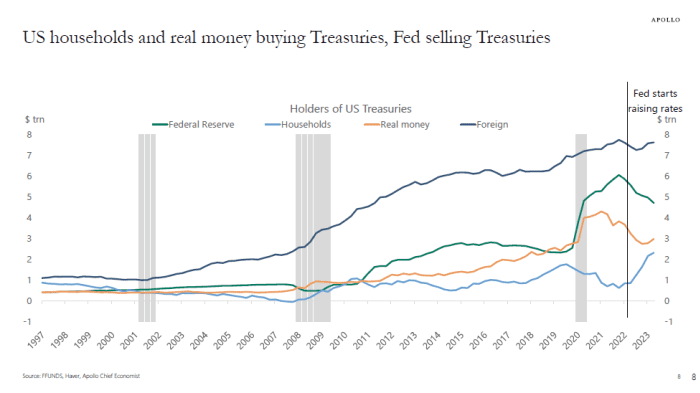

U.S. households have made massive strikes within the roughly $25 trillion U.S. Treasury market for the reason that Federal Reserve started its marketing campaign of price hikes final yr.

Their holdings have shot as much as about $2.5 trillion from lower than $1 trillion when the Fed started elevating charges in 2022, to succeed in the very best degree up to now 25 years, based on Torsten Slok, chief economist at Apollo Global Management.

U.S. households now personal extra Treasury securities than any time up to now 25 years.

FFUNDS, Haver, Apollo Chief Economist

“The bottom line is that US households and real money are finding current levels of US yields attractive,” Slok wrote in emailed commentary Friday.

The sharp rise of the 10-year Treasury yield

BX:TMUBMUSD10Y

to virtually 4.5% in current periods, the very best degree since late 2007, has been a key deal with Wall Street. Big expertise shares and different rate-sensitive sectors of the market bought off sharply after the Federal Reserve signaled it might preserve its coverage price greater for longer than anticipated.

A slight pullback Friday within the 10-year Treasury yield, a benchmark price used to gasoline the U.S. financial system, was giving shares a slight enhance, however equities nonetheless have been on tempo for sharp weekly losses.

See: ‘Hurricane’ in Treasurys relents barely as yields dip from multi-year highs

For the week, the S&P 500 index’s

SPX

shopper discretionary phase was main the stock-market gauge decrease, down 5% eventually examine Friday. That is likely to be an indication that traders suppose firms centered on luxurious items, like autos, furnishings, holidays and different nonessential objects, might be susceptible to a fizzling financial system.

See: The Fed’s inflation learn is lifeless improper. That’s why a 2024 downturn looms, says professor who pioneered in style recession predictor

Tesla Inc.

TSLA,

shares have been greater than 7% decrease on the week, eventually examine, whereas these of Amazon.com Inc.

AMZN,

have been off about 6.7%, whereas others within the “Magnificent Seven” pack of outperforming shares this yr have been additionally on tempo for losses since Monday.

Higher borrowing prices chew shoppers, but in addition threaten main firms going through a pile of maturing debt within the subsequent few years. Older, decrease coupon securities in a portfolio additionally now look much less beneficial.

Gains for the yr in a swath of the bond market have been erased by rising yields, with the benchmark Bloomberg U.S. Aggregate index on tempo for a – 0.6% return on the yr via Friday, and -14.4% on a three-year return, based on FactSet.

The iShares Core U.S. Aggregate Bond ETF,

AGG

an exchange-traded fund that tracks the Bloomberg index, was down 2.1% on the yr via Friday.

Source web site: www.marketwatch.com