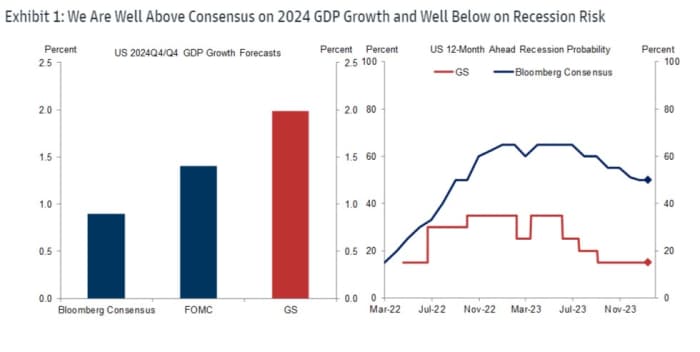

Goldman Sachs thinks the U.S. economic system shall be rising by greater than double market consensus on the finish of 2024, and has a listing of 10 the reason why it’s extra optimistic than most.

In a observe revealed over the weekend, a Goldman economics workforce led by Jan Hatzius stated they see U.S. GDP increasing on an annualized foundation by 2% within the fourth quarter of this yr, in comparison with about 0.9% proven in a Bloomberg ballot of economists.

Goldman additionally sees a lower than 20% likelihood of a U.S. recession within the subsequent 12 months, whereas the Bloomberg consensus is about 50%.

This prompts Goldman to ask the query: “What are other forecasters worried about that we aren’t?” To reply they’ve checked out 10 dangers for 2024 which might be typically highlighted by different forecasters and defined why they fear much less.

Source: Goldman Sachs

The first threat perceived by many is a shopper slowdown if unsustainable spending ends, the saving charge rises from a low stage, or households run out of extra financial savings.

But Goldman says it expects 2% consumption development this yr as a result of actual wage development will stay optimistic as nominal wages rise however inflation falls, all whereas a strong jobs market encourages spending and opposite to expectations the exhaustion of extra financial savings won’t have the influence some concern.

“While spending by low-income households whose incomes were boosted most by pandemic stimulus initially rose above trend, it normalized a while ago,” says Goldman.

That hyperlinks to the second concern of rising shopper delinquency and default charges. “[These] mostly reflect normalization from very low levels in recent years, higher interest rates, and riskier lending, not poor household finances,” the financial institution contends.

Next is the concern of a sharper deterioration within the labor market. Goldman thinks that is unlikely given job openings are nonetheless excessive and the speed of layoffs nonetheless sluggish.

“While a few recent data points have been weaker, more statistically reliable signals such as trend payroll growth and our composite job growth tracker remain strong,” says Hatzius and the workforce.

Some observers have expressed considerations about the slender breadth of job development, which of late has been dominated by healthcare, leisure and hospitality and authorities.

But Goldman says there are a number of causes this isn’t such an issue, together with that these three sectors should not small, accounting for 40% of employment, and an enormous purpose they’ve attracted labor is as a result of they have been understaffed and raised relative pay to staff.

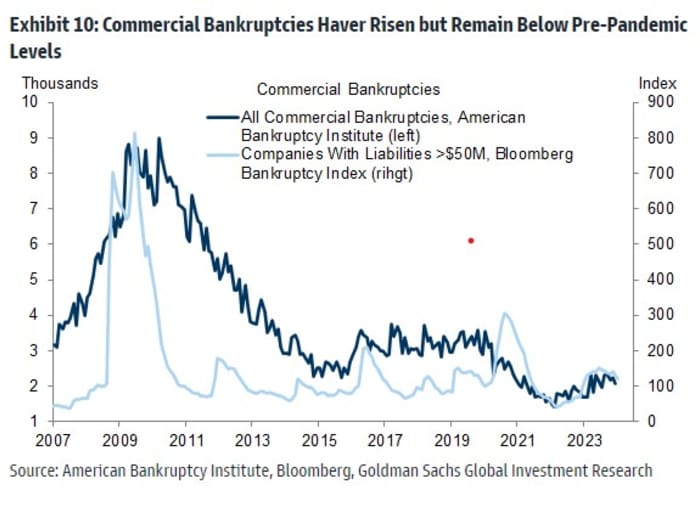

Fifth on the checklist is the prospect of rising company bankruptcies. However, Goldman contends that giant and small firms are usually on “solid financial footing” and that the present variety of bankruptcies remains to be nicely under the pre-pandemic stage. “While large company bankruptcies are somewhat higher, they have only returned to their 2019 levels,” says Goldman.

Source: Goldman Sachs

One purpose some observers concern company stress is the looming debt maturity wall as firms need to refinance at increased rates of interest. Goldman thinks the influence shall be modest, with increased company curiosity expense lowering capex development by 0.1 proportion factors in 2024 and 0.25pp in 2025, and hiring by 5,000 jobs a month in 2024 and 10,000 jobs a month in 2025.

“The effect is small in part because the increase in interest expense should only be moderate and in part because increases in interest expense have only modest effects on capital investment and hiring,” says Goldman.

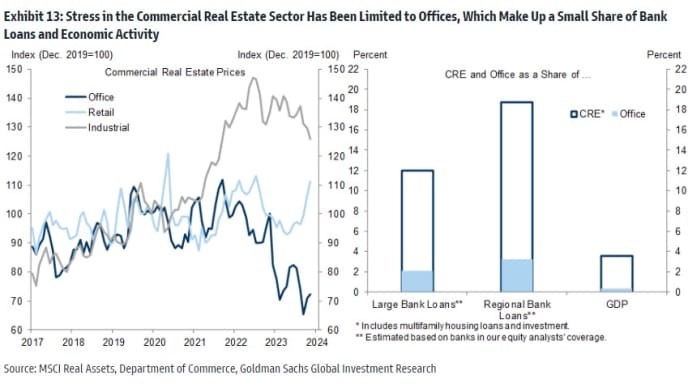

An space of extreme concern is business actual property, as distant work leaves many workplace buildings half empty and financially unviable. There are worries that some lenders will battle to soak up the losses on their business actual property portfolios.

But Goldman stresses that it’s places of work particularly and never CRE broadly that face an enormous drawback and that workplace loans account for less than 2-3% of banks’ mortgage portfolios.

“As a result, banks should be able to manage the headwind from lower office values. Indeed, the Fed’s 2023 stress test found that the banks subject to these tests would have enough capital to weather even an extreme scenario where CRE prices declined 40% and the unemployment rate rose to 10%,” Goldman says.

Source: Goldman Sachs

Other elements that Goldman thinks should not such an issue are: one thing lastly breaks, however peak ache from increased rates of interest is already handed; fading fiscal assist won’t be the drag observers concern; financial institution credit score crunch, however small enterprise haven’t reported a extreme lack of entry to credit score.

Source web site: www.marketwatch.com