Early skirmishing in futures suggests the S&P 500 might get better a small portion of the two.6% it shed in simply the final two periods. Big tech has completed most of that injury, however a pop for Amazon.com on Friday following its outcomes might halt the carnage, for now.

It’s turbulent instances like these when dividend earnings seems extra interesting to many traders. The good news, through a brand new observe from David Kostin, chief U.S. fairness strategist at Goldman Sachs, is that S&P 500 dividend per share will develop by 5% for this 12 months.

“Lackluster” earnings development in 2023 will see dividend per share development in 2024 ease to 4%, he reckons. Though, that’s to not be sniffed at in a market struggling for upward momentum.

But watch out. High dividend yielding shares should not essentially top quality, or as protected as many consider, says a staff of analysts at Piper Sandler led by Michael Kantrowitz.

“Sure, a portfolio of higher dividend yielding stocks can provide some margin of safety compared to some valuation metrics, but it can also be littered with value traps too!,” they are saying in a observe printed this week.

The chart under illustrates simply how a lot high-dividend yielding shares have underperformed the top of the range components for the 12 months thus far, and the desk exhibits it’s the worst of all 118 components Piper Sandler tracked.

Source: Piper Sandler

What has prompted this poor efficiency? There have been two important headwinds for these shares this 12 months.

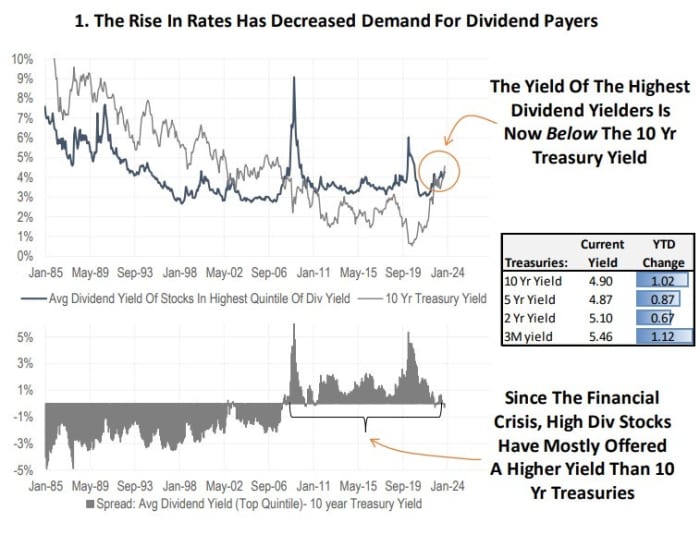

“One issue is that bond yields have increased so much that Treasury yields across the curve are above the yield offered on the highest dividend yielding stocks (top quintile),” says Pier Sandler

Source: Piper Sandler

This shall be a brand new phenomenon for youthful traders, as a result of for the reason that nice monetary disaster the excessive dividend yield issue has usually supplied a larger yield than benchmark bonds.

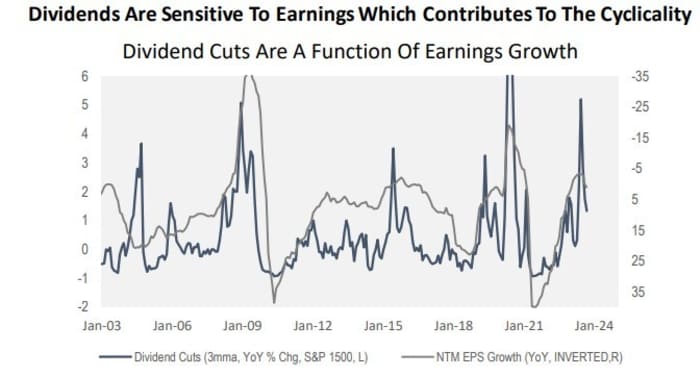

The different headwind is that dividend yield is a cyclical issue, and this has not been a 12 months the place cyclical components have been outperforming.

“Even though high dividend yield was historically thought of as a more stable trait due to the cushion of the dividend payment, we show that the factor is actually quite cyclical!” says Piper Sandler.

This is partly as a result of dividend adjustments are business-cycle delicate. High-dividend yielding shares are strongly positively correlated with financial development, which impacts earnings development developments and thus payouts.

Source: Piper Sandler

So, the query traders ought to ask is: How to search out the top quality excessive dividend payers? The reply says Piper Sandler is to investigate shares by what the dealer calls an “ability to sustain.” This is calculated by taking money stream and deducting most popular dividends and capex, then dividing the end result by widespread dividends.

“Our ability-to-sustain screen aims to help find higher quality companies with sustainable dividends. Year to date, using the ATS screen as an overlay on a high dividend yield screen would have increased returns by 9% vs. just screening for high dividend yield,” says Piper Sandler.

A pattern record of excessive yielding shares with an ATS ratio of larger than 1, which Piper Sandler deems a horny dividend payer, contains Altria

MO,

Verizon Communications

VZ,

Keycorp

KEY,

Truist Financial

TFC,

Comerica

CMA,

Boston Properties

BXP,

AT&T

T,

Simon Property

SPG,

and Citizens Financial

CFG,

Markets

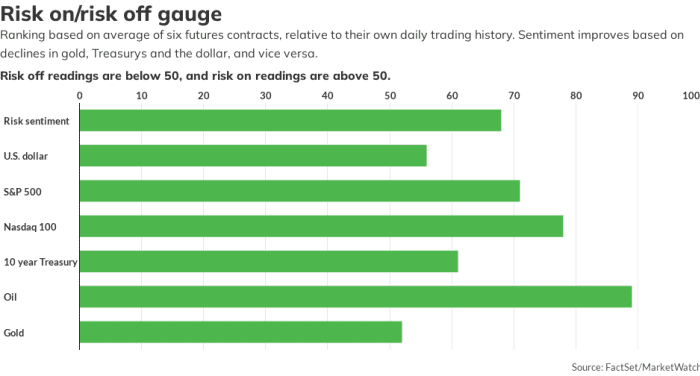

U.S. stock-index futures

ES00,

YM00,

NQ00,

are larger as benchmark Treasury yields

BX:TMUBMUSD10Y

nudge larger. The greenback

DXY

is little modified on the day, whereas oil costs

CL.1,

rally and gold

GC00,

sits simply shy of $2,000 an oz..

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The Federal Reserve’s favored inflation gauge shall be printed at 8:30 a.m. Eastern. The core private consumption expenditure index for September is anticipated to have risen by 3.7% over the earlier 12 months, slowing from August’s 3.9% improve. The month-on-month studying is forecast to have accelerated to 0.3% from 0.1%, nevertheless.

Other U.S. financial knowledge due on Friday embrace the ultimate studying on October client sentiment, due at 10 a.m..

Companies releasing earnings earlier than the opening bell rings on Wall Street embrace Exxon Mobil

XOM,

Chevron

CVX,

and Colgate-Palmolive

CL,

Amazon.com

AMZN,

shares are up greater than 6% in Friday’s premarket motion after the cloud and retail large delivered an enormous earnings beat.

Intel inventory

INTC,

is leaping practically 8% after the chip firm crushed expectations for its third quarter and delivered an upbeat forecast.

Shares of Ford Motor

F,

are off practically 3% after the corporate withdrew steering, citing the pending settlement with the United Auto Workers, and revealed a $1.3 billion loss for its EV unit.

Brent crude oil

BRN00,

rose again above $90 a barrel because the market was rattled by U.S. strikes on Iran-backed teams in Syria.

Best of the online

Sell the S&P 500. Buy this as a substitute.

Rating X: Twitter’s chaotic 12 months below Elon Musk’s shock therapy.

Ted Pick, new Morgan Stanley CEO, is a math whiz amongst math whizzes.

The chart

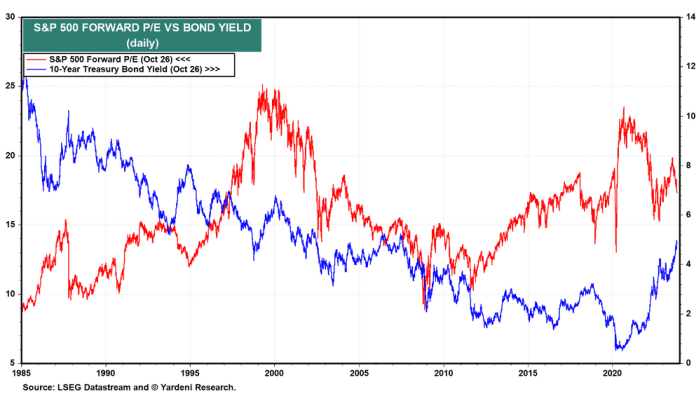

The inventory market decline over the previous two days was triggered by disappointing third quarter earnings outcomes and steering from Google dad or mum Alphabet

GOOGL,

and Facebook

META,

that prompted communications and know-how shares to drop sharply, says Ed Yardeni, president of Yardeni Research

“On the opposite hand, Microsoft

MSFT,

IBM

IBM,

Intel

INTC,

and Amazon all beat expectations this week,” he notes, but the market nonetheless fell. Why? Answer: “Of course, the recent selloff may reflect a downward rerating of the market’s valuation multiple as a slightly delayed response to the jump in the bond yield to 5.00%,” he says.

Source: Yardeni Research

Top tickers

Here had been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

AMZN, |

Amazon.com |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

META, |

Meta Platforms |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

MSFT, |

Microsoft |

|

INTC, |

Intel |

Random reads

Marble bust purchased for £5 might be value £3 million.

Italian lady wins courtroom case to evict her two huge infants.

Leaf blowers are noisy, polluting and simply pointless. Here’s the fightback.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com