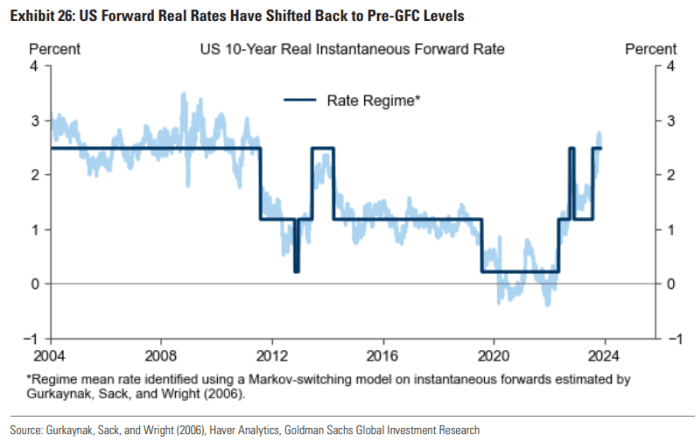

With the Federal Reserve holding its benchmark rate of interest on the highest stage in 22 years, analysts at Goldman Sachs Group say the “big question” for traders is whether or not the return to bond yields seen earlier than the worldwide monetary disaster of 2008 proves persistent.

“For the U.S., we have more confidence that longer-run rates will ultimately settle higher than the Fed expected last cycle,” Goldman analysts stated in an economics analysis report dated Nov. 8. “Resilience in the U.S. looks surer than in some other economies.”

GOLDMAN SACHS ECONOMICS RESEARCH NOTE DATED NOV. 8, 2023

Investors have been anxious concerning the Fed leaving rates of interest greater for longer, though many are also anticipating that the central financial institution is completed elevating them after inflation has eased from its 2022 peak.

“A period of ‘higher for longer’ yields may expose areas of vulnerability in the U.S.—whether it is the access to finance for smaller companies, continued pressure on some credit provision by small banks, or subdued mortgage, housing, and commercial real estate activity,” the Goldman analysts stated. But “we do not expect these to threaten the overall economic outlook.”

They additionally pointed to investor concern over the U.S. public debt profile and introduced the 2024 U.S. presidential election into focus.

“We think markets will remain patient unless next year’s U.S. elections bring the possibility of fresh unfunded fiscal expansion,” the Goldman analysts stated.

Long-term Treasury yields rose this week, with the speed on the 10-year Treasury be aware

BX:TMUBMUSD10Y

at 4.627% on Friday, in keeping with Dow Jones Market Data. While 10-year yields have fallen this month, they’re nonetheless up round 80 foundation factors to this point this 12 months primarily based on 3 p.m. Eastern Time ranges on Friday.

U.S. yield volatility is “too high” and prone to decline “in our central case,” the Goldman analysts stated. The “challenge to higher returns” from longer-term authorities bonds is that “the market is still pricing rate cuts that we think will not be delivered under our baseline forecasts.”

Read: Heightened charge volatility factors to those alternatives in shares, bonds for ETF traders, says State Street’s Michael Arone

The Fed lifted its benchmark charge to five.25% to five.5% in July, and has saved it at that stage in an effort to tame inflation that is still above its 2% goal. The Fed’s subsequent coverage assembly might be in December.

“Beyond the growth challenges from higher rates and ongoing geopolitical risks, the biggest reason that a shift toward more balanced allocations may prove premature is the obvious one: the prospect that better growth, stickier inflation, and weaker fiscal positions lead to continued upward pressure on yields and downward pressure on valuations,” stated the Goldman analysts. “We think those concerns are likely to remain a feature of the near-term outlook, at least until inflation eases enough to settle them.”

Still, whereas the return on money stays “high,” Goldman sees different asset lessons outperforming, “at least modestly,” subsequent 12 months, in keeping with the be aware. “A more constructive view on the value of duration in portfolios is a new element for our outlook.”

The U.S. financial system is on monitor to develop 2.4% in 2023, which is 2 proportion factors above the consensus forecast from a 12 months in the past, the analysts stated. Goldman sees only a 15% likelihood of a recession beginning within the subsequent 12 months, under the median forecast for a roughly 50% likelihood, the be aware exhibits.

Still, “the value of bonds as a recession hedge should rise in a world where central banks cut interest rates to offset downside growth risk, especially as inflation falls further,” the Goldman analysts stated.

“Longer-dated yields above the cash rate would make the case for adding duration simpler,” they stated, “so the market may need to reach that point, particularly if worries about fiscal sustainability require a larger premium than we expect.”

Source web site: www.marketwatch.com