, Deutsche Bank highlights returns for chosen main asset courses over the 12 months because the invasion.

Total return efficiency of chosen main world monetary property in final 12 months because the begin of Ukraine War (in USD).

SOURCE: BLOOMBERG FINANCE LP, DEUTSCHE BANK

Since February 2022, world traders have pulled a complete of $135 billion from bond funds, in response to analysts at BofA Global Research, citing EPFR Global information in a weekly notice. Meanwhile, traders have allotted $354 billion to money since Russia’s invasion of Ukraine. Equity funds have witnessed a complete of $40 billion of inflows, and gold has seen $12 billion of outflows, mentioned Michael Hartnett, chief funding strategist at BofA Global Research.

Contrary to what many would have anticipated, given Europe’s proximity to the conflict, European equities have outperformed U.S. equities over the previous 12 months, as traders took cash out of U.S. equities so as to add to their publicity in worldwide inventory markets, betting European markets may benefit from a weaker greenback.

The MSCI Euro index

MPEH23,

which tracks the efficiency of enormous and mid-cap illustration throughout 15 developed markets in Europe, climbed greater than 8% over the previous 12 months, whereas the MSCI USA slumped 7.2%, in response to Dow Jones Market Data.

“The dollar has rallied 6.5% against the euro; the European outperformance in local currency terms is even higher. The overall outperformance could of course be more to do with a much higher weighting to tech in the U.S. which has underperformed on much higher rates and extreme starting valuations,” mentioned Reid.

After rallying for many of 2022, the greenback’s worth relative to different currencies had dipped over the previous few months because the Federal Reserve spoke of constructing progress in bringing down inflation pressures. However, a flurry of hotter-than-expected January inflation reviews helped buoy the buck and reversed the greenback losses. The ICE U.S. Dollar Index

DXY,

jumped 3.2% to 105.20 this month.

See: Why U.S. gas costs proceed to really feel the consequences of Russia’s invasion of Ukraine

Meanwhile, the U.S. benchmark crude ended Friday round 17% under the extent seen simply forward of Russia’s invasion of Ukraine.

“Ironically, given the war in Europe, oil is one of the worst performers over the last year. Even European gas prices are more than 50% lower than they were a year ago, albeit after being up 200% by the end of August,” mentioned Reid.

See: The actual influence of Russia’s invasion of Ukraine on commodities

Source web site: www.marketwatch.com