The inventory market is wanting chipper once more as bond yields slide on hopes the Federal Reserve is finished elevating rates of interest. A well-received earnings report from Apple after Thursday’s closing bell might reinforce the most recent rally in massive tech shares.

Still, some buyers and market observers are involved that a lot of the good points within the tech sector this yr have been brought on by over-exuberance concerning AI. The inference is that such shares could also be susceptible to a waning of the AI narrative.

Fear not, as a result of in response to Galina Pozdnyakova and Luke Templeman, analysts at Deutsche Bank, AI’s affect on the 2023 tech rally has been overstated.

They settle for that for the reason that launch of ChatGPT a yr in the past, AI chip maker Nvidia

NVDA,

for instance, has seen its shares surge about 140%, and the Nasdaq-100

NDX

has gained round 20%. Yet they argue that different elements counsel that AI optimism has not been the principle driver of tech markets.

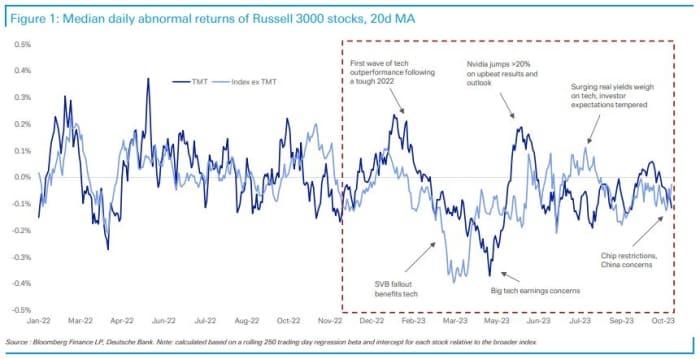

“It is true that tech has somewhat decoupled from the broader market this year, but it is less clear that AI had a major role in this,” they are saying, and supply the chart beneath that reveals a measure of irregular returns for the tech sector in contrast with the remainder of the market.

Source: Deutsche Bank

“There is a visible outperformance wave in the first months of the year when tech benefited from a risk-on mood as well as in the aftermath of large drawdowns in 2022,” they are saying. “Later on, big tech rallied on the back of perceived haven status amid the SVB selloff, followed by another advance around an upbeat forecast from Nvidia in late May.”

So, what are the opposite non-AI elements which have pushed tech shares? Rising actual yields has been an essential narrative for the reason that summer season, with strikes throughout the sector turning into extra synchronized.

“While, early on, ChatGPT propelled semiconductor stocks and left the software industry firms behind, now, various industries across the TMT sector seem to be converging. That points to a waning effect on markets of generative AI and indicates investors are refocusing on non-AI factors in their stock decisions,” say the Deutsche Bank analysts.

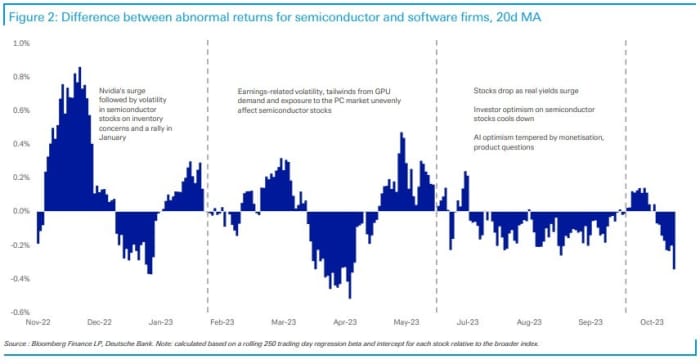

Another strategy to observe AI’s waning affect available on the market is to separate out semiconductor shares from software program and companies corporations. The chart beneath reveals an preliminary soar in semiconductor shares — primarily pushed by Nvidia –after ChatGPT’s launch in November final yr.

Source: Deutsche Bank

This was adopted by some smaller market oscillations associated to earnings of semiconductor firms, alongside the a selloff in these software program shares thought of susceptible to the usage of ChatGPT.

“Nevertheless, the wedge between the two industry groups has stabilized over the last few months, showing few new AI-driven shocks. Moreover, semiconductor stocks came under pressure as investors tempered expectations,” say Pozdnyakova and Templeman.

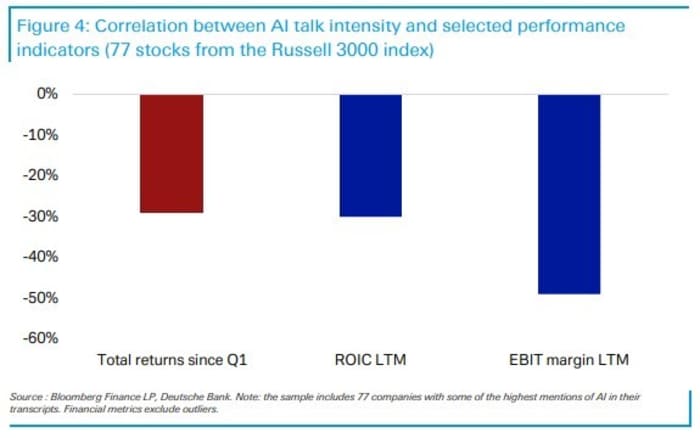

The Deutsche Bank analysts additionally checked out company transcripts and located there was a lot AI discuss, however little constructive share worth motion.

The mentions of AI-related phrases in firm paperwork have sharply accelerated this yr as administration attempt to pitch income and/or price advantages from the know-how, they be aware.

However, inventory returns have a adverse correlation to the depth of AI chatter. Taking a pattern of 77 Russell 300 shares, the analysts discovered that the correlation between whole returns for the reason that first quarter and the depth of AI discuss in fourth quarter 2023 to first quarter 2023 transcripts was minus 29%.

Source: Deutsche Bank

“In part, this is because AI was more in focus for smaller and less profitable firms. In other words, corporate AI enthusiasm is sticky, unlike investor attitudes which seem to be more discerning,” they are saying.

Pozdnyakova and Templeman reckon that massive good points in AI, within the close to time period, will probably come from throughout the personal markets as enterprise capital picks the subsequent winners.

“Indeed, beyond a handful of stocks, there have been few clear winners or losers from the buzz around generative AI. At present, some of the major non-semiconductor players are still figuring out the product,” they conclude.

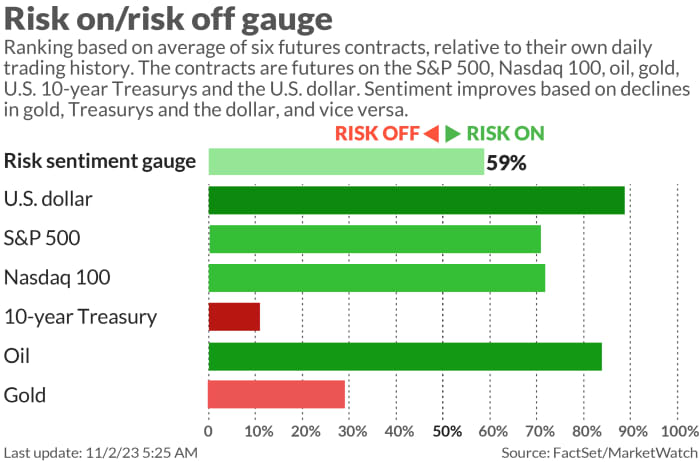

Markets

U.S. stock-index futures

ES00,

YM00,

NQ00,

are increased as benchmark Treasury yields

BX:TMUBMUSD10Y

slide. The greenback

DXY

is weaker, whereas oil costs

CL.1,

acquire and gold

GC00,

is firmer.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Apple

AAPL,

the world’s most respected listed firm, will launch its outcomes after the market closes on Thursday. Shares within the iPhone maker are up about 1% in premarket buying and selling and up 34% for the yr.

Shares of Roku Inc.

ROKU,

are leaping almost 20% in Thursday’s premarket buying and selling after the corporate simply topped income expectations for the third quarter and famous “a solid rebound in video ads.”

PayPal‘s inventory

PYPL,

is rallying 7% after the corporate topped expectations with its newest earnings and named a brand new chief monetary officer.

Starbucks shares

SBUX,

are including 7% after the espresso retailer chain posted better-than-expected earnings for its fiscal fourth quarter.

Amusement park firms Cedar Fair

FUN,

and Six Flags

SIX,

have agreed to a merger of equals valued at about $8 billion together with debt.

U.S. financial information due on Thursday contains the weekly preliminary jobless claims alongside third quarter productiveness and unit-labor prices at 8:30 a.m. Eastern. Factory orders for September shall be launched at 10 a.m..

The Bank of England left rates of interest unchanged at 5.25%, however the pound

GBPUSD,

gained 0.5% to $1.2220 after Governor Andrew Bailey prompt he was in no hurry to think about reducing charges.

Best of the net

Jeff Gundlach says ‘massive interest-expense problem’ might trigger the subsequent U.S. monetary disaster.

The financial system is nice. Why are Americans in such a rotten temper.

How does the world’s largest hedge fund actually make its cash?

Why Norway — the poster little one for electrical automobiles — is having second ideas.

The chart

A powerful greenback can present headwinds for the U.S. inventory market, so buyers might want to be aware of this chart of the greenback index

DXY

from Michael Kramer at Mott Capital Management.

“It looks like a bull flag on the dollar, and that would mean that the dollar index goes higher. But that means that the data will have to support the dollar moving higher, and there will be plenty of data coming the rest of this week to support this potentially,” says Kramer.

Source: Mott Capital Management

Top tickers

Here have been probably the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

PYPL, |

PayPal |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

PLTR, |

Palantir Technologies |

|

NIO, |

NIO |

|

AMZN, |

Amazon.com |

|

GME, |

GameStop |

|

AMD, |

Advanced Micro Devices |

Random reads

The secrets and techniques behind how Pokémon playing cards are made.

The 38 most haunted locations on this planet.

Cats have greater than 50 facial expressions examine finds.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com