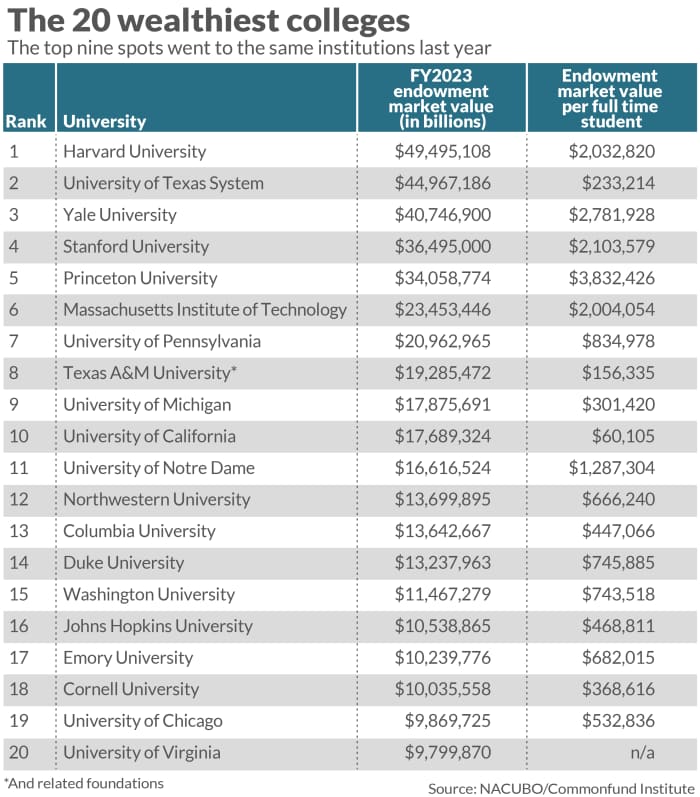

Harvard University’s endowment grew to greater than $49.5 billion final yr, making it as soon as once more the nation’s wealthiest faculty.

The University of Texas System wasn’t far behind with an endowment worth of practically $45 billion, whereas Yale University remained the third-richest faculty at the same time as its endowment market worth dropped barely from final yr.

The rating of the nation’s largest faculty endowments is the results of a research of the monetary belongings of practically 700 tutorial establishments, printed Thursday by the National Association of College and University Business Officers and the Commonfund Institute.

Some establishments, just like the University of California system, noticed their fortunes swing during the last yr. UC’s market worth jumped 14.7% to just about $17.7 billion, permitting the system to have the Tenth-largest endowment and bumping the University of Notre Dame out of the No. 10 spot. The prime 9 college endowments by market worth had been unchanged from 2022. The common faculty endowment noticed a 7.7% return within the final fiscal yr ending June 30, 2023, in response to the report.

The research showcased the numerous wealth that some schools have at their disposal. Harvard’s endowment, for instance, is price greater than the annual gross home product of nations like Jordan, Bolivia and Paraguay.

The findings come amid continued debate over whether or not rich, tax-advantaged universities ought to obtain extra scrutiny. Following clashes on campuses throughout the nation over matters like range, fairness and inclusion and the Israel-Hamas struggle, conservative lawmakers have regarded to focus on the endowments of wealthy, name-brand colleges. In the previous, college-access organizations and others have additionally questioned whether or not colleges with massive endowments ought to be spending extra on making faculty financially viable for a bigger swath of scholars.

“Whether the criticism is coming from the left or the right, there’s not a lot of people to stand up and defend the leaders of Ivy League institutions, and I think that’s in part because they’re not using their endowments to serve most Americans,” stated Charlie Eaton, creator of “Bankers in the Ivory Tower, The Troubling Rise of Financiers in U.S. Higher Education.”

The bulk of the cash that universities drew down from their endowments final yr was spent on monetary support. Schools used practically 48% of their distributions, on common, for that function, in response to the report. But there is a chance to do extra, in response to critics like Jennifer Bird-Pollan, affiliate dean of educational affairs on the University of Kentucky’s J. David Rosenberg College of Law.

“Where’s the growth going? What does that mean for the university? Or do you just sort of pat yourself on the back and say we had another banner year for the endowment?” she stated.

Private foundations are required to spend no less than 5% of their belongings on charitable features annually. Universities had a median endowment-spending fee of 4.7% final yr, in response to the survey. At universities with endowments over $1 billion, the typical fee was 4.5%.

‘We don’t ever ask, how a lot is sufficient?’

Universities counter that endowments aren’t simply piggy banks, however are quite meant to shore up the long-term way forward for the faculty. Additionally, colleges are restricted within the methods they’ll spend their endowment cash as a result of donors flag it for particular makes use of, schools say. And establishments do use them to fund operations; on common, colleges use their endowments to pay for 11% of their annual working budgets, the research discovered. Schools with bigger endowments stated they funded 17% or extra of their budgets.

Still, to Bird-Pollan, the deal with endowments’ progress and worth highlights how disconnected they are often from universities’ priorities general.

“We don’t ever ask, how much is enough? We just say more is always better,” she stated. “I think it’s worth asking if that’s really true. What did the donors have in mind when they gave this huge amount of money to the university? Did they have in mind that it was going to go to some hotshot investment bank and not really be used for the functioning of the university?”

Part of that progress mindset is a results of the affect that the broader monetary world’s methods have had on endowment administration over the previous a number of years, Bird-Pollan stated. Indeed, between fiscal years 1988 and 2023, the share of endowment belongings allotted to various investments, like non-public fairness and enterprise capital, went from lower than 10% to greater than 50%, the research discovered.

Typically, bigger endowments carry out higher than smaller endowments — however that wasn’t the case final yr. Schools with endowments valued at lower than $50 million noticed a 9.8% return, in contrast with 2.8% for colleges with endowments over $5 billion and a 5.9% return for colleges with endowments valued between $1 and $5 billion, per the research.

That’s as a result of smaller endowments had been extra uncovered to public equities, which carried out higher than these options final yr, Commonfund Institute Chief Executive Mark Anson advised reporters on a convention name.

Still, the flexibility of bigger endowments to resist the form of danger related to various investments will most likely permit them to fare higher in the long run, stated Eaton, an affiliate professor of sociology on the University of California, Merced. Smaller endowments might not be capable to afford to topic themselves to the form of short-term volatility related to these sorts of belongings, he famous.

That some colleges’ endowments can climate swings of their funding efficiency signifies how disconnected the funds could also be from some universities, Eaton stated.

“When you’re endowment grows to be $50 billion a year, and it’s so large that it doesn’t really matter for the extent to which you can subsidize your university operations if you have a bad year, that’s kind of a sign that the old logic about endowments doesn’t really hold,” he stated. That “old logic” is the concept the endowment is there to make sure that every technology of scholars obtain the identical academic expertise as their predecessors.

It’s not simply the financial surroundings that may impression college endowments; the political surroundings might play a task, too. The survey indicated that culture-war politics could also be having an affect on the strategy of schools’ funding managers.

About 35% of the colleges featured within the research stated they use some form of accountable investing technique, together with ESG. That determine represents a “leveling off” after seeing progress in earlier years, stated George Suttles, government director of the Commonfund Institute.

The “fraught” political local weather might have prompted some colleges that had been contemplating a accountable investing technique to take pause, Suttles stated.

For the third yr in a row, the survey requested schools in regards to the share of presents to their endowments that had been tagged for range, fairness and inclusion, or DEI. About two-thirds of faculties stated they acquired DEI-related presents, a stage much like earlier years. Overall, about 6.4% of presents to schools in fiscal yr 2023 had a DEI function, in response to the research.

But which will change. The interval the survey covers ended simply because the Supreme Court issued an opinion banning affirmative motion at schools — a ruling that some specialists have stated may impression presents and monetary support. In addition, the reporting interval ended earlier than the latest donor backlash towards schools’ strategy to range, antisemitism and different points.

NACUBO Chief Executive Kara Freeman referred to as the difficulty of DEI “extremely important, as it gets to core mission,”

“Institutions of higher education must reflect both the students they serve and the communities that surround them,” she stated in an e mail. “At the end of the day, our endowments must help leverage and enhance our teaching, research and service capabilities.”

Source web site: www.marketwatch.com