Stock market traders needn’t fear concerning the impression of a doable U.S. authorities shutdown in mid-November. That’s the conclusion I reached after analyzing the inventory market’s response to previous authorities shutdowns.

Since 1981 there have been 10 of those shutdowns, and whereas that quantity paints a sorry image about our political system, it’s giant sufficient to permit some tentative statistical conclusions to be reached. (Shutdowns are a comparatively trendy incidence. It wasn’t till a 1981 ruling by the then U.S. Attorney General {that a} failure to go a spending invoice led to shutdowns.)

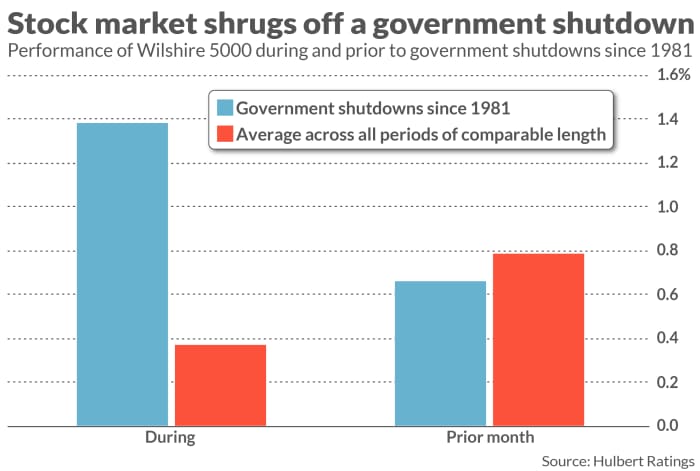

Over the month previous to these 10 shutdowns, the inventory market on common carried out no otherwise than it did when the federal government was working usually. During these shutdowns the inventory market in reality carried out higher than common — although not by sufficient to fulfill conventional requirements of statistical significance.

If a authorities shutdown have been to happen, it could be on Nov. 17, when the cash runs out from the stopgap spending measure that Congress handed on Oct. 1. The betting markets presently place one-in-three odds on a shutdown occurring.

To measure whether or not previous shutdowns have had any noticeable impression on the inventory market, I targeted on a record compiled by the History channel. I measured the inventory market’s complete return throughout every of these shutdowns, in addition to over the month prior. The averages are summarized within the chart under.

The most up-to-date shutdown occurred in late 2018 and early 2019, and the inventory market’s efficiency at the moment then illustrates why different components have a far greater impression on inventory costs than authorities shutdowns. That shutdown 5 years in the past started on Dec. 21 and lasted till Jan. 25, throughout which the Wilshire 5000 complete return index gained a powerful 11.2%. Over the month previous to that shutdown, in distinction, the Wilshire 5000 misplaced nearly as a lot — 8.7%.

This expertise superficially means that the market reacts poorly within the runup to a shutdown, after which performs effectively throughout that shutdown — a case of “sell the rumor, buy the news.”

Yet the true reason for the market’s large drop and subsequent restoration in December 2018 and January 2019 was the Federal Reserve. The U.S. central financial institution had raised rates of interest plenty of instances in 2018, and the inventory market started to say no considerably in September of that 12 months. The final hike in that 12 months’s rate-hike cycle occurred on Dec. 19, 2018, inflicting the inventory market to briefly enter into official bear market territory. Members of the Fed’s interest-rate-setting committee shortly signaled that the Fed would hit the “pause” button, and the market soared.

The lesson for as we speak is that, even when a authorities shutdown or the specter of one impacts the inventory market, different occasions will play a much more vital function.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He could be reached at mark@hulbertratings.com

More: As Mike Johnson turns into House speaker, analyst places danger of presidency shutdown at 20% to 30%

Also learn: How to play the approaching January bounce-back for 2023’s stock-market losers

Source web site: www.marketwatch.com