Just days forward of probably pivotal outcomes from Nvidia Corp., Goldman Sachs has lifted its year-end S&P 500 goal to five,200, however with a lot of that hinging on Big Tech’s means to maintain delivering robust income.

“Our upgraded 2024 EPS forecast of $241 (8% growth) stands above the median top-down strategist forecast of $235 (6% growth) and reflects our expectation for stronger economic growth and higher profits for the Information Technology and Communication Services sectors, which contain 5 of the ‘Magnificent 7’ stocks,” stated a crew led by David Kostin, chief U.S. fairness strategist, in a observe late Friday.

With its new goal, Goldman falls in keeping with a few of Wall Street’s most bullish forecasters — Oppenheimer’s John Stoltzfus and Fundstrat’s Tom Lee who additionally see a 5,200 end after every precisely known as 2023’s rally. Ed Yardeni of Yardeni Research is on the high, with a goal of 5,400.

It marks the second time Goldman has lifted its S&P 500 goal, after a bump to five,100 from 4,700 in late December. Earlier this yr, RBC Capital boosted its S&P 500 forecast to five,150 from 5,000 and UBS raised its personal goal to five,150 from 4,850.

Behind that new forecast is a extra bullish financial outlook — Goldman’s economists not too long ago lifted their 4Q/4Q 2024 actual U.S. GDP development forecast to 2.4% because of stronger shopper spending and residential funding. That’s as they count on an S&P 500 ahead worth/earnings a number of of 19.5 occasions, barely under the present 20 occasions.

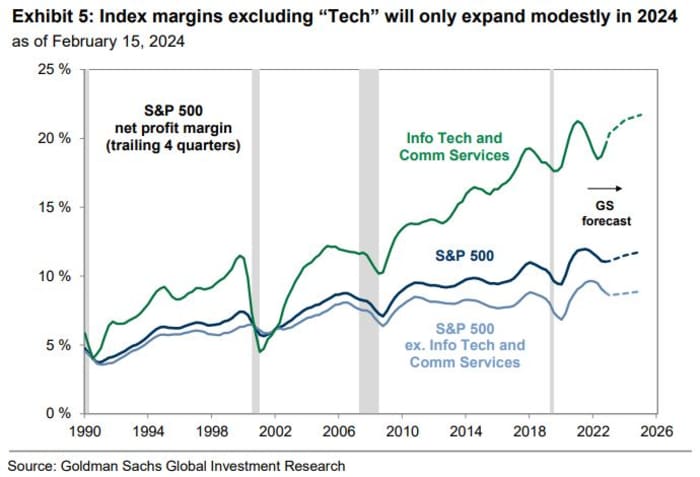

“The nearly-completed 4Q earnings season highlighted the ability of corporates to sustain profit margins despite slowing inflation,” stated Kostin and his crew.

But the financial institution’s rosier outlook hinges on the flexibility of Big Tech to maintain performing. Kostin and his crew famous how the fourth quarter had “highlighted the ongoing fundamental strength” of the Magnificent 7 shares — Meta Platforms

META,

Microsoft

MSFT,

Apple

AAPL,

Alphabet

GOOGL,

Tesla

TSLA,

Neflix

NFLX,

and Nvidia

NVDA,

Analysts have warned that Nvidia earnings, due Wednesday, might mark a “make or break” second for shares, with expectations for earnings per share of $4.59, a greater than 700% surge from the identical quarter final yr.

Read: Bullish bets on Nvidia, different ‘Magnificent Seven’ members close to their most crowded ranges prior to now yr

As Deutsche Bank strategist Jim Reid informed shoppers on Monday, “it’s a reflection of the world we live in that the most important event of the week may be Nvidia’s earnings on Wednesday. It is now the 4th largest company in the world and the best performer in the S&P 500 so far this year (+46.6% YTD), so this will be very important for sentiment.”

Addressing Nvidia earnings straight, Goldman strategists stated if the chip maker reviews in-line estimates, “the Magnificent 7 will have grown sales by 15% year/year and lifted margins by 582 basis points year/year, leading to earnings growth of 58%.”

The financial institution expects Information Technology and Communications Services, which include 5 of the Magnificent 7 — Meta, Microsoft, Apple, Alphabet and Nvidia — to submit the strongest earnings development amongst S&P 500 sectors this yr. The remainder of the index will see some slight enhancements, however “to a much smaller degree,” they stated.

Goldman added that power in Big Tech has additionally pushed greater forecasts amongst its friends, with Magnificent 7 earnings estimates revised up by 7% prior to now three months and margins forecasts by 86 foundation factors. That’s versus 3% and 30 foundation factors downward revisions to earnings and margins forecasts for the remainder of the 493 shares.

The financial institution stated stronger U.S. development than anticipated or continued upside surprises from mega-caps might each be upside dangers to their forecasts.

“Likewise, disappointing growth in the macroeconomy or from the largest stocks would create downside risk to our S&P 500 earnings forecasts. In addition, an acceleration in input cost inflation would diminish the outlook for the nascent profit margin rebound and therefore for broad corporate earnings growth,” stated Kostin and his crew.

Source web site: www.marketwatch.com