Tuesday’s pop for shares after some grim job opening knowledge helped the S&P 500 and different indexes trim August losses, although touchdown within the inexperienced for the month nonetheless appears to be like like an extended shot. Futures recommend a wrestle for Wednesday.

For these buyers who’ve discovered this summer season powerful going, a group at UBS led by chief funding officer Mark Haefele provide validation. They say markets have being pulled in opposing instructions “netting to no clear direction overall.” That’s as numerous large easy questions don’t have any solutions proper now, equivalent to how sturdy is the patron and are buyers promoting rallies or shopping for dips?

Haefele says positioning suggests buyers are solely again to impartial on shares, and with the S&P 500

SPX

solely off 3.4% from its current peak, there’s “hardly a large dip to buy after a strong rally.”

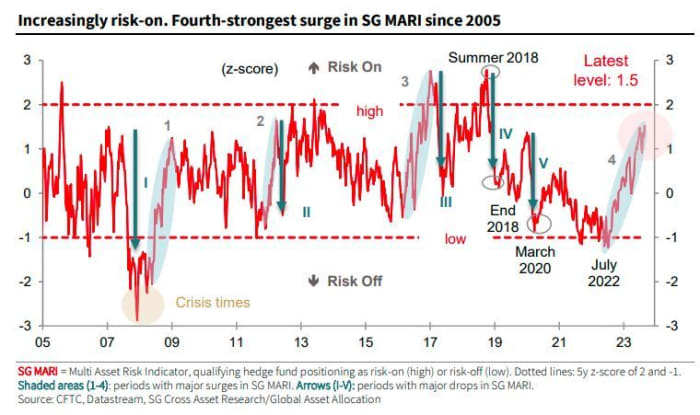

Onto our name of the day from Société Générale, which flags a threat indicator monitoring hedge funds that’s “increasingly risk-on.”

As SG’s strategist Arthur van Slooten and head of worldwide asset allocation Alain Bokobza observe, hedge fund positions, whether or not lengthy or quick, are value watching as they’ll make clear monetary market developments.

“After a nice summer break, we discover that hedge funds have continued to adjust

positions upward and are now clearly risk-on,” they are saying.

They illustrate that by way of their Multi Asset Risk Indicator — SG MARI, which qualifies hedge fund positions as threat on or threat off — now at its highest stage of 1.52 since summer season 2018, when it noticed a peak of two.76. “The current peak has been almost 13 months in the making. During this period, SG Mari has increased by 2.7 points, ranking the episode among the top four strongest recoveries since 2005,” say the strategists, providing the beneath chart:

Van Slooten and Bokobza say happily, the present stage of their threat indicator MARI is “still comfortably below the zone that indicates investor exuberance,” which might be a stage of two or above.

“That said, even though it is still some way from that danger zone, most surges in SG MARI (see shaded areas on the above chart) have been followed by significant drops (see arrows on the chart) in the indicator,” they are saying. So, assume hedge funds having piled into shares and different belongings, backing out in an enormous method.

In May, the strategists famous inconsistency of hedge fund positioning in bonds and fairness. Since that point, shorts on shares to hedge in opposition to a recession have largely been neutralized.

“So, recession fears seem to have been ditched for now, potentially at a rather unfortunate moment,” say the pair.

Last phrase goes to want a cheerful 93rd birthday to Warren Buffett. Long could one of many world’s most adopted buyers reign.

Read: Want to diversify your stock-market investments away from top-heavy indexes? Here’s one other straightforward method.

The markets

U.S. inventory futures

ES00,

NQ00,

are beneath some strain, whereas Treasury yields bounce off close to three-week lows triggered by weak job openings knowledge on Tuesday. The 10-year

BX:TMUBMUSD10Y

is yielding 4.143%. A bitcoin

BTCUSD,

rally has cooled, following Grayscale Investments’ courtroom win.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The U.S. personal sector added 177,000 jobs in August, the bottom quantity since March 2022. Revised second-quarter GDP is due at 8:30 a.m. and pending-home gross sales at 10 a.m.

Brown-Forman inventory

BF.B,

is down over 4% after the Jack Daniel’s dad or mum reported surprisingly weak revenue and gross sales.

Reporting late Tuesday, HP

HPQ,

shares are down 8% after reporting a third-straight income miss and warning of a challenged financial system.

Box

BOX,

inventory is down 9% after the purposes developer earnings that hardly beat forecasts and weak steering. Video-chip maker Ambarella

AMBA,

is down 19% on a disappointing forecast.

After the shut, cloud-based software program group Salesforce

CRM,

will report.

Hurricane Idalia, which weakened to a Cat. 3 storm on Wednesday, has made landfall on Florida’s Big Bend area with winds of not less than 130 mph.

Mutinous Gabon troopers stated they’re overturning the outcomes of a presidential election. Shares of Maurel and Prom

MAU,

a western oil firm with operations within the nation, tumbled in Paris, as did a listed subsidiary of TotalEnergies

EC,

Best of the net

Inside one CEO’s relationship with a TV anchor.

Not the ‘stereotypical retired life’: At 58, she went to style design college and ended up on ‘Project Runway’

Locals are fearful after tech buyers snapped up farmland.

The chart

Time to look at cocoa

CC00,

?

Here’s a chart from Chris Weston, head of analysis at Pepperstone:

Pepperstone

“Having rallied for five consecutive days, we see price closing at the highest levels since 2011 [on Tuesday]. Some will see the chart and be compelled to initiate shorts given the outrageous bull trend since October, but this is a juggernaut right now and the buyers have firm control,” Weston instructed purchasers.

The tickers

These had been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

VFS, |

VinFast Auto |

|

NIO, |

NIO |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

TTOO, |

T2 Biosystems |

|

PLTR, |

Palantir Technologies |

Random reads

Burger King is being sued over a not-big-enough Whopper.

Heat-resistant timber are serving to cool this desert metropolis.

Congrats to Bacup Bavarian and different winners of the World Gravy Wrestling Championships .

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com