Better-than-expected CPI is ready to mild a fuse underneath Wall Street shares, as some see it as serving to maintain the Fed in its perceived no-more-hike field.

With bond yields the info may maintain driving that end-year fairness rally idea.

Onto our name of the day, from Bank of America, which talks about the place the vast majority of buyers anticipate the 2024 “playbook” for investing to go — and far of that has to do with a Federal Reserve backing off rates of interest.

In its world fund supervisor survey for November, strategist Michael Hartnett and his crew clarify that buyers have turned cautious on the macro image.

So most anticipate a smooth touchdown for the economic system — rate of interest hikes which have labored to gradual the economic system simply sufficient, however not right into a recession — decrease charges, a weaker greenback and a continued bull marketplace for large-cap tech shares.

Read: What’s driving Wall Street’s gloomiest interest-rate forecast

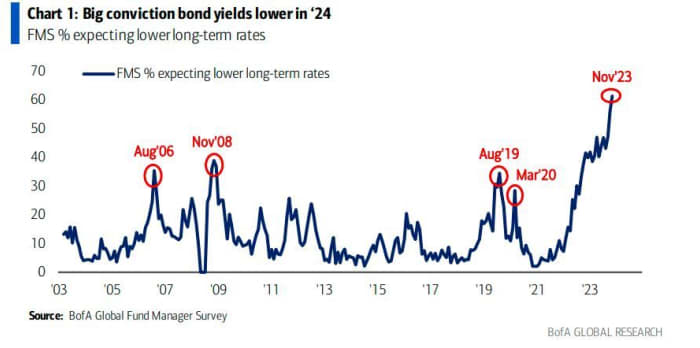

A internet 76% of these surveyed imagine the Federal Reserve mountain climbing cycle is over, and 61% anticipate decrease bond yields, which because the beneath chart reveals, is essentially the most on document:

And that’s regardless of the second highest variety of buyers ever saying fiscal coverage was too stimulative, the survey finds.

The survey additionally reveals buyers have trimmed their money ranges to a two-year low of 4.7% from 5.3%, and moved to the most important bond obese since March 2009. And as a part of that view the Fed is completed mountain climbing, buyers flipped to their first fairness obese since April 2022.

Now, if the economic system goes towards the final pondering right here and a “hard landing” or sharp slowdown kicks in, then a contrarian investor would need to be bullish on money, quick on U.S. development shares and Japan equities. they are saying. And within the case of “no landing” and better rates of interest, then lengthy money, greenback and commodities is the contrarian wager to make.

Hartnett and co. additionally laid out what they imagine is the most important contrarian play of 2024 — “long leverage, short quality.”

While he doesn’t fairly break this down, generally however not all the time, leverage can seek advice from corporations that must borrow cash, so this is able to indicate a bullish wager on that group. But a bullish wager on these would imply no worry of an imminent credit score occasion, that Hartnett has mentioned in current months.

As for brief high quality? Those contrarian buyers may wager towards corporations with wholesome stability sheets that aren’t overborrowing or overleveraging

Read: Here are the most important clean-energy transition challenges and funding alternatives

And: The Dow industrials hit a dying cross on Monday. That may very well be a bullish or bearish sign

The markets

Stock futures

ES00,

YM00,

NQ00,

are hovering after barely higher than-expected CPI knowledge, as bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

sink. Elsewhere, the greenback

DXY

dropping and gold

GC00,

is climbing.

The buzz

Consumer costs have been flat in October, towards expectations for a 0.1% rise, and the primary month of no enhance since July 2022. Annual CPI rose 3.2% , beneath a forecast of three.3%. Core CPI, which strips out meals and vitality, additionally got here in softer-than-expected, up 0.2% versus a forecast of 0.3% and was up 4% over the previous yr, the bottom price since September 2021. That was down from 4.1%

Plus: Follow MarketWatch’s dwell protection of CPI knowledge

A bunch of Fed audio system are on the docket as properly — Fed Vice Chair Philip Jefferson at 5:30 a.m. spoke about financial coverage in unsure occasions, Fed Vice Chair for Supervision Michael Barr will testify to a Senate panel at 10 a.m. on supervisory and regulatory actions and Chicago Fed President Austan Goolsbee will communicate at 12:45 p.m.

Home Depot

HD,

topped estimates for third-quarter earnings however in a cautious approach, forward of Target

TGT,

TJX

TJX,

and Walmart

WMT,

outcomes this week. One query? Is trade theft nonetheless an enormous downside?

Swiss-based miner and commodity dealer Glencore

GLEN,

can pay $6.93 billion for a 77% stake within the steelmaking coal enterprise of Canada’s Teck Resources

TECK,

TECK.A,

LL Flooring

LL,

the previous Lumber Liquidators, is fielding a $90 million takeover provide.

Best of the net

How a NFL bettor simply turned $500,000 into $6 million — one of many largest parlay payouts ever

Jamie Dimon is promoting his inventory. So are these different Wall Street bankers (subscription required)

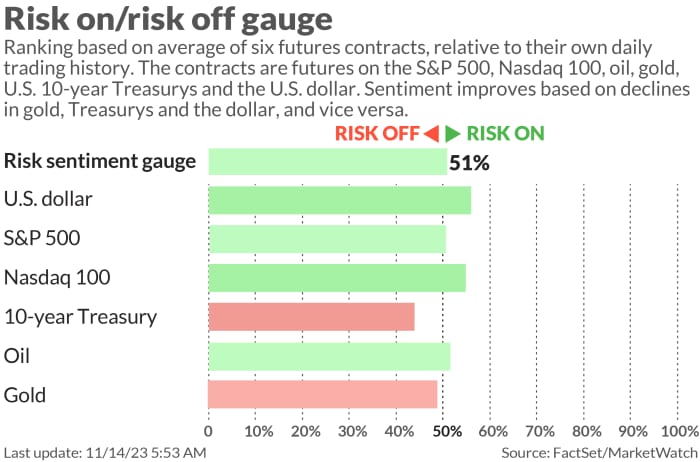

The chart

Top tickers

These have been the top-searched stock-market tickers on MarketWatch as of 6 a.m.:

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

AMZN, |

Amazon |

|

PLTR, |

Palantir |

|

PLUG, |

Plug Power |

|

MSFT, |

Microsoft |

Random reads

Some (don’t get too excited) good news for ultra-processed meals followers.

Merry Swiftmas. Online stampede for Taylor Swift Christmas baubles.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com