Investors in index funds have been effectively rewarded by a excessive focus within the largest expertise corporations over the previous decade. But there are additionally persevering with warnings concerning the threat of such heavy concentrations, even in index funds that observe the S&P 500. Solutions are provided to restrict this threat, however when you anticipate Big Tech to proceed to drive the broad market returns over the approaching years, why not make an much more targeted guess?

Comparisons of three index-fund approaches spotlight how profitable focus within the “Magnificent Seven” has been.

The Magnificent Seven are Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Nvidia Corp.

NVDA,

Amazon.com Inc.

AMZN,

Alphabet Inc.

GOOGL,

GOOG,

Tesla Inc.

TSLA,

and Meta Platforms Inc.

META,

We have listed them within the order of their focus inside the Invesco S&P 500 ETF Trust

SPY,

which tracks the S&P 500

SPX.

The U.S. benchmark index is weighted by market capitalization, as is the Nasdaq Composite Index

COMP

and the Russell indexes.

SPY is 27.6% concentrated within the Magnificent Seven. One solution to play the identical group of 500 shares however remove focus threat is to take an equal-weighted strategy to the index, which has labored effectively for sure lengthy intervals. But right here, we’re specializing in how effectively the concentrated technique has labored.

Let’s check out the group’s focus in three standard index approaches, then take a look at long-term efficiency and think about what occurred in 2022 as rising rates of interest helped crush the tech sector.

Here are the portfolio weightings for the Magnificent Seven in SPY, together with these of the Invesco QQQ Trust

QQQ,

which tracks the Nasdaq-100 Index

NDX

and the Invesco S&P 500 Top 50 ETF

XLG

:

| Company | Ticker | % of SPY | % of QQQ | % of XLG |

| Apple Inc. |

AAPL, |

7.05% | 10.85% | 12.46% |

| Microsoft Cor. |

MSFT, |

6.65% | 9.53% | 11.76% |

| Amazon.com Inc. |

AMZN, |

3.30% | 5.50% | 5.84% |

| Nvidia Corp. |

NVDA, |

3.02% | 4.44% | 5.33% |

| Alphabet Inc. Class A |

GOOGL, |

2.17% | 3.12% | 3.83% |

| Alphabet Inc. Class C |

GOOG, |

1.88% | 3.11% | 3.32% |

| Tesla Inc. |

TSLA, |

1.79% | 3.10% | 3.17% |

| Meta Platforms Inc. Class A |

META, |

1.77% | 3.60% | 3.12% |

| Totals | 27.63% | 43.25% | 48.83% | |

| Sources: Invesco Ltd., State Street Corp. | ||||

The identical group of seven corporations (eight shares with two frequent share lessons for Alphabet) is on the high of every exchange-traded fund’s portfolio, though the highest seven for QQQ aren’t in the identical order as these for SPY and XLG. QQQ’s weighting was modified just lately because the underlying Nasdaq-100 underwent a “special rebalancing” final month.

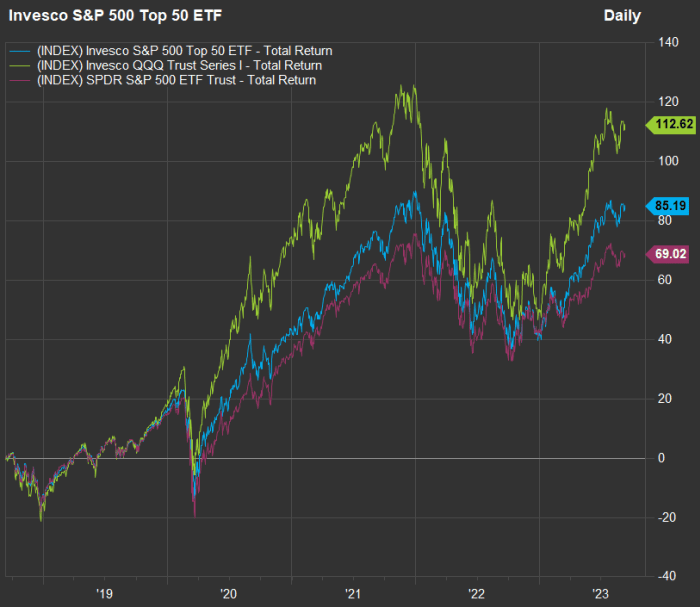

Here’s a five-year chart evaluating the efficiency of the three approaches. All returns on this article embody reinvested dividends.

FactSet

QQQ has been the clear winner for 5 years, however it’s also price noting how effectively XLG has carried out when put next with SPY. This “top 50” strategy to the S&P 500 incorporates many shares that aren’t listed on the Nasdaq and subsequently can’t be included in QQQ, which itself is made up of the biggest 100 nonfinancial corporations within the full Nasdaq Composite Index

COMP,

Examples of shares held by XLG that aren’t held by QQQ embody such non-tech stalwarts as Berkshire Hathaway Inc.

BRK.B,

Johnson & Johnson

JNJ,

Procter & Gamble Co.

PG,

Home Depot Inc.

HD,

and Nike Inc.

NKE,

Now let’s go deeper into long-term efficiency. First, listed here are the whole returns for varied time intervals:

| ETF | 3 Years | 5 Years | 10 Years | 15 Years | 20 Years |

|

SPDR S&P 500 ETF Trust SPY |

40% | 69% | 223% | 370% | 531% |

|

Invesco QQQ Trust QQQ |

41% | 113% | 430% | 882% | 1,158% |

|

Invesco S&P 500 Top 50 ETF XLG |

41% | 85% | 262% | 404% | N/A |

| Source: FactSet | |||||

Click on the tickers for extra about every ETF, firm or index.

Click right here for Tomi Kilgore’s detailed information to the wealth of data out there free of charge on the MarketWatch quote web page.

There isn’t any 20-year return for XLG as a result of this ETF was established in 2005.

For 5 years and longer, QQQ has been the runaway chief, however for five, 10 and 15 years, XLG has additionally overwhelmed SPY handily, with broader trade publicity.

Something else to contemplate is that in 2022, when SPY was down 18.2%, XLG fell 24.3% and QQQ dropped 32.6%.

For disciplined long-term traders, the tech ache of 2022 might not appear to have been a small worth to pay for outperformance. And it could have been simpler to take the pounding when holding SPY and even XLG that yr.

Here’s a take a look at the common annual returns for the three ETFs:

| ETF | 3 years | 5 years | 10 years | 15 years | 20 years |

|

SPDR S&P 500 ETF Trust SPY |

11.8% | 11.0% | 12.4% | 10.9% | 9.6% |

|

Invesco QQQ Trust QQQ |

12.0% | 16.3% | 18.2% | 16.4% | 13.5% |

|

Invesco S&P 500 Top 50 ETF XLG |

12.2% | 13.1% | 13.7% | 11.4% | N/A |

| Source: FactSet | |||||

So the query stays — do you imagine that the biggest expertise corporations will proceed to steer the inventory marketplace for the following decade a minimum of? If so, a extra concentrated index strategy could also be for you, supplied you’ll be able to stand up to the urge to promote right into a declining market, such because the one we skilled final yr.

Here is one thing else to remember. In a be aware to purchasers on Monday, Doug Peta, the chief U.S. funding strategist at BCA, made an enchanting level: “The only novel development is that all the heaviest hitters now hail from Tech and Tech-adjacent sectors and are therefore more prone to move together than they were at the end of 2004, when the seven largest stocks came from six different sectors. “

Nothing lasts forever. Peta continued by suggesting that investors who are tired of big tech taking all the glory “need only wait.”

“[I]f history is any guide, their time at the top of the capitalization scale will be short,” he wrote.

Don’t miss: These 4 Dow shares take high prizes for dividend development

Source web site: www.marketwatch.com