“The Dow’s average February return after rising in January is just 0.16%.”

Wall Street’s pleasure over the bullish posture of the January Indicator tells us extra about their exuberance than how the U.S. inventory market will truly carry out this yr.

There’s a perception on Wall Street that “as goes January, so goes the year.” After a rocky begin to the month, which initially instructed that the January Indicator is likely to be unfavorable for the remainder of 2024, the U.S. inventory market has rebounded properly — making it nearly sure that January might be a constructive month for the market and the January Indicator might be bullish for the yr.

If solely the January Indicator rested on a robust statistical basis.

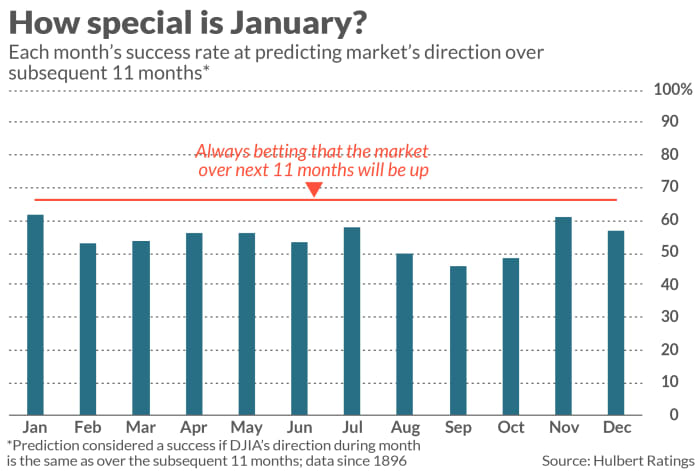

I’ve questioned the January Indicator earlier than, and on this column, I’m taking a look at it in a brand new approach. For every month since 1896, I calculated the Dow Jones Industrial Average’s DJIA success price at predicting the inventory market’s route over the following 11 months. As you may see from the accompanying chart, a number of months are nearly pretty much as good an indicator as January — corresponding to July and December. And the success price for an additional month — November — is simply pretty much as good as December.

So there’s nothing significantly distinctive about January.

You would possibly conclude from these outcomes that there must be a November, July or December Indicator along with January. However, the info don’t help that conclusion. The purpose many alternative months have what seems to be respectable predictive skills is that the inventory market rises far as a rule. So it solely appears just like the inventory market’s route in a given month “predicts” the market’s subsequent-11-months route. To declare that it does makes no extra sense than concluding that, as a result of night time follows day, day “causes” night time.

Another implication of the chart is that, as a result of the market rises as a rule, you’ll do higher than the January Indicator by at all times predicting that the market can be up over the following 11 months. Since 1896, such a prediction would have been profitable 66.2% of the time. This is represented by the crimson line within the chart, and also you’ll discover that that is higher than the success price of not simply January however these of all the opposite months as effectively.

Another purpose to query the statistical basis of the January Indicator is that the market in February usually reverses its January route. This just isn’t what you’ll count on if there have been a robust foundation in actuality for the January Indicator, versus being little greater than an artifact of investor sentiment.

Consider that the Dow’s common February return after rising in January is simply 0.16%, which is beneath the typical acquire throughout all months since 1896 of 0.62%. The most definitely explanation for this below-average efficiency is that exuberant merchants soar on the bullish bandwagon on the finish of these Januarys by which it turns into clear that the market might be up for the month. This causes the market to get forward of itself, resulting in below-average efficiency in February.

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He could be reached at mark@hulbertratings.com

More: 1987 stock-market crash has classes for merchants satisfied Fed will slash charges in 2024

Also learn: BlackRock cites AI in upgrading U.S. shares to obese

Source web site: www.marketwatch.com