You nearly definitely are exaggerating the chance that the inventory market will, in coming months, endure a crash as unhealthy as that of 1987.

Contrarians are smiling.

It’s totally comprehensible that traders are fearful a few crash, given the various analysts who’re declaring the inventory market to be forming a bubble. Keith McCullough, the CEO of Hedgeye Risk Management — who my colleague Jonathan Burton interviewed earlier this week — says that “there are a lot of similarities to 1987 now: the market’s quick start in January, people in love with stocks. That’s a catalyst for the stock market to crash.”

In reality, although, the likelihood of a 1987-magnitude crash within the subsequent a number of months could be very tiny — simply 0.33%.

We know what the typical investor believes the likelihood of a crash to be due to a survey that Yale University’s Robert Shiller started conducting a number of a long time in the past. He distills his outcomes into one quantity: the proportion of respondents who suppose there’s a less-than-10% likelihood of a 1987-magnitude crash within the subsequent six months. According to the most recent survey, that quantity is 33.9%.

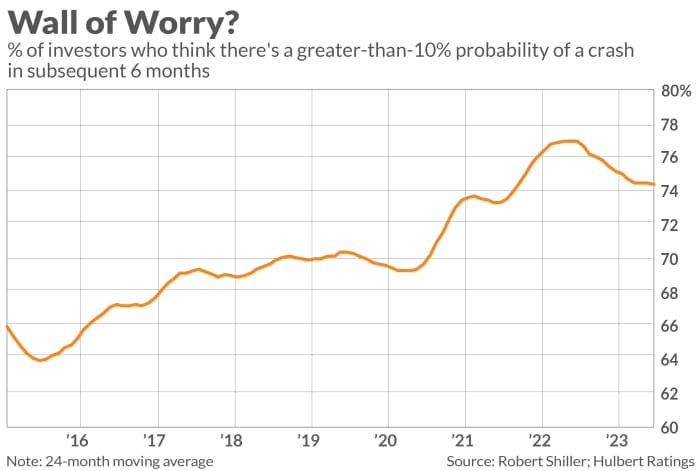

That means 66.1% of traders consider that the chance is above 10%. And that’s what’s plotted within the accompanying chart. Notice that there was a definite uptrend on this proportion in recent times. In 2015, its 24-month transferring common stood at 64%, versus 74% at the moment — down solely barely from its excessive from final yr of 77%.

We know the precise likelihood of a crash due to a examine that appeared a number of years in the past within the Quarterly Journal of Economics titled “Institutional Investors and Stock Market Volatility.” The examine was performed by Xavier Gabaix, a finance professor at Harvard University, and three scientists at Boston University’s Center for Polymer Studies: H. Eugene Stanley, Parameswaran Gopikrishnan and Vasiliki Plerou. After analyzing a long time of stock-market historical past within the U.S. and different nations, the authors devised a formulation that predicts the typical frequency of stock-market crashes.

I fed into the researchers’ formulation a one-day decline of twenty-two.6% occurring within the subsequent six months. That decline is how a lot the Dow Jones Industrial Average

DJIA

fell on Black Monday in 1987. According to the formulation, the likelihood of such a decline is 0.33%.

Why traders have turn out to be more and more fearful a few crash

A giant motive for the secular uptrend in traders’ perception within the chance of a crash is that the inventory market suffered two bear markets in a current two-and-a-half-year interval: February-March 2020 and January-October 2022. It’s uncommon for 2 bear markets to happen in such fast succession, and that has soured many traders’ long-term outlooks.

Consider the 38 bear markets since 1900 that seem on the calendar maintained by Ned Davis Research. In solely three circumstances did two bear markets happen in such fast succession. Two of these three cases occurred through the Great Depression, and the third happened within the early Nineteen Sixties. It had been greater than 60 years since two successive bear markets delivered the one-two punch that traders suffered not too long ago.

For perception into the psychological significance of that one-two punch, I turned to a 2015 examine by Camelia Kuhnen of the University of North Carolina. Kuhnen is an professional in neuroeconomics, an interdisciplinary discipline that brings collectively areas as various as computational biology, neuroscience, psychology and mathematical economics.

In her examine, “Asymmetric Learning from Financial Information,” she reviews that there’s a vital distinction between how traders replace their beliefs following losses than how they do this following positive aspects: Losses generate disproportionately extra pessimism than positive aspects result in optimism. This tendency, rooted deep in how our brains work, results in what she calls a “pessimism bias.” Not solely is that this bias widespread following intervals with massive losses, just like the one we’re in at the moment, it dissipates slowly — even when the market’s subsequent efficiency is sort of robust.

This in flip means that Shiller’s crash-confidence index might be a helpful contrarian indicator. I examined for that risk on month-to-month information since mid-2001, which is when the survey started to be performed every month. Sure sufficient, when traders had been extra fearful a few crash, the inventory market on common carried out higher over the following one-, three- and five-year intervals.

And in contrast to different sentiment indicators, which have solely short-term significance, Shiller’s crash-confidence index has its best explanatory energy over a several-year horizon. So whereas that index tells us little about the place the market is headed over the subsequent a number of months, it does present an elevated chance of a powerful market over the subsequent a number of years.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He might be reached at mark@hulbertratings.com.

Source web site: www.marketwatch.com