Shares of Hasbro Inc. took a dive Tuesday, after the toy maker reported fourth-quarter outcomes that fell nicely in need of expectations, amid sharp drops in client and leisure gross sales and as stock was halved.

The firm expects declines in 2024 income for each the Consumer Products and Wizards of the Coast enterprise segments, whereas Wall Street was on the lookout for roughly in-line performances.

Hasbro’s inventory

HAS,

sank 11.9% towards a three-month low in premarket buying and selling. That put it on monitor to endure the most important one-day decline because it tumbled 18.7% on March 16, 2020, on the top of the COVID-19 pandemic panic.

Net losses widened to $1.06 billion, or $7.64 a share, from $128.9 million, or 93 cents a share, in the identical interval a yr in the past.

Excluding nonrecurring objects, similar to a adverse $7.18-per-share impairment of goodwill, adjusted earnings per share of 38 cents was down from $1.31 and missed the FactSet consensus of 65 cents.

That marked the third straight miss of earnings expectations, and the most important miss on a share foundation since second-quarter outcomes of 2020, in line with FactSet knowledge.

Revenue dropped 23.2% to $1.29 billion, beneath the FactSet consensus of $1.34 billion.

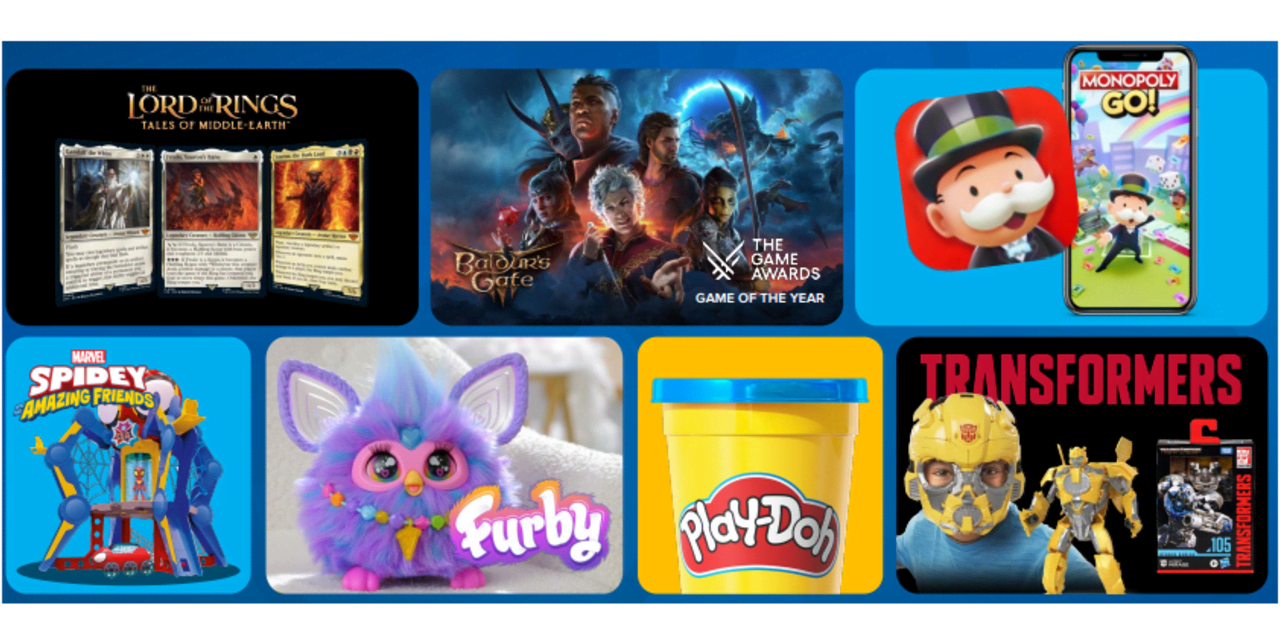

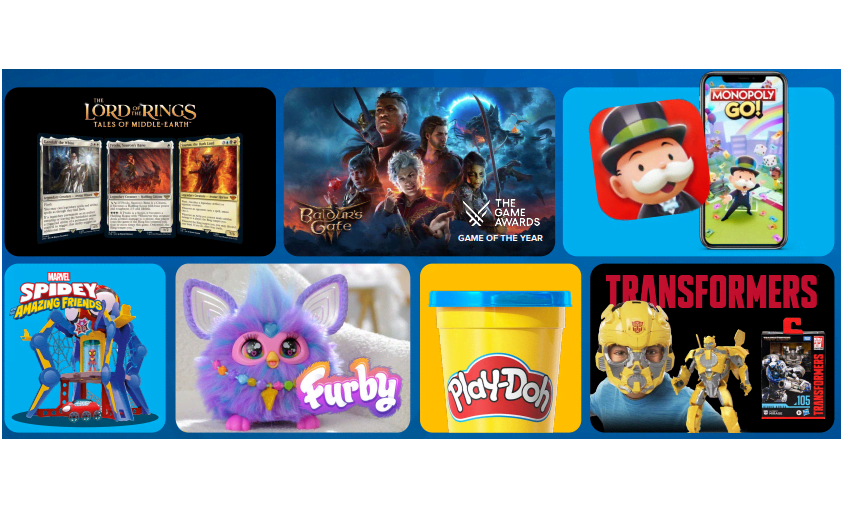

Among Hasbro’s enterprise segments, Wizards of the Coast and Digital Gaming income elevated 10%, as development in digital gaming licenses offset slight declines in Wizards tabletop and digital video games gross sales.

Consumer Products income slumped 25%, with toys and sport quantity dropping 19%, toy and sport fee and blend off 4.7% and license exits contributing a 2.5% decline.

Entertainment income sank 31%, as divested movie and TV property contributed a 34% drop whereas the remaining Hasbro Entertainment income fell 11%.

Inventory on the finish of 2023 was diminished by 51% from a yr in the past, together with a 56% decline in Consumer Products stock.

For 2024, the corporate expects Wizards of the Coast income to fall 3% to five% and Consumer Products income to be down 7% to 14%. The common of two analyst estimates compiled by FactSet implied 0.5% development in Consumer Products gross sales and little change in Wizards of the Coast gross sales.

The inventory has rallied 18.4% over the previous three months by way of Monday whereas the S&P 500

SPX,

has superior 13.8%.

Source web site: www.marketwatch.com