The await Nvidia earnings is almost over, however with the outcomes not coming till after the closing bell, a jittery Wall Street may stretch losses to a few straight shedding periods. Fed minutes are additionally en route.

Apart from these burning subjects, buyers can also’t cover from the truth that a U.S. presidential election, which appears destined for a fiery rematch between President Joe Biden and former President Donald Trump, is mere months away. Already, word strategists at Societe Generale, forex markets are pricing in a giant day of volatility for the euro/greenback the day after the U.S. election.

Our name of the day, from impartial advisory agency Signum Global Advisors, is on the facet of contrarians, saying Biden goes to win this, even when polls are favoring Trump.

“At this stage in the U.S. presidential race, more datapoints a priori seem to favor former President Donald Trump over current President Joe Biden. Adjusted for what we view as the determining factor in this election — voter mobilization — however, our current base case expectation is a Biden victory (65%), coupled with a divided Congress (Republican-majority Senate, Democrat-majority House),” says a staff led by senior analyst Rob Casey in a Tuesday word to shoppers.

They acknowledge odds stacked towards Biden, resembling voter disapproval —39.7% for and 55.9% towards — and cite information exhibiting first-term presidents who can’t hit 50% approval throughout any time of the yr earlier than the election gained’t win. And then there’s the age concern, with polls registering extra concern over Biden’s 81 years on the planet than Trump’s 77 years.

But Signum’s information factors to 2 of three main fashions that favor Biden over Trump, depending on the financial system staying on observe, voter turnout and third-party votes sticking close to historic norms. They count on Democratic turnout to be boosted by legal guidelines limiting abortion and issues over preserving democracy. They add that points the place Biden trails Trump, like immigration, are “less visceral,” noting for example with immigration that solely 17% say it’s affected them immediately.

More good news for Biden: “Since 1944, no incumbent president running for re-election has lost without a recession during or immediately preceding the election cycle,” mentioned Casey and the staff. Leading financial indicators on Tuesday confirmed indicators of a slowdown are fading.

Incumbency can be on Biden’s facet, say the analysts, who word that since 1980, 57% of sitting presidents in search of re-election have gained, and from 1968 to 2016, the incumbent has gotten 52% of the vote.

Another favorable metric — polls are favoring Trump, however these have confirmed off by a number of factors in 2004-2020 election cycles. Betting markets, favoring him 51.7% to 31.4%, had been incorrect at this stage in 2016 and 2020.

“Adjusted for these considerations, the election is arguably wide open at this stage (3 datapoints to each candidate), and our own assessment is a Biden win (at 65% odds), for the following reason: we expect Democrat-leaning voters to mobilize in greater numbers relative to Republican-leaning voters,” they are saying.

Also learn: This is the error buyers are making in excited about a second Trump presidency, say UBS strategists

Read: Trump tax minimize 2.0: Would slashing the company price once more enhance shares?

The markets

Tech

ES00,

NQ00,

is main inventory futures south, with Treasury yields

BX:TMUBMUSD10Y

regular. The Hang Seng

HK:HSI

rose almost 1.5%. Some attributed that to a crackdown on quant fund buying and selling.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,975.51 | -0.92% | 2.58% | 4.31% | 21.98% |

| Nasdaq Composite | 15,630.78 | -1.96% | 1.76% | 4.13% | 32.61% |

| 10 yr Treasury | 4.281 | 2.87 | 10.02 | 40.03 | 35.59 |

| Gold | 2,040.70 | 0.34% | 0.87% | -1.50% | 10.23% |

| Oil | 77.23 | 0.38% | 3.43% | 8.27% | 0.88% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The buzz

After the shut, Nvidia

NVDA,

is predicted to report a 400% surge in adjusted earnings per share and income may triple.

Palo Alto Networks

PANW,

is off 20% after a disappointing forecast, with comparable losses from Teladoc

TDOC,

whose personal outlook fell quick. SolarEdge

SEDG,

is slumping on weak gross sales.

Amazon

AMZN,

will be a part of the Dow Jones Industrial Average in every week, changing Walgreens

WBA,

Also, Amazon founder Jeff Bezos has offered extra shares.

The minutes of the Fed’s January assembly are due at 2 p.m., with a number of Fed audio system forward of that — Atlanta Pres. Raphael Bostic at 8 a.m., Richmond Pres. Tom Barkin at 9:10 a.m. and Gov. Michelle Bowman at 1 p.m.

A United Airlines

UAL,

flight minimize its flight quick after wing injury.

Best of the net

Stock-market buyers worry short-volatility bets may crush the rally

Streaming a film overseas could quickly include taxes on the border

Nvidia-linked shares drew massive bets days earlier than submitting sparked rally.

The chart

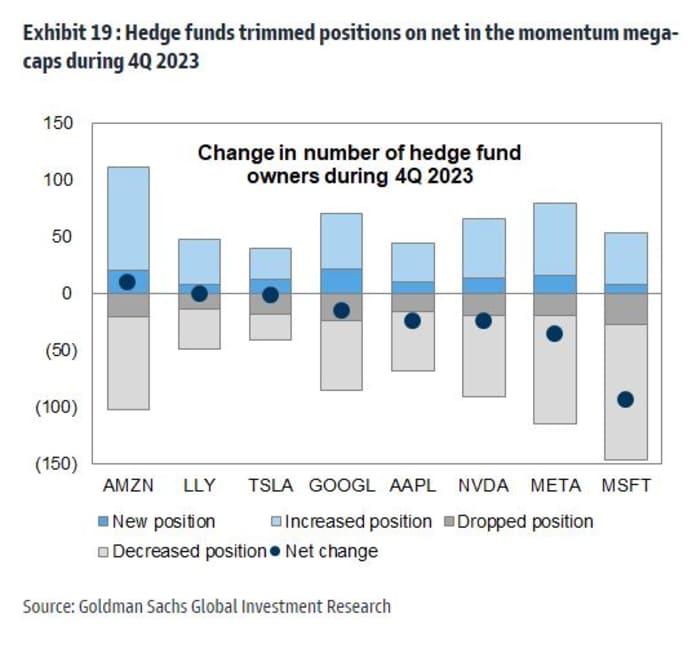

Hedge funds pared their publicity to Magnificent Seven shares over the last quarter of 2023, experiences Goldman Sachs. Those funds had been aggressive consumers within the first three quarters of final yr — Amazon was the exception to year-end promoting. They say former VIP Microsoft noticed the largest fall in possession by these managers.

Top tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

SMCI, |

Super Micro Computer |

|

HOLO, |

MicroCloud Hologram |

|

AMZN, |

Amazon |

|

PANW, |

Palo Alto Networks |

|

OCGN, |

Ocugen |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

AMD, |

Advanced Micro Devices |

Random reads

Jet-setter — Enzo the Italian greyhound.

College pupil monitoring Taylor Swift’s jets is not going to be deterred.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast concerning the monetary news we’re all watching – and the way that’s affecting the financial system and your pockets.

Source web site: www.marketwatch.com